As the commercial real estate industry turns the page from 2023 to 2024, direct lenders and financial intermediaries are much more confident about the growth prospects for annual loan production than they were a year ago. They are also keenly aware of the growing level of distress in the office sector.

Fifty-eight percent of participants in France Media’s 13th annual lender forecast survey expect the total dollar amount of commercial and multifamily loans closed by their firms this year will be higher than in 2023. Another 24 percent anticipate annual business volume will decrease, and 18 percent indicate it will remain at the same level.

By comparison, 35 percent of respondents in last year’s survey expected their firms to increase loan volume in 2023. The largest group of respondents, 44 percent, anticipated annual loan volume to decrease.

In the latest survey, views on the annual percentage change in business activity vary greatly. Among respondents who expect their firms to boost deal volume in 2024, 41 percent predict an increase of over 20 percent. Another 27 percent expect a more moderate increase of 6 to 10 percent.

Among those who foresee a decrease in the total dollar volume of loans closings this year, 35 percent anticipate a decline of more than 20 percent, while 26 percent expect a reduction of 5 percent or less.

Fifty percent of respondents expect refinancing activity to account for the bulk of loan production at their firms in 2024, followed by acquisition financing (24 percent) and construction financing (20 percent). The remaining 6 percent of participants selected “other.”

Those were among the key findings generated by the survey, which was conducted via email from early November to early December 2023. Among survey participants, 63 percent identified themselves as mortgage brokers while the remaining 37 percent were capital providers. Survey respondents were more active in the Western United States than any other region.

Distressing Office Outlook

The well-chronicled struggles of the office sector are reflected in the survey results. Some 65 percent of respondents expect the volume of distressed office properties to increase significantly this year compared with 2023. Perhaps more surprising is that 25 percent of respondents anticipate a significant rise in the volume of distressed multifamily properties in 2024, even though the real estate asset class is in high demand among investors and tenants alike.

When asked how long it will be before office buildings in their market return to pre-pandemic utilization levels, the largest number of respondents (34 percent) indicated three years or longer, but 30 percent said “never.”

Not everyone has such a bearish outlook on the office sector, however. Shlomi Ronen, managing principal of Los Angeles-based Dekel Capital, a real estate merchant bank that offers capital market advisory and private equity expertise to operators, investors and developers, says he’s not convinced the office sector will see a significant increase in distressed assets this year.

“Tenant demand seems to be picking up, and with the economy headed for a soft landing, that will bode well for continued office demand. Outside of the tech and legal sectors, the work-from-home [model] seems to be winding down as companies realize that they need their employees in the office to see productivity gains,” says Ronen.

The office sector has been reeling in the wake of the COVID-19 pandemic that struck the United States in early 2020. The remote work model that was supposed to be temporary has endured and even become widely accepted at many companies, resulting in rising vacancies and a decline in owners’ net operating income.

What’s more, many office owners facing looming loan maturities and seeking to refinance will have to do so at interest rates much higher than five to 10 years ago when the loans were originated. Higher interest rates have increased the cost of debt and driven down building values.

In short, a growing number of office owners run the risk of defaulting on their loans, say industry experts.

Respondents were asked to cite which property sector they believe provides the least attractive financing opportunities (multiple answers allowed). By far, the most frequently cited property type was office (89 percent), followed by the hotel sector (31 percent), retail (14 percent) mixed-use (10 percent), multifamily (8 percent), and industrial (5 percent).

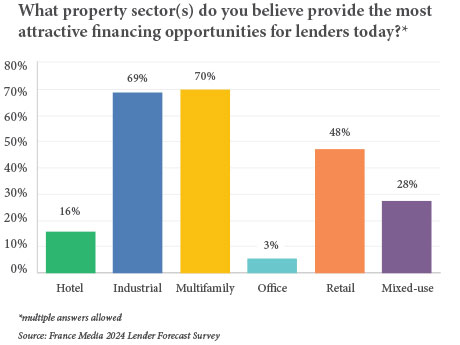

When asked which property types provide the most attractive financing opportunities for lenders, respondents most frequently cited multifamily (70 percent), with industrial a close second (69 percent), followed by retail (48 percent), mixed-use (28 percent), hotel (16 percent) and office (3 percent) (see chart above).

“For industrial and multifamily, there’s been consistent tenant demand with low vacancy rates in most major markets combined with investor appetite for the product types,” says Ronen.

Wild Ride for Interest Rates

Interest rate volatility has become a way of life for borrowers and lenders over the past two years. The benchmark U.S. 10-year Treasury yield briefly hit 5 percent — the highest level since October 2007 — in mid-October 2023. Shortly thereafter, it began to tumble and finished the year at 3.86 percent. At the close of business on Jan. 8, 2024, the 10-year yield stood at 4.03 percent.

