By Taylor Williams

In late October, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, gave a virtual speech in which he carried a glass jar with the word “transitory” labeled on it.

Inside the jar were wadded-up dollar bills, deposited by Bostic’s staff members each time they used the word “transitory” to describe the surge in prices of consumer goods and services. The exercise was meant to dispel the notion that the current inflationary environment would be fleeting or short-lived.

Based on the results of Texas Real Estate Business’ annual reader forecast survey, commercial brokers and developers/managers in the Lone Star State aren’t likely to be contributing to that fund any time soon.

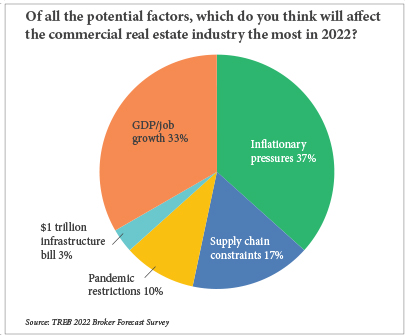

When asked to identify the macroeconomic force that was most likely to impact the commercial real estate industry in 2022, both of these groups selected inflationary pressures over supply chain constraints, pandemic restrictions, the $1 trillion infrastructure bill and employment/gross domestic product (GDP) growth.

It’s worth noting that the survey officially closed on Monday, Dec. 13, about a week before the nation began to see a major surge in COVID-19 cases, most of which were classified as the Omicron variant.

In the subsequent three-week period, some investment banks cut their GDP forecasts for 2022 in response to the resurgences in cases. According to data from Johns Hopkins University, the country set a new record on Monday, Jan. 3, when more than 1 million new cases were reported from over the holiday weekend.

But those public health fears may be tempered in Texas, where businesses have been operating at full capacity for numerous months and where job growth remains a national leader.

“The commercial real estate market will continue to work through challenges as the economy adjusts to government interference,” wrote Sean Scott, managing director at GREA, formerly Greystone Investment Sales. “In states like Texas, that adjustment will have largely positive outcomes. More heavily regulated states will continue to have greater growing pains and population losses, as values fluctuate to greater degrees.”

Inflation, however, tends to affect all markets more evenly. At the end of November, the Consumer Price Index, the key metric by which inflation is measured, was up 6.8 percent year-to-date, excluding movement of prices of the volatile commodities that are food and fuel. That figure, which is tracked by the U.S. Bureau of Labor Statistics, represented the latest data available at the time of this writing and marked the fastest rate of price escalation in nearly 40 years.

Of the three respondent groups, developers/managers were almost equally as concerned about supply chain snarls impacting commercial deals and projects in 2022 as inflation. Brokers downplayed the ramifications of the delays and disruptions in the global movement of goods, instead citing GDP/job growth as the second-most important macroeconomic variable to monitor.

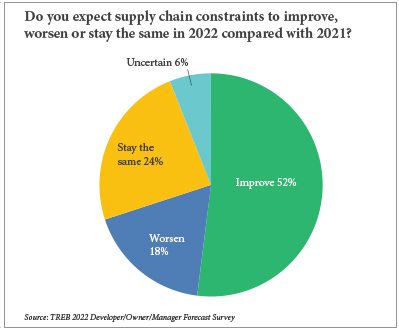

In a separate question, however, more than 50 percent of the respondents across all professions said that they expected the supply chain woes to ultimately improve in 2022. Among those who disagreed with that notion, more brokers and developers stated that the problem would be more likely to stay the same than worsen.

“The greatest challenge [in 2022] will continue to be supply chain constraints,” wrote Patrick Vaughn, operating director — non-energy at Southern Ute Growth Fund. “But they will improve as businesses adapt and innovation creates new opportunities for those willing to embrace them. That goes for labor as well — the labor market may trend to stability in certain sectors due to automation being accelerated by the tight labor market.”

“The greatest challenge [in 2022] will continue to be supply chain constraints,” wrote Patrick Vaughn, operating director — non-energy at Southern Ute Growth Fund. “But they will improve as businesses adapt and innovation creates new opportunities for those willing to embrace them. That goes for labor as well — the labor market may trend to stability in certain sectors due to automation being accelerated by the tight labor market.”

All respondent groups were similarly split on the question of the labor shortage, with virtually equal numbers of respondents across both groups believing that the situation would either improve or stay the same. According to the U.S. Bureau of Labor Statistics, the labor force participation rate stood at 61.8 percent at the end of November, down from the pre-pandemic level of 63.3 percent in February 2020.

“The pandemic forces business to change, adapt and innovate,” continued Vaughn. “While there still may be labor shortages in certain industries, others will learn how to thrive with less people.”

In some ways, COVID-19 is the common thread that links inflation, supply chain issues and labor shortages. Federal and state relief bills and stimulus payments to business and consumers impacted by the virus over the last 22 months pumped large amounts of money into an economy that still featured historically low interest rates. Dock workers at the nation’s largest ports, as well as truck drivers and warehouse workers, have been highly susceptible to virus transmission as essential workers. The U.S. labor market is unequipped to meet the millions of job openings, and multiple studies have cited fears of contracting COVID as a major deterrent for employees to return to the workplace.

It’s all interconnected, as some survey participants noted in their answers to free-response questions.

