By Taylor Williams

According to the results of Texas Real Estate Business’ annual reader forecast survey, to many commercial brokers and owners in Texas, the change of power in the White House is very much a good thing.

In the survey, respondents across a wide range of commercial jobs, practices and asset classes shared expectations for 2025 across an even wider range of topics. But as is usually the case every fourth December, it was the results of the presidential election that generated the most insight and feedback from participants. Like the man himself, the commentary on Donald Trump was often polarizing, but it’s a welcome respite from years of focusing on inflation and interest rates.

Across two separate surveys, 45 brokers and owners/developers answered, via free-response format, the same question of how Trump’s re-election would impact the industry in the short run. Though in their entirety, responses ran the gamut from effusive to disheartened and everything in between — with many respondents unsurprisingly opting to remain anonymous — the overall resulting feeling is clearly one of optimism.

During his first term as president, Trump, a major commercial developer himself, routinely pressured the Federal Reserve to lower interest rates, which were already at historic lows. His efforts were by no means unsuccessful and unquestionably supercharged job growth during the core years of his first term. However, the counterargument — that in exchange for accelerated short-term growth, the economy was backed into a corner with no recourse for stimulation that was needed when a global pandemic hit — is also fair.

Commercial real estate professionals, however, tend to prefer low interest rates no matter the state of the larger economy. Deal-penciling implications aside, higher interest rates represent perhaps the largest barrier to business growth in both brokerage and development simply because they dictate everything.

Elevated interest rates make it mathematically harder for owners to secure fresh debt or refinance old loans, putting pressure on operating costs. Deal volume slows, hurting brokers’ books of business. Even tenants feel the sting as overall consumer spending is discouraged, in some cases prompting users to delay real estate decisions as they face declining sales. On the surface, everybody loses.

And there is no quick fix. Even with the Federal Reserve cutting the federal funds rate by 100 basis points over the final four months of 2024, business activity and transaction volume have been slow to rebound. To be fair, part of that malaise was and is tied to the election itself. But with the ugly, partisan race for the White House also came prolonged uncertainty about the country’s larger economic position, and nothing grinds business to a halt quite like uncertainty.

Trump’s “America-first” economic agenda promotes philosophies and practices that in theory should curb and keep inflation down: reduced government spending, onshoring of manufacturing operations, ramping up of domestic oil and gas production. Yet Trump has also vowed to slap tariffs on imports from dozens of countries, including some of America’s biggest trade partners, which many economists believe could have the opposite effect. But judging by the survey results and responses, while parts of Trump’s economic plan may conflict, his message, persona and track record are viewed as boons for the American business community.

“Trump is seen, for right or wrong, as a positive influence on the U.S. economy,” wrote Chase McAteer, executive vice president at Houston-based brokerage firm Oxford Partners. “In the short-term, the impact on the commercial real estate industry will be positive as interest rates continue to fall, inflation continues to moderate and business owners roll into 2025 with positive sentiment about where the economy stands. Sentiment drives business decisions more than the actual market conditions.”

“Headwinds will shift toward tailwinds as commercial real estate will be the beneficiary of rising confidence in all sectors of the economy,” added Scott Henderson, executive vice president at SVN | EverTrust Realty Advisors.

Some Texas brokers were blunter in their assessments of Trump’s impact on the health of the industry.

“[We’re breathing] a big sigh of relief,” wrote Lloyd Thomas, associate broker at San Antonio-based NAI Excel.

“[Trump is] pro-business, pro-deregulation, pro-America,” added Andrew Sandquist, vice chairman at Newmark.

One broker who has always been especially candid in our survey, Brian Novy, owner at Austin-based commercial services firm The Novy Co., considered the contrarian perspective of Trump’s re-election in his remarks. Ultimately, however, Novy conceded that the results of the election constituted a net positive.

“[We are] extremely concerned about Trump’s tariffs,” wrote Novy. “As tax cuts sound good for the wealthy, [they] will hurt the middle class. Inflation increases. Increases in prices [will be] passed on to consumers. His cuts could hurt social services and healthcare. Mass deportation will definitely [affect] the construction, manufacturing, hospitality, healthcare and tech industries, losing workers this country needs.”

Novy followed that assessment with the assertion that “Trump will have a dramatic positive effect on the economy in general, as people are fed up with constraints put on them by the Democrats’ administration.”

For their part, developers and owners were somewhat less enthusiastic about Trump’s victory, but by no means dismayed. In expressing their reasoning, several respondents added qualifiers that may or may not come to fruition as instrumental in determining just how beneficial Trump’s election will be for the industry.

“[Trump’s re-election will be] positive if we see a reinstatement of 100 percent bonus depreciation,” wrote Shawn Griffith, the Denton-based vice president of treasury and finance at California-based Craft Capital Investments. “Ideally, the bulk of his policies are expected to be business-friendly, but we will have to wait and see.”

“We hope, among other things, that the Trump White House will further expand opportunity zones, which are set to expire next year,” added Jerome Johnson, founder of Avery & Ivory Capital, a commercial investment firm based in the Houston area. “Hopefully the duration and the boundaries of opportunity zones continue to grow in order to reinvest capital in areas across the country.”