It seems like ages ago now, but at the start of 2022, the 10-year yield was a comparatively low 1.51 percent. The sharp uptick coincided with the Federal Reserve’s aggressive move to combat inflation by raising the federal funds rate from near zero to a range of 5.25 to 5.5 percent over a roughly 18-month period.

Against this backdrop, the survey asked lenders and financial intermediaries to provide their “best guess” as to where the 10-year yield will stand at the end of 2024. The largest group of respondents (30 percent) predict a year-end rate of 4.5 percent, followed by 27 percent who anticipate a year-end rate of 4 percent, and 19 percent whose best guess is 3.5 percent. Another 15 percent of respondents expect the 10-year yield to end 2024 at 5 percent or higher.

“The [recent] drop in the 10-year Treasury yield has definitely been a catalyst for refinance activity, allowing borrowers to pay off bridge debt and lower their interest carry cost,” explains Ronen of Dekel Capital. “It has been tough to predict where the 10-year Treasury yield is headed. Given its recent levels, 4.5 percent does not seem unreasonable.”

The X Factor

In a capital-intensive business, naturally the cost of capital plays a critical role. Survey respondents were asked, “Of all potential factors, which do you think will affect the commercial real estate industry the most in 2024?”

Their possible choices included interest rates, inflation, GDP and job growth, the U.S. national debt, geopolitical risk, the U.S political climate, supply chain constraints and rapidly changing technology.

An overwhelming majority (82 percent) identified interest rates as the single biggest factor to impact the commercial real estate industry in 2024. The U.S. political climate was cited by 6 percent of respondents, followed by GDP and job growth at 4 percent.

CMBS Issuance Takes a Hit

The commercial mortgage-backed securities (CMBS) market provides liquidity to real estate investors and commercial lenders. Since the mid-1990s, the financing vehicle has played a vital role in providing debt capital to borrowers.

Although the final figures for CMBS issuance in 2023 were not yet released as of press time, deal volume through approximately the first three quarters of 2023 on a year-over-year basis had plummeted due to sharp rises in interest rates and bond spreads.

Private-label CMBS and commercial real estate collateralized loan obligation (CLO) issuance totaled $30.7 billion as of Sept. 25, 2023, according to the CRE Finance Council. That marked a 67 percent decrease from the previous year’s tally of $92.4 billion for the same period.

Survey participants were asked to project total domestic CMBS issuance in 2024. The largest group of respondents (28 percent) project that total issuance will range from $30 billion to $39 billion, followed by 19 percent who expect total issuance to be less than $30 billion, and 16 percent who indicate the total issuance will be $40 billion to $49 billion.

Challenges, Opportunities

In the write-in portion of the survey, lenders and financial intermediaries weighed in on a variety of timely issues.

“The greatest opportunity for mortgage bankers or brokers over the next year will be in arranging equity to fill the gap on new construction loans due to tighter underwriting as well as higher construction costs. In addition, we can leverage our correspondent life insurance company lenders while local banks remain on the sidelines with liquidity issues,” stated Thomas F. Grzebinski II, a senior director with mortgage banking firm Gantry. He is based in the firm’s Upstate New York office.

Jonathan Kiesetter, president and CEO of California-based Grace Capital Group Real Estate Partners, said it will be crucially important in 2024 that “lenders get their existing loan portfolios stabilized so they can originate new loans.”

Steve Raub, president of San Antonio-based Investment Realty Co., who embraced the “Survive ’23 to Thrive in ’25” axiom, wrote that the commercial real estate outlook for his region is largely positive.

“In the San Antonio-Austin corridor, we are seeing steady growth with construction constrained by high interest rates. Going forward, all sectors should advance. Offices are permanently altered by the work-from-home [model], and only time will tell how that evolves.”

Andy Proctor, principal of Richmond, Virginia-based Atlantic Real Estate Capital, wrote that “loan term maturity defaults and a lack of payoffs will continue to negatively impact the banking industry’s ability to make new loans, constraining the amount of capital in the marketplace. Opportunities for private lenders to fill this gap will continue.”

According to data analytics firm Trepp LLC, $544.3 billion in commercial mortgage loans, including multifamily, is set to mature in 2024.

Rafi Golberstein, CEO of PACE Loan Group based in Eden Prairie, Minnesota, wrote that despite all the turmoil in the mortgage market, the C-PACE industry continued to expand in 2023, resulting in the company’s best year ever.

C-PACE makes it possible for commercial property owners to obtain low-cost, long-term financing for energy efficiency, water conservation and renewable energy projects. The financing vehicle has some attractive features, pointed out Golberstein.

“C-PACE continues to thrive as an alternative financing solution to inject liquidity into properties, lower the overall cost of capital and complete capital stacks.”

— Matt Valley

This article originally appeared in the January issues of our regional publications.