“Inflationary pressures, supply chain problems, labor shortages and the higher cost of labor are creating a perfect storm that will impact retail sales and profits in 2022,” wrote Jeannie De Fazio, vice president and managing broker at Dallas-based retail developer N3 Real Estate.

“Consumers will tighten their belts in 2022 due to rising costs of living and retail sales will decrease accordingly,” De Fazio continued. “Retailers providing essential goods and services will be the only winners in 2022 — but with lower profit margins. This is all without the added impacts of prolonged or reinstated COVID pandemic policies.”

Silver Linings

Despite the overwhelming consensus that inflation will adversely impact commercial leasing, development, sales and financing in 2022, most survey participants indicated that the Texas markets would survive the heightened cost of doing business this year.

Each respondent group was asked to specify just how severe the impacts of inflation would be on their businesses in 2022. Respondents were given five choices: significantly positive, moderately positive, significantly negative, moderately negative or no impact. Across each group, about half the respondents chose the “moderately negative” option.

Interestingly, “moderately positive” was the second-most common answer choice in each group as well. This selection suggests that brokers, developers and managers believe that Texas has strong consumer demand, population growth and corporate relocation activity such that commercial users and investors want to be here, even if it costs them a little extra to lease or buy.

In addition, this finding reflects the fact that inflation can be a double-edged sword. Owners may find the current market conditions to be advantageous in terms of achieving higher sales prices and valuations for their properties.

This could in turn prompt more activity in the market as sellers are incentivized to sell at what could be the peak of the market. With that divergent piece of logic potentially in mind, developer survey participants displayed more balance than in years past with regard to their fundamental buy/sell position for the year. About 50 percent expect to be net buyers, while 30 percent see themselves as net sellers in the new year.

In terms of leasing activity, tenants’ operating costs are also set to rise due to inflation. Again, multiple schools of thought prevail as to what this means for the market. Higher rents could be a natural byproduct of the inflated economy, or the elevated cost of doing business, including providing tenant improvement allowances, could preclude landlords from pushing rents on cash-strapped tenants whose leases are up for renewal. Those tenants will face a choice of whether to renew during a high-cost period or relocate to less-expensive spaces.

In either case, brokerage services will likely still be required, which might explain why 95 percent of broker respondents believe that they will do roughly the same or, in most cases, greater volumes of business in 2022 versus 2021.

Real estate is a long game, and while inflation may not be transitory in the extreme short term, pricing levels should eventually moderate. In addition, real estate is a well-known hedge against inflation, given that it has less short-term volatility than the stock market and a significantly greater risk-reward payout than U.S. Treasury notes.

In fact, that proposition alone is enough to make some investors bullish on the current market, as one respondent pointed out. “With inflation and the dynamic growth in Texas, it will be tough to overpay for commercial real estate assets in 2022, and [investors’] basis will look good in five years, especially within the multifamily and industrial spaces,” wrote Richard Robson, senior associate at Marcus & Millichap’s Dallas office.

Other Findings

In addition to chiming in on macroeconomic influences and expected deal volumes, survey respondents were also invited to share expectations on how various commercial asset classes would perform in 2022.

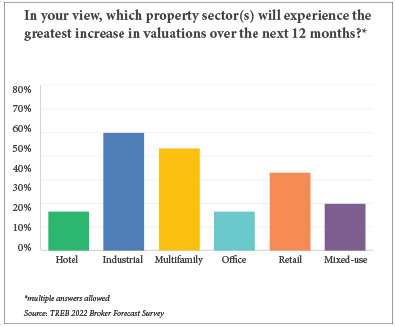

The results of these questions largely mirrored those of recent past surveys and indicated that the impacts that COVID-19 has had on how people work, dine, shop and travel are still very much in effect. Brokers selected industrial and multifamily as the property types that were both most likely to experience a high velocity of sales and to show the greatest increases in valuation this year.

E-commerce activity is likely to soar in the early stages of 2022 following the end of the holiday shopping season and the surge in COVID-19 cases. The bullishness of multifamily has certainly not been hurt by the pandemic and subsequent growth in working from, cooking in and generally staying home. But the investment appetite for this property type is also a function of the simple fact that Texas needs more housing of all types to accommodate its rapidly growing population.

Yet based on brokers’ responses, the outlook for brick-and-mortar retail is not all gloom. About a third of those who weighed in on the question of asset valuation — a question in which more than one property type could be selected — included retail on their list of appreciable sectors.

“The [biggest] challenge [in 2022] will be providing housing to all those moving into the area,” said respondent Larry Jokl, broker at Bremco Real Estate & Property Management, a brokerage firm based in the South Texas city of Brownsville. “The multifamily growth is not sufficient enough to accommodate all of those moving in. The other challenge involves the fact that there’s not enough major retail in the area.”

For their part, developers seemed to echo this view, noting when it came industrial and multifamily deals in 2022, they expected to have greater negotiating power with tenants on rental rates.

In terms of which asset classes present the most attractive financing opportunities, lenders overwhelmingly cited industrial and multifamily, with those two property types accounting for 27 of the 33 votes cast for this question. Texas lenders and intermediaries were quite bearish on hotel and office deals, with those two options accounting for about 90 percent of the responses to the question of which property types offered the least attractive financing opportunities.

— This article originally appeared in the January 2022 issue of Texas Real Estate Business magazine.