NEW YORK CITY — JLL has arranged a $16.4 million loan for the refinancing of CIRRUS, a 46-unit multifamily property in Brooklyn’s Prospect Lefferts Gardens neighborhood that was completed in 2024. Designed by AB Architekten with interiors by SR Projects, CIRRUS offers studio and one-bedroom apartments and amenities such as a fitness studio, coworking lounge, package room and a sky lounge with grills, a wet bar and dining areas. Aaron Niedermayer, Robert Tonnessen and John Flynn of JLL arranged the loan on behalf of the owner, New York City-based developer Astral Weeks. The direct lender was not disclosed.

Northeast

ROCKY HILL, CONN. — Marcus & Millichap has negotiated the $14.3 million sale of Big Y Plaza, a 60,497-square-foot shopping center in Rocky Hill, located south of Hartford. Built on 14 acres in 1988, the center was fully leased at the time of sale to the namesake grocer and Wells Fargo. Joseph French Jr., Jeffrey Stearney and John Krueger of Marcus & Millichap represented the Connecticut-based seller in the transaction and procured the buyer, a New York-based investor. Both parties requested anonymity.

SOUTH AMBOY, N.J. — Wingtat Cargo has signed a 96,000-square-foot industrial lease in South Amboy, about 30 miles south of New York City. The shipping company is taking space within the newly constructed, 152,100-square-foot warehouse and distribution building at 111 Main St. Gary Politi and Michael Viera of JLL represented the landlord, a partnership between Woodmont Industrial Partners and Joseph Jingoli & Son Inc., in the lease negotiations. Jimo Liu of Cushman & Wakefield represented the tenant.

CHARLESTOWN, MASS. — EverybodyFights will open a 28,000-square-foot gym in Charlestown, located north of Boston, that will be the fitness concept’s third in the state capital area. The space is located within Hood Park, a 20-acre mixed-use redevelopment of the former H.P. Hood & Sons dairy production facility. The gym will feature an infrared sauna, cold plunge tub, Normatec recovery tools, onsite physical therapy services and a dedicated member lounge. The opening is scheduled for December.

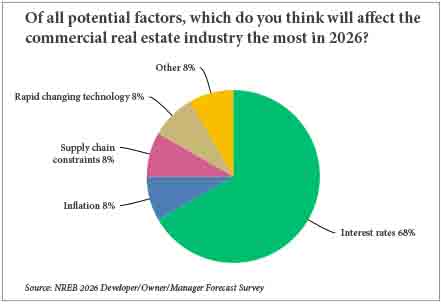

By Taylor Williams The roller coaster ride continues. That’s more or less the joint takeaway from Northeast Real Estate Business’ annual reader forecast surveys for commercial brokers and developers/owners. For if the past 12 months have revealed anything about the economic and geopolitical factors that impact deal volume, investor sentiment and overall industry health, it’s that those dynamics are wildly unpredictable and highly subject to change. In last year’s survey, respondents across both groups expressed optimism — albeit guarded — for better business prospects in 2025. The incoming Trump administration was viewed as pro-business, and the previous year had ended with a trio of long-awaited cuts to short-term interest rates. Capital sources on both the debt and equity sides of the market envisioned a new, more prosperous chapter in 2025 as 2024 closed with subsided inflation, healthy job growth and less volatility in the 10-year Treasury yield. Editor’s note: In mid-November, Northeast Real Estate Business sent email invitations to participate in the annual online survey to three separate groups — brokers; developers, owners and managers; and lenders and financial intermediaries. The survey was held open through mid-December. Invitations to participate were also included in the Northeast Real Estate Business e-newsletter, as …

NEW YORK CITY — American Lions, which is a joint venture between locally based developers Fetner Properties and Lions Group, has received a $111 million bridge loan for the refinancing of The Bold, a 164-unit apartment building in Queens. Designed by SLCE Architects, the 28-story building is located at 2701 Jackson Ave. in the borough’s Long Island City area and includes 50 affordable housing residences. Units come in studio, one-, two- and three-bedroom floor plans. The amenity package consists of a coworking lounge, gym with a climbing wall, party room with a bar and kitchen, clubhouse lounge, media room and a golf simulator room. Christopher Peck, Nicco Lupo, Michael Shmuely, Alex Staikos and Adam Dietrich of JLL arranged the loan through PGIM Real Estate.

MILLSTONE, N.J. — JLL has arranged an undisclosed amount of acquisition financing for a roughly 1 million-square-foot industrial property in Millstone, about 55 miles south of New York City. Millstone 8 Logistics Park was built in 2022 and features a cross-dock configuration, clear height of 40 feet, 170 loading doors and parking for 458 cars and 273 trailers. The facility was fully leased at the time of the loan closing to an undisclosed provider of third-party logistics services. Jim Cadranell, Jon Mikula, John Cumming and Caleb Henry of JLL arranged the loan through Northwestern Mutual on behalf of the buyer, institutional investment firm BGO.

PLAINVILLE, CONN. — Locally based brokerage firm O,R&L Commercial has negotiated the $2.7 million sale of a 36,000-square-foot industrial building in Plainville, located southwest of Hartford. The building at 7 Johnson Ave. was fully leased at the time of sale to two tenants: M&S Building Systems and World Fulfillment. Jay Morris of O,R&L represented the seller in the transaction, and David Murdock of Sentry Commercial represented the buyer. Both parties were limited liability companies that requested anonymity.

NEW YORK CITY — RillaVoice Inc. has signed a 57,350-square-foot office lease in Brooklyn’s Williamsburg district. The AI-powered communications firm has committed to the entire eighth floor at 25 Kent, a 500,000-square-foot building, for a 10-year term. Cooper Weisman and Ryan Gessin of Newmark represented RillaVoice in the lease negotiations. Jordan Gosin, Will Grover and Drew Wiley, also with Newmark, along with internal agents Craig Panzirer and Alex Radmin, represented the landlord, Global Holdings.

PHILADELPHIA — CBRE has arranged a $156 million loan for the refinancing of Bridge Point Philadelphia, an 889,300-square-foot industrial property. Canyon Partners Real Estate and J.P. Morgan provided the loan to the owner of the property, Chicago-based Bridge Industrial, which will use a portion of the proceeds to fund lease-up costs. Steve Roth led the CBRE team that originated the debt. Delivered in 2024, Bridge Point Philadelphia comprises two buildings, one of which features a rear-load configuration and the other of which features a cross-dock configuration. The development also offers “excess “trailer parking, and multi-tenant divisibility. Third-party logistics firm Veho signed a 148,611-square-foot lease at the property shortly after it was completed. In addition, Bridge Point Philadelphia offers proximity to an array of major thoroughfares and logistics hubs, including interstates 76, 95 and 476, as well as the Port of Philadelphia and Philadelphia International Airport. “We were pleased to work closely with Canyon, whose efforts were instrumental in efficiently completing this financing,” said Roth, who holds the title of vice chairman at CBRE. “Their collaborative approach ensured a smooth execution and a successful outcome for all parties involved.”

Newer Posts