By Taylor Williams

Editor’s note: This article covers the opening session (approximately the first 20 minutes) of the “Real Recession Risk or Temporary Distraction?” webcast. To watch a replay of the entire event and listen to the subsequent conversation, please use the link at the bottom of the page.

At least for one week in April, Mark Zandi was to economics what Tony Romo has been to professional football — a broadcaster who sees the play before it happens.

As a featured speaker on a Marcus & Millichap webcast titled “Real Recession Risk or Temporary Distraction?” that took place on Monday, April 21, the chief economist for Moody’s Analytics expressed major concerns over the impacts that the Trump administration’s tariffs had on business sentiment and investor confidence.

Zandi qualified his analysis by stating unequivocally that while damage had already been done, he expected the administration to take an “off ramp,” and revise its tariff policies. Doing so would be crucial to avoiding further sinking the stock and bond markets and potentially hurting the commercial real estate market too by extension, Zandi said.

His prediction, which was made as a market selloff was unfolding — appeared to come true almost instantaneously. Trump administration officials — as well as the president himself — soon put forth public statements that reflected yet another shift on tariffs. On Tuesday, The Associated Press reported that U.S. Treasury Secretary Scott Bessent had described the United States-China trade war as “unsustainable” and anticipated a “de-escalation.”

Early Wednesday morning, President Donald Trump appeared to confirm that notion, telling reporters that the 145 percent tariffs he’d previously slapped on imports of Chinese goods would “come down substantially,” according to reports from CNN. Previously in April, Trump had seemingly settled on a baseline rate of 10 percent on imported goods from all countries, with additional premiums to be applied on a country-by-country basis. Trump had also issued a 90-day pause on reciprocal tariffs for countries that hit back with their own duties on American imports.

As it has done for much of the past two months since tariffs became a fixture in mainstream news coverage, the stock market reacted quickly and aggressively to these statements. Major indices — the Dow Jones Industrial Average, NASDAQ and Standard & Poor’s 500 — all posted significant gains during Wednesday’s trading session, though the markets cooled in late-afternoon trading and remain down from their beginning-of-year levels as of this writing.

Based on recent history, there is little reason to suspect that this pivot will not be counter-pivoted upon in the coming days or weeks depending on the ensuing machinations of the stock market or fresh fluctuations of yields on U.S. Treasury notes. And Zandi’s analysis of the situation was hardly the only criticism of its kind from a qualified economist to crack the news cycle. But just 24 hours removed from the webcast, which Marcus & Millichap said more than 10,000 people registered for, it did appear that Zandi’s analysis had reached some influential ears in Washington.

What Zandi Said

After delivering a blunt nonstarter — “buckle up” — to kick off the webcast, Zandi wasted no time in telling the audience how he really felt about tariffs and trade wars.

“The uncertainty around economic policy, particularly around the global trade war, is doing significant damage, mostly to business and investor sentiment and consumer confidence,” he said. “If we don’t see a shift in policy pretty quickly, the risk is very high that we’ll go into recession. I do think that the president and his administration will take an off ramp one way or another and de-escalate the [trade] war, allowing us to navigate, because the economy came into the year in a very good place and can weather a lot of storms. But unless this storm abates pretty quickly — in the next few weeks — it’s increasingly likely that we suffer an economic downturn.”

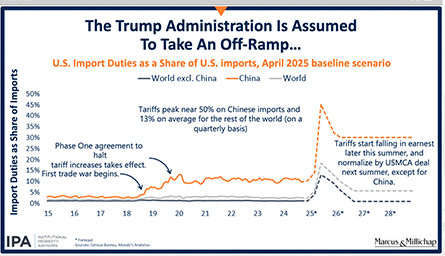

Zandi then presented slides that put the magnitude of the current tariffs into context. His slides showed the current effective tariff rate — calculated as the aggregate tariff revenue divided by the value of the tariffed imports — if all tariffs that had been previously announced were actually implemented, including reciprocals.

If that situation materialized, Zandi said, the effective tariff rate would be about 21 or 22 percent. Before Trump’s re-election, the effective tariff rate was between 2 and 3 percent, and before Trump’s first term, the metric was closer to 1 percent, Zandi said. According to his data, that would be the highest effective tariff rate to hit the U.S. economy since the early 1930s, when the country was in the throes of the Great Depression.

Zandi then connected the dots between tariffs, inflation and economic growth.

“Every percentage point increase in the effective tariff rate raises inflation in the subsequent year by about 10 basis points and reduces GDP growth by six to seven basis points,” Zandi said. He added that his calculations did not include retaliatory tariffs that other countries had either threatened or leveed against U.S exporters, simply noting that tit-for-tat tariffing made the numbers “a bit darker.”

Zandi would go on to analyze patterns in the bond market and exchange rates involving the American dollar that, in his view, spoke to an erosion of foreign faith in the U.S. financial system. He also touched on the nature of the United States’ relations with some of its major trading partners before wrapping his analysis on a positive note, namely by reiterating his belief that the administration would yield to market pressures and ease off the tariffs.

