By James Barry III, The Barry Company

The Southeast Wisconsin industrial real estate market has been having a very good run for the past several years. Vacancy rates have continued to stay at historically low levels, absorption of space has declined a bit, but remains consistent, and rental rates and sale prices have climbed steadily upwards.

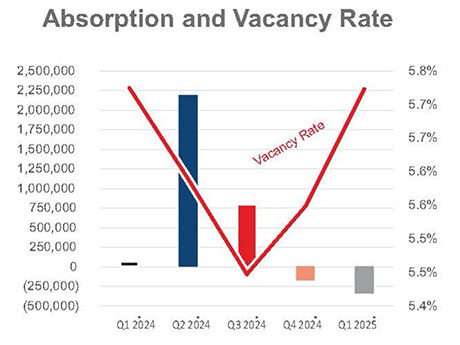

According to the latest statistics gathered by the Commercial Association of Realtors – Wisconsin (CARW), the overall vacancy rate for industrial space in Southeast Wisconsin is 5.7 percent, well below the historic “natural” vacancy rate of 7 to 8 percent (see chart above).

Certain major submarkets have astonishingly low vacancy rates: 1.3 percent in Waukesha County, 0.5 percent in Sheboygan County and 0.6 percent in Walworth County. These submarkets have almost no industrial space available, and any newly available space tends to be snatched up very quickly at premium lease rates or sale prices. Given the lack of available industrial land in many of Southeast Wisconsin’s submarkets and the lack of new speculative construction, this low vacancy environment promises to continue for the foreseeable future.

South I-94 Corridor

The major exception to this low vacancy rate scenario in Southeast Wisconsin is the South I-94 Corridor, extending from the southern part of Milwaukee County south to the Illinois border. This corridor has been home to an extraordinary amount of industrial development during the last decade, including the development of two multi-million-square-foot distribution centers for Amazon, millions of square feet of space occupied by Uline (with more to come) and a plethora of large speculative buildings developed by both Wisconsin-based and out-of-state developers.

The result is that this corridor has been significantly over-developed, with well over 11 million square feet of vacant space now available and a vacancy rate of over 11 percent in the Kenosha and Racine submarkets, well above the 5.7 percent vacancy rate in the overall Southeast Wisconsin market. While construction of new buildings in this corridor has slowed substantially, it will still take several years for the market to correct and for vacancy rates to return to their natural levels.

Hot submarkets

With the exception of the I-94 South Corridor, however, all the other Southeast Wisconsin submarkets continue to enjoy strong fundamentals, such as low vacancy rates, barriers to entry due to limited available land, and quality developers supported by strong lenders. This has put strong upward pressure on lease rates and on the price per square foot of industrial buildings that are being sold.

As a consequence, lease rates that were in the $5 to $6 per-square-foot range several years ago are now in the $7 to $8 per-square-foot range or higher. And buildings that would have sold in the $60 to $70 per-square-foot range just a few years ago are now selling for prices approaching $100 per square foot and often well in excess of that threshold.

Adding to this upward pressure are constantly increasing construction costs, which have risen significantly faster than the inflation rate since the early 2020s. All this means that, in most cases, it has been a landlord’s market, particularly in submarkets where the available industrial space inventory is almost nonexistent.

Based on current trends, we expect to see continued strength in the overall Southeast Wisconsin market, but particularly in the submarkets adjacent to the I-94 West Corridor, such as Waukesha and Walworth counties, and extending even into Jefferson County.

We also expect the submarkets adjacent to the I-41 corridor, such as northern Milwaukee, Ozaukee and Washington counties, to outpace the overall market. Municipalities such as Germantown, Menomonee Falls, Sussex and Jackson have all been very proactive in encouraging industrial development and communities who enable such development to occur will continue to prosper.

Active developers

Southeastern Wisconsin is blessed with many strong industrial development and investment firms who conduct their business prudently and for the long term. Zilber Development has had an excellent track record of building and filling medium-size industrial buildings in the I-41 and South I-94 corridors and continues to steadily grow its portfolio.

The Luther Group has completed several new, successful projects in the Menomonee Falls area and has built a strong portfolio in the New Berlin Industrial Park.

Wangard Properties has recently brought to market several new medium-size speculative buildings in Franklin and Sussex and is actively seeking new opportunities. And Briohn Construction is very active with new build-to-suit developments in Waukesha and Washington counties, as well as throughout the market.

Local lenders such as Associated Bank, Bank of Ixonia, Landmark Credit and Tri-City Bank are often the source of funding for these new projects. In other words, Southeast Wisconsin has a strong foundation for continued prosperity in the industrial real estate sector for many years to come.

Industrial sale-leasebacks

With the higher interest rate environment that the business community is now facing, industrial sale-leasebacks have enjoyed a resurgence in the Southeast Wisconsin industrial real estate market. Southeast Wisconsin is seen as a desirable market in which to place capital for long-term, low-risk investments.

Recent examples of notable sale-leasebacks are the sale of Aztalan Engineering’s 75,800-square-foot industrial campus in Lake Mills, the sale of Cutweld’s 21,900-square-foot industrial building in Menomonee Falls and the sale of an 89,000-square-foot manufacturing building in Waukesha County.

Investors such as Stag, Phoenix Investors, Smart Asset Realty and numerous local investors remain active in purchasing sale-leasebacks and other investment properties in Southeast Wisconsin.

In sum, the Southeast Wisconsin industrial real estate market remains very solid and will be very robust into the foreseeable future, with rental growth steadily continuing and property values continuing to appreciate. It is a good time to be involved in this market as an owner, investor, lender or broker.

James Barry III is president of The Barry Company. This article originally appeared in the May 2025 issue of Heartland Real Estate Business magazine.