By Max Helgeson, CBRE

As the national real estate landscape undergoes transformative shifts, Kansas City has emerged as one of the region’s most attractive multifamily markets. There are a myriad of attributes making Kansas City an unrivaled destination to deploy capital in the heart of the Midwest. Here are six key areas that propel the market to the forefront of real estate investors’ considerations.

Economic anchors, diversification

Kansas City has one of the nation’s most diverse economies with no sector comprising more than 15 percent of overall employment. A national leader of several durable industries provides unmatched economic stability and significant risk mitigation for investors. Moreover, the metro’s strategic location in the heart of the U.S. and strong transportation infrastructure make it a favored logistical hub for corporations across the world. Finally, the market is a base for startups and entrepreneurs drawn to the area’s abundant talent pool and competitive office space rates.

Strategic infrastructure, connectivity

Infrastructure is a cornerstone of Kansas City’s rise to prominence. The city’s strategic network of highways, interstates, railways, fiber networks and a major airport not only facilitates connectivity but positions it as a hub for commerce. This strategic infrastructure acts as a magnet, pulling in investors keen on markets that are not just thriving today, but strategically positioned for sustained growth.

A haven for capital in any economic climate

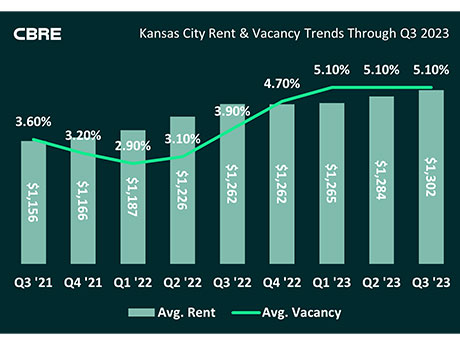

Kansas City’s diverse economy and low cost of living have traditionally helped its multifamily market withstand economic slumps better than other U.S. cities. During the 2008-2009 Great Recession, national average rents fell by 7.1 percent, while Kansas City only saw a 2.2 percent drop. In 2020, amid the pandemic, national rents fell by 4.7 percent, while Kansas City’s rents increased by 1.5 percent. In 2023, despite economic instability and inflation, Kansas City showed its resilience again with a 3.2 percent annual rent increase in the third quarter, significantly above the national average of 0.7 percent.

The nation’s most affordable rental market

Kansas City’s multifamily sector serves as a beacon of affordability. Through the third quarter of 2023, the metro’s average rent stood at $1,302, representing only 20.3 percent of the median household income. This positions Kansas City as one of the most affordable rental markets in the country, with a significantly lower ratio compared with the national average of 36.1 percent. In an inflationary environment, this is a critical metric that has captured the attention of national and international capital seeking stability in uncertain times.

Suburban submarkets led metro growth, including North Overland Park (+5.4 percent) and Olathe/Gardner (+4.7 percent). Metro vacancy stayed flat with the previous quarter at an average of 5.1 percent. The lowest vacancy submarkets were Olathe/Gardner (3.3 percent), Shawnee/Lenexa/Mission (3.5 percent) and South Overland Park (4.2 percent).

Demand for multifamily is expected to remain strong, as rising mortgage rates and increased construction costs have driven the cost of owning a home to unprecedented levels. Year over year, the median home sales price has increased significantly throughout suburban Kansas City (10.39 percent). Furthermore, Kansas City had the fourth-highest mortgage premium (mortgage payment versus rent payment) in the nation behind San Jose, Austin and Seattle, according to a 2023 report from CBRE. Per the report, “Markets like Kansas City have seen significant increases in both rents and home prices due to in-migration from higher-cost markets.”

Unprecedented supply, demand

Since 2014, 33,782 new units have been delivered in Kansas City, a roughly 25 percent increase in metro inventory. Despite a heavy concentration of new units in Johnson County, Kansas (31 percent of pipeline) and the urban core (29 percent of pipeline), all submarkets saw new units delivered over the last 10 years, which helped keep absorption levels near 1:1. The market’s intentional focus on areas identified for growth has helped position Kansas City as a thriving metro.

A preferred market for capital

Rising interest rates have significantly cooled multifamily transaction volume across the nation in 2023, and Kansas City is no exception. Nevertheless, the city has remained among the most active Midwest U.S. markets for multifamily investment. Through November 2023, metro sales volume totaled $852 million, down 66 percent from a record 2022 year ($2.5 billion in total sales volume).

Despite a reduction in transactions, Kansas City remains a preferred market for capital in the region. In both 2022 and 2023 year to date, Kansas City ranked as the third most-traded market among the Midwest’s 20 largest metros, behind only Chicago ($6.4 billion in 2022 and $3.3 billion in 2023) and Indianapolis ($2.7 billion in 2022 and $1.1 billion in 2023).

Future of unparalleled growth

Kansas City’s journey to becoming the Midwest’s most attractive real estate market is underlined by a convergence of factors — economic diversity, affordability, robust infrastructure, favorable fundamentals and high quality of life provide unmatched stability and risk mitigation. As capital increasingly turns its gaze toward the Midwest, Kansas City stands tall, beckoning with a promise of not just stability but a future of unparalleled growth in the heart of the region.

Max Helgeson is a senior vice president with CBRE. This article originally appeared in the January issue of Heartland Real Estate Business magazine.