NEW YORK CITY — Berkadia’s newly released 2022 Mid-Year Powerhouse Poll reveals that the multifamily market continues to experience increased demand among investors and renters despite rising rents and interest rates.

The survey respondents included 123 Berkadia investment sales agents and mortgage bankers across 65 offices, 80 percent of whom reported that they expect multifamily rental demand to continue to outpace supply for the remainder of 2022. The survey was conducted in July.

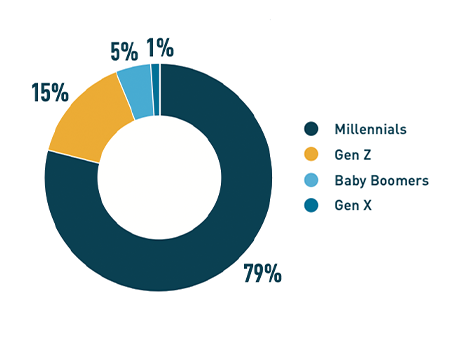

Nearly 80 percent of Berkadia mortgage bankers and investment agents responded that millennials, persons born roughly between 1981 and 1996, are likely to be the generation that will make up the highest percentage of multifamily renters in the next one to two years. An even greater percentage of Berkadia professionals in the Western region (88 percent) report that the majority of their current renters are millennials.

The survey results also revealed that baby boomers tend to rent single-family rental/build-for-rent (SFR/BFR) housing most commonly, while Gen Z typically rent workforce housing.

Seventy-two percent of advisors reported that, besides cost, location is most important to renters today. While movement away from metropolitan areas continues — a trend made popular during the COVID-19 pandemic as renters sought more space — 59 percent of Berkadia professionals indicated that the movement is not occurring as rapidly as it was during the height of the pandemic in 2020 and early 2021.

“Despite rising interest rates and persistent inflation, the commercial real estate industry will continue to exhibit resiliency, proven by investor demand in our primary and secondary geographic markets across the country,” stated Ernie Katai, executive vice president and head of production at New York City-based Berkadia, in a press release highlighting the poll results. “With the rising cost of homes and interest rates, the renter lifestyle has increased investor demand in primary and secondary markets across the country.”

Investor demand in multifamily properties differs across regions, the survey results show, with the Southeast seeing an increase in demand and the West seeing a decrease. In addition, Southeastern, Southwestern, and Western respondents reported a moderate increase of 30 percent in property supply in their regions.

Investor focus is primarily on Class A assets (40 percent), followed by Class B (25 percent), affordable housing (15 percent) and SFR/BFR (13 percent). Berkadia advisors report that long-term investments, followed by single-family rentals, are likely to be most attractive to institutional clients in the next one to two years.

Eighty percent of Berkadia mortgage bankers and investment sales agents reported that rising interest rates and inflation have a high impact on their local market, and 94 percent felt that rent increases will have a significant influence on deal volume in the multifamily industry.

Some 59 percent of respondents indicated that private investors were likely to provide the most activity in 2022, compared with 31 percent who felt institutional investors would provide the most activity within the multifamily market.

When asked how investors are addressing the growing popularity of integrating environmental, social, and governance (ESG) criteria within portfolios, 44 percent of Berkadia professionals said investment properties are being developed to meet ESG criteria and 20 percent said that properties are being converted to comply with energy-efficiency policies.

Production rates in the Northeast and Midwest have remained stable since the beginning of the year while other areas, such as the Southwest, have slowed, the survey results showed.

Some 42 percent of Berkadian respondents indicated that investment sales production in the Northeast has remained stable since January, compared with 20 percent in the Midwest. Conversely, 83 percent of investors indicated that investment sales production has slowed in the Southwest since January.

Read Berkadia’s full 2022 Mid-Year Powerhouse Poll report here.

— Channing Hamilton