By Adam Johnson, NAI Hiffman

For years, you’ve read headlines saying the U.S. office market is struggling with record-high vacancy that threatens to push many owners into default. And that is absolutely true.

But there’s another side to the story that isn’t getting as much attention, and is playing out not only in Chicago, but also in metros across the country: that smaller, multi-tenant office properties — particularly in suburban locations closer to where workers live — continue to not only survive but thrive following the pandemic.

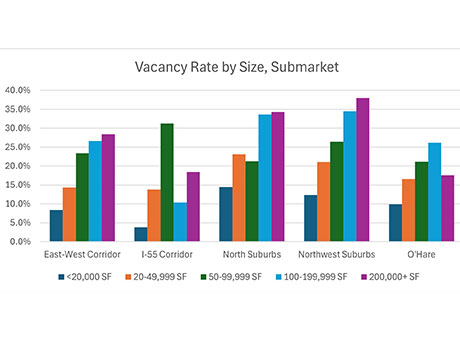

Throughout suburban Chicago, office buildings with less than 50,000 square feet have considerably higher occupancy rates than larger ones. For instance, at the smallest buildings — those under 20,000 square feet — vacancy was as low as 3.8 percent as of the second quarter of 2024, whereas for the largest properties over 200,000 square feet, vacancy climbed as high as 38 percent, according to NAI Hiffman research.

By comparison, mid-size, office buildings between 20,000 to 50,000 square feet reported vacancy rates ranging from 14.3 percent in the western suburbs to 23.1 percent north of the city.

Small tenants, big impact

We’ve all heard about larger office properties going back to their lenders. Look under the hood of those buildings, and most likely, they defaulted due to a single large tenant whose departure couldn’t easily be backfilled, at least not without significant investment to carve up and modernize the space left behind. Smaller vacancies, on the other hand, are a much easier sell.

Office properties with several small users on the rent roll help diversify and spread risk. For instance, a building that devotes 10 percent or less of its space to any one tenant is more desirable because a single move-out won’t result in negative cash flow.

Many suburban companies of this size are smaller, entrepreneurial firms that didn’t adopt permanent hybrid work schedules. This is partially because their employees were less reliant on public transit — a factor that contributed to the emptying out of buildings downtown. In the suburbs, many workers live close to the office, making the commute easier to justify even if they still have to drive short distances.

Another benefit of smaller, multi-tenant buildings: There are only so many ways you can slice a 2,500-square-foot space. The tenants that occupy these footprints typically do so under shorter-term leases with fewer improvement dollars. Together, these factors have allowed smaller offices to endure in an otherwise tough office environment.

Fix up, or tear down?

While small, multi-tenant buildings have fared well, the overall metropolitan Chicago office market softened in 2024, according to Hiffman research. Many landlords — or lenders that took back their properties — have found they need to invest heavily in their buildings to attract and retain tenants.

Well-capitalized owners are making those upgrades to well-located assets, while others are selling their large, dated properties to buyers looking to convert them to alternative uses. This is a positive for the market, as it is eliminating so-called “zombie” space that inflates vacancy. In the northwest suburbs, the former Sears headquarters is being replaced with a data center; another corporate center is being converted into an industrial development; and a third office building will become residences. These three projects alone will remove more than 4 million square feet from Chicago’s suburban office inventory.

For the remainder of the suburban market, leasing activity has slowed significantly. The year-to-date total stands at 2.2 million square feet, down 34.7 percent from the first half of 2023. Moreover, Class A leasing fell 60 percent from the first half of 2023 as the “flight to quality” appears to have moderated due to slow job growth and tenant cost-cutting initiatives. As a result, suburban vacancy reached a new cyclical high of 27 percent at mid-year, up from 25.3 percent one year ago.

Vacancy also rose to a new cyclical high of 23 percent downtown, where landlords have also struggled to backfill large blocks of space amid tenant relocations and downsizings. As in the suburbs, some buildings are being taken offline due to obsolescence. Under a city-led initiative, 1.3 million square feet of vintage office space in the historic LaSalle Street corridor is being converted into 1,000 mixed-

income rental units.

Bright spots

While Chicago’s central business district recorded positive absorption in the second quarter for the first time in two years, the West Loop and Fulton Market are where many downtown tenants want to be. A new building at 360 N. Green St. delivered this fall, adding 500,000 square feet to the downtown inventory. The property is already 90 percent leased, showing how the newest buildings continue to outperform — often at the expense of their older counterparts.

Other developments under construction include 919 W. Fulton Market, a 373,000-square-foot office building with 23,000 square feet of retail, and 800 W. Fulton Market, which will feature 470,000 square feet of office space and 35,000 square feet of retail.

Some of the most recognizable names in the Chicago office market are doubling down rather than packing up. For instance, JPMorgan Chase is refurbishing its offices in the Loop, and Google is renovating the sprawling James R. Thompson Center for its new Chicago headquarters. Major law firms have also committed to large leases in trophy towers.

Signs of recovery are on the horizon. In both the city and suburbs, landlords are finding success with spec suites; our Project Services team has designed and built out many of them, catering to users in search of modern, turnkey space. Owners are also adding in-demand amenities and renovating common areas to maximize use and functionality.

Many business and real estate leaders are optimistic on the future of metropolitan Chicago despite its highly publicized challenges. The region boasts one of the most diversified economies in the country, including nascent industries like quantum computing; attracts graduates from across the Midwest; and offers affordability relative to coastal markets, which are also facing growing challenges associated with climate change.

So, while the headlines may tell a different story, for now at least, those who know the market best understand that with vacancy comes opportunity.

Adam Johnson is an executive vice president with the office services and capital markets group at NAI Hiffman. This article originally appeared in the October 2024 issue of Heartland Real Estate Business magazine.