“My baseline outlook does not include a recession because I’m assuming the administration will find an off ramp quickly during this 90-day period of discussion on retaliatory tariffs and will strike a few deals with some countries, cooling things off and allowing the administration to effectively back away from the tariffs and normalize them over the next 12 to 18 months,” he said. “If that happens — and it has to happen quickly — we should be able to navigate through this.”

Nadji Responds

Following Zandi’s opening remarks, Hessam Nadji, CEO of Marcus & Millichap and the de facto moderator of the webcast, acknowledged the concerns that tariffs and trade wars are sending through markets. Nadji, however, adopted a decidedly less ominous tone about the overall economic outlook and expressed an equally strong belief in the off-ramp theory.

“It’s clear that the uncertainty from the trade wars and headlines of the last several weeks rippling into inaction — meaning decisions on expansions and hiring out of reaction to this degree of heightened uncertainty — is a real thing,” he said. “It’s happening as we speak, but it takes a while to accelerate and decelerate, so some economic slowing is already baked in, even in the best-case scenario of an off ramp.”

Nadji then outlined a potential positive scenario of economic rebound when and if the administration did take its foot off the tariff pedal. He drew attention to the fact that just a couple months ago, business and investor sentiment were quite strong and enthusiastic, implying that that positive momentum could not only be recaptured, but also elevated.

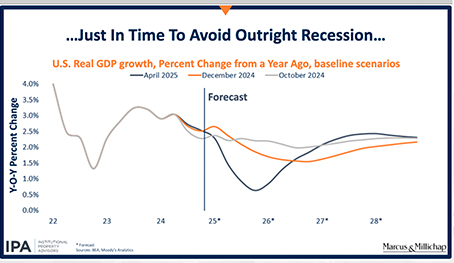

“Should this scenario come together as Mark framed it, we should see an acceleration [in business growth and confidence] from the original forecast for the latter part of 2025 and into 2026, based on the enthusiasm related to the election outcome that we had at the beginning of the year,” he said, utilizing graphics to underscore his point. “We saw that enthusiasm in late 2024, and although we’re now projecting growth below that due to the scope and scale of the tariffs, we give the probability of hitting the off ramp a very high chance.”

While Nadji acknowledged that “nobody wins a trade war,” his larger point seemed to be that the potential for strong economic and real estate growth in the second half of the year and beyond is still very much intact. Zandi did not disagree with this assessment, although he too conceded that the off-ramp scenario was pretty much applicable to all countries not named China. When it comes to the world’s second-most populous country (it’s true, India has eclipsed China), “it’s a whole ‘nother dynamic,” Zandi said. The Biden administration previously repealed tariffs on many countries that were executed during Trump’s first term but kept in place and even elevated in some cases those on China.

Nadji concluded his opening segment with an anecdote about his recent meetings with politicians, investors and other businesspeople in Washington, D.C. He said that his conversations with those individuals had yielded mixed opinions in terms of economic sentiment. But he emphasized his conviction on the strength of underlying property fundamentals across all major categories of commercial real estate — even office, albeit to a lesser degree — noting that the current state of the market “appears to be an opportunity window, if you believe in the off-ramp scenario.”

DeBoer Weighs In

Jeff DeBoer, president and CEO of The Real Estate Roundtable, a nonprofit, real estate-oriented public policy think tank and lobbying group based in Washington, D.C., was the third panelist on the webcast. When Nadji passed the metaphorical microphone to him, DeBoer kicked off his portion of the opening by shedding some light on how things work on Capitol Hill.

Like Zandi, his assessment — that a fast-moving, ever-shifting policy landscape is par for the course in the nation’s capital under any administration — now appears prescient. With this administration, however, rampant swings are even more commonplace, as evidenced by market volatility in the first quarter. In doing so, DeBoer appeared to indirectly endorse the off-ramp theory along with Zandi and Nadji.

“In my 40 years of working in Washington, if you get a call in the morning on any day and someone says, ‘how are you today?’ you say, ‘I’m OK, but is there something I don’t know?’” DeBoer explained. “Information is always coming and going, but in the current environment, it’s even more acute. Things are changing so rapidly, and some things that were said to us at the meeting that Hessam referenced changed almost within 24 to 48 hours.”

Having thus set the table, DeBoer then directly asserted his shared belief that economic disaster could and would be averted and gave clear reasons as to why.

“This is so different from past recessions, whether it was the early 90s, the turn of the century, the Great Financial Crisis or the pandemic, because those scenarios were tied to problems within the markets and financial systems,” he said. “Today, we have a policy-induced issue that has been brought upon people, meaning that it could change overnight. So I’m also optimistic about the off-ramp scenario.”

The Trump administration is using that allegorical off-ramp, at least for now.

DeBoer also reiterated the age-old, widely accepted maxim that in times of inflation or economic volatility, shifting capital into hard assets like real estate is a viable strategy. He added that valuations have come down in some subcategories of certain commercial asset classes as higher interest rates worked their way through the system in recent years and that vacancies were also generally down across the board as construction activity has waned. Accepting those premises at face value translates to good buying opportunities for real estate investors, DeBoer said — once the policy-induced problems emanating from the White House are overcome.

Click here to watch the webcast in its entirety.