By Glenn Brill, Daniel Keller and Niculae Draghici of FTI Consulting Inc.

Once viewed as a relatively stable niche for real estate investors, the film and TV production facilities (“studio”) market is entering a precarious future.

According to a recent study by Ampere Analysis, global film and TV production spending is expected to grow just 0.4 percent in 2025 after the end of a pandemic-era spending surge, while the development of new, purpose-built studios has soared. Markets such as New York, Georgia and Toronto have more than doubled their stage capacity in the past five years, according to data from Film LA, reshaping the industry and its implications for investors in an uncertain market environment.

Producers are following generous refundable tax credit programs and favorable foreign exchange rates around the world, prompting competition among regional production centers to offer more compelling incentives to lower the cost of production.

New Supply, Tax Credits Lead The Way

Los Angeles (LA) remains the home of legacy studios and the highest concentration of production facilities. Yet as Film LA notes, that market is struggling to lease space as major producers prioritize dedicated facilities for their own use in regions with attractive tax incentives and a competitive or lower cost basis.

In New York City, an underbuilt market with aged facilities, several large-scale, purpose-built projects ranging from 750,000 to 1.5 million square feet are proposed or in progress, according to analysis from Deloitte. New construction is expanding the supply of Tier 1 facilities in anticipation of strong demand that is expected to drive occupancy close to full capacity.

As supply expands, large-scale producers are increasingly occupying dedicated facilities as long-term “anchor tenants” rather than competing for space on the “as-needed” market. In doing so, they seek to control production timelines and ancillary costs. This indicates a shift toward producer-controlled assets, reducing demand for third-party, independently operated studios.

For example, Netflix recently opened a 165,000-square-foot dedicated production facility in Brooklyn, and in May 2025 broke ground for its new $900 million studio facility in Monmouth County, New Jersey, which is a redevelopment of a former U.S. Army base. In an interview with Times of India, Netflix co-CEO Ted Sarandos highlighted the importance of the state’s tax credits in the company’s investment decision.

Geographic Realignment Is Ongoing

Markets like Toronto, Atlanta and those of the Northeastern United States have increasingly captured market share from LA, which is still considered the hub of “above-the-line” talent and where production deals get done.

Toronto is the clearest example of a lower-cost alternative with its uncapped refundable tax credits, favorable foreign exchange rate, available union craft labor and a growing pipeline of modern facilities. Georgia is also highly competitive with a strong tax credit program and expanding supply supported by experienced facilities managers.

In the Northeast, tax credits and shooting locations are continuing to attract market share as the greater New York City market remains attractive as a center of the U.S. urban lifestyle for filmmakers and talent, with new production facilities planned to open.

The Current Los Angeles Market Is Uncertain

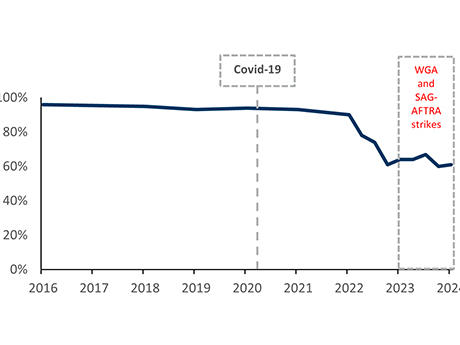

LA’s film and TV studios are experiencing the impact of surging production in other regions. California’s $300 million tax incentive program was lower in comparison to other states and was considered a reason for production to slow considerably. In addition, interruptions to production including the 2023 Writers Guild of America, Directors Guild of America and Screen Actors Guild – American Federation of Television and Radio Artists (SAG-AFTRA) strikes and recent LA wildfires have likely disrupted the workforce and impacted the number of production days. Consequently, studio occupancy has yet to rebound.

LA shoot days fell 22 percent in the first quarter of 2025 compared to the same period in 2024, and California’s share of U.S. film and TV production has dropped to a historic low of 20 percent, according to a report from FilmLA that was covered by The Hollywood Reporter. The impact of the broader marketplace on greater LA is demonstrated by the recent performance of publicly traded Hudson Pacific Properties, which owns over 1.5 million square feet of studio space in the LA area. The company’s total studio occupancy declined from 76.9 percent in the first quarter of 2024 to 73.8 percent in the first quarter of 2025 in a market that has historically operated at 90 percent or higher occupancy level.

In response to market conditions, California recently raised the state’s maximum tax credit allocation to $750 million to stem the outflow of production to other markets.

Meanwhile, LA’s studio inventory consists of many century-old campuses, and many lack the amenities, technology and space efficiency today’s productions demand. Further reducing the demand for space is the ongoing development and impact of digital technology, as producers seek to do more with less space. Ultimately, leasing older facilities to large-scale productions is more challenging, especially as newer supply enters the market.

What’s Next?

The rapid expansion of purpose-built studio space, competitive tax incentive programs and the rise of vertically integrated production companies are reshaping the competitive landscape for film and TV production facilities.

For investors and operators, navigating this evolving market will require a sharp focus on operating cost efficiency, public policy trends, emerging regional cost advantages and opportunities to level the playing field as part of mixed-use development.

As cost pressures are expected to remain constant and overall production spending remains flat, regional competition for production spending is expected to heat up. In this regard, the production industry’s drive for cost efficiency is fueled not only by the availability of generous tax credits, but also by the increased availability of union craft labor in lower-cost markets.

The convergence of competitive tax credits and new supply across the marketplace is primed to increase competition for a finite amount of production spending in the near future. Investors need to carefully consider a production facility’s competitive market position, including its built-in attributes and the opportunity to secure longer-term stabilized cash flow for an asset class primed for a shakeout.

Glenn Brill is a managing director in the real estate solutions practice at FTI Consulting Inc. Contact him at glenn.brill@fticonsulting.com. Daniel Keller is a consultant, and Niculae Draghici is an intern in the real estate solutions practice at FTI Consulting.