“It’s likely positive [for the industry] if tax cuts occur and a more business-friendly environment [prevails],” concluded Arnold Rodriguez, COO at Studio Village, a Texas-based firm that serves the real estate needs of the entertainment industry.

Some developers and owners did, however, more fully acknowledge the potentially harmful impacts that some of Trump’s policies could have on commercial real estate.

“If he follows through on tariffs, it is likely that construction costs remain very high, which will continue to stifle development along with elevated rates,” wrote one participant who opted to remain anonymous.

“Significant immigration enforcement will negatively impact labor availability, population growth and users of real estate broadly,” commented another who similarly chose anonymity.

Other Findings

As part of the survey, brokers and owners both weighed in on more traditional industry issues. And once again, a theme of optimism for 2025 prevailed.

For context, the survey officially closed on Tuesday, Dec. 16 — two days before the Federal Reserve formally enacted its third rate cut of the current cycle, which brought the federal funds target rate to 4.25 to 4.5 percent. The nation’s central bank did not make any major waves with that move, which was largely priced into market expectations, leaving only the question of whether additional hikes were on deck for 2025.

But the closing of the survey also preceded the release of the December jobs report, which beat economists’ expectations, though much hiring around this time of year is seasonal. At any rate, the jobs report quickly dashed investors’ hopes for more immediate rate cuts, which of course sent the stock market into a short-lived downward spiral. As such, all forthcoming insights from brokers and owners about macroeconomic expectations and firm-level business projections do not reflect the impacts of those events.

But enough with the buzzkilling. Here are some of the core survey findings that speak to the belief that 2025 will be a year of elevated deal volume, project progress and general growth within the Texas commercial real estate industry:

• About 76 percent of brokers stated that they expected their firm’s total transaction volume by dollar amount in 2025 to exceed that of 2024

• As a follow-up, among those who projected greater deal volume in 2025, 69 percent projected that the year-over-year revenue increase would be in the double digits

• Roughly 63 percent of owners/developers said that they expect to be net buyers in 2025, while only 28 percent anticipated being net sellers

• More than half (55 percent) of developers noted that they were either “highly confident” or “moderately confident” that their companies would grow their overall project pipelines in 2025

• Between 90 and 95 percent of brokers and owners alike belonged to the camps that believed that interest rates would either decrease or remain the same this year

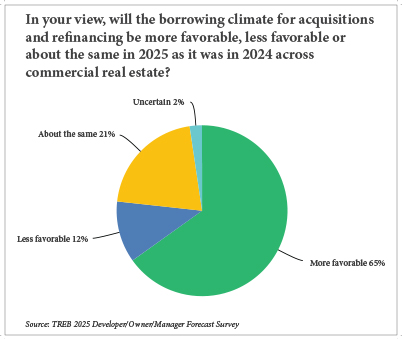

• Similarly, only 12 percent of owners/developers indicated an expectation that the overall borrowing climate would be less favorable for them this year versus 2024

As for performances of specific commercial property types, Texas brokers generally remain bullish on multifamily and industrial — two sectors whose fundamentals have softened a bit over the past 18 months or so. These two fan favorites finished first and third, respectively, in the broker-based poll of asset classes that would likely experience the greatest increases in valuations in 2025.

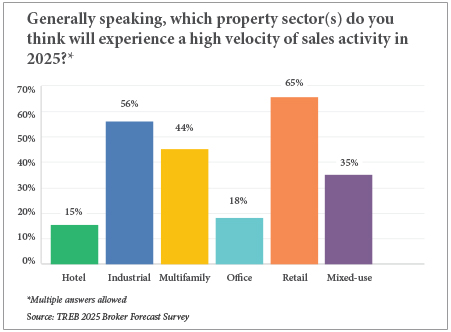

Second on that list — by a very thin margin — was retail. Brokers appear to have embraced the narrative that brick-and-mortar retail should continue to perform well, driven by low supply growth in most markets and retailers’ optimization of omnichannel sales platforms that include a physical presence. Brokers also selected retail as the asset class that was most likely to see overall highest velocity of sales activity in 2025.

Across office, retail, industrial and multifamily, owners/developers had mixed views on whether their negotiating power with tenants would be stronger, weaker or the same this year versus last year. The consensus seems to be that multifamily owners will have the ability to push rents a bit more strongly this year, whereas industrial owners still need time for excess supply to burn off. That narrative is bound to vary significantly, however, not only from one major market to the next, but also across various submarkets in the same MSAs.

There remains a consensus of little optimism for the office market, which brokers overwhelmingly selected as the property type that would have the lowest volume of investment sales activity in 2025. In addition, less than a third of broker respondents see office usage returning to pre-pandemic levels within the next 18 to 24 months.

Developers were even more pessimistic about the future fortunes of the office market, with roughly 40 percent of participants flatly stating that such levels of utilization would probably never be achieved again.

— This article originally appeared in the January 2025 issue of Texas Real Estate Business magazine.