It will likely surprise no one, given the wealth of coverage on the issue of reduced office usage, that office vacancy is the top challenge currently facing central business districts (CBDs) worldwide, according to a recent report by JLL.

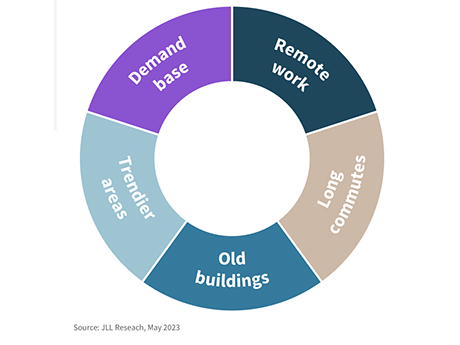

Long and costly commutes, property obsolescence, competition from other submarkets and unstable demand are the other top hurdles for CBDs.

Far from pessimistic though, the report — The Future of the Central Business District — says that CBDs can and will adapt to the new landscape, with government officials and commercial real estate players holding the power to “unlock the future potential of CBDs.”

Hybrid work presents a hindrance

According to research presented in the report, roughly 60 percent of workers “expect flexible arrangements” when it comes to their presence in their offices, with hybrid working arrangements (comprising schedules that are partly remote and partly in-office) becoming increasingly popular. Workers, the report states, now spend an average of 2.3 days of the week remotely, and office vacancy in the United States sits at 20.2 percent.

Aside from the implications for the office sector, the woes of which are well documented, the absence of workers from offices translates to reduced foot traffic in retail spaces and the CBDs at large. This is further compounded by a reluctance on the part of the population to spend time and money commuting, one of the factors driving the desire to work from home in the first place.

CBDs today must also contend with property obsolescence, another of the challenges identified by JLL’s research. A great number of buildings located in CBDs are older — the report shows that in New York City, more than 90 percent of CBD inventory was built prior to 2015, with Boston, Washington, D.C. and Chicago all roughly between 80 and 90 percent.

Aging properties require retrofitting, particularly in the interest of meeting efficiency regulations enforced in the name of environmental sustainability, and newer mixed-use neighborhoods are emerging as competition for existing CBDs. Fulton Market in Chicago, Shoreditch and King’s Cross in London, MediaSpree in Berlin and Roppongi in Tokyo are singled out as exemplars of this new breed of neighborhoods.

Unstable demand is the final obstacle pointed out in the report. Aside from irregular office space usage, the report notes that hospitality and retail are likewise subject to wavering demand, albeit to a lesser degree. Though pent-up consumer appetite following the end of pandemic restrictions contributed positively to spending, the report classifies revenue in these sectors as “highly volatile,” with predictions for leisure travel for 2023 remaining below pre-pandemic levels.

Office has opportunity to evolve

Survival in the face of such challenges will require CBDs to transform, with an emphasis on mixed-use destinations, according to the report. Greater cooperation and partnership between private and public parties will be key to facilitating this evolution and actualizing the future of CBDs as envisioned in the report — transport-focused with access to extensive amenities and educational and cultural institutions.

Governments can aid in this transformation by offering greater levels of flexibility, including amending zoning and fiscal policies, to developers and investors. Additionally, the report suggests the expansion of tax credits, which could “offset the cost of conversion and reduce the lead time for delivery of new product.”

For their part, investors are advised to “diversify acquisition mix to reduce exposure to external shocks” as well as adopt a strategy regarding “shifting user preferences,” allowing for repositioning properties and portfolios in the face of the new landscape of the commercial real estate industry.

Developers should likewise “focus on creating destinations that respond to changes in how people live and work.” It is also important that developers lend special consideration to delivering assets that can meet “increasingly ambitious” environmental regulations, thereby ensuring the long-term viability of projects and of the new species of CBD, one designed to not only survive, but thrive, in the coming decades.

To read the entire report, click here.

—Hayden Spiess