By Taylor Williams

They may not be ready to do cartwheels and pop champagne, but when it comes to business expectations for 2025, commercial real estate professionals in the Northeast have a decidedly brighter outlook than in recent years.

The last two years have been defined by barriers to economic growth on numerous levels. Pick your post-COVID geopolitical or macroeconomic poison — stubborn inflation, crushing interest rate hikes, multiple wars, restarting of global supply chains — all culminating with an incredibly heated U.S. presidential election. Is it any wonder that “survive till ’25” became the rallying cry of the commercial real estate industry?

And while 2025 has arrived, the election has been decided and the Federal Reserve has strung together a series of small, yet meaningful cuts to short-term interest rates, the hangover from the aforementioned disruptors has not fully evaporated. Donald Trump’s return to the Oval Office brings a fresh slate of questions about how certain policies — namely tariffs and mass deportations — will impact business at both the national and local levels. And the expectation-smashing December jobs report proved sufficient to immediately pause the Fed’s would-be pattern of rate cuts. And it’s only been one month.

As such, cautious optimism is the prevailing sentiment among commercial brokers and owners who participated in Northeast Real Estate Business’ annual reader forecast survey. The survey invited professionals across all asset classes and markets throughout the region to weigh in on expectations for their business, property type(s) and the industry as a whole via a series of multiple choice and free-response questions.

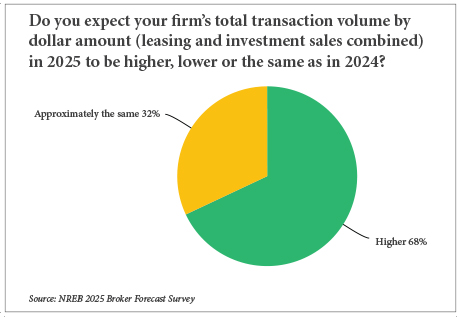

Among the two sets of respondents, for which separate surveys were conducted with some overlap in questioning, brokers were clearly the more optimistic group — which is to be expected. But out of 25 brokers queried about their company’s basic financial forecast for 2025, 75 percent said that they expected to see elevated transaction volume by dollar amount relative to 2024. Another eight said they expected volumes to be about the same, but none anticipated a decline in deal volume or revenue.

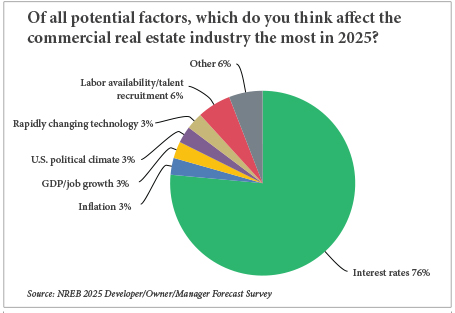

Among those 17 glass-half-full brokers, 10 stated that they expected their company’s total transaction volume and revenue to grow by double digits relative to 2024. Brokers also overwhelmingly (92 percent) indicated a belief that interest rates would either decrease or remain the same in 2025, although that finding was etched before the release of the December jobs report. Most broker participants also believe that the yield on 10-year U.S. Treasury bonds will remain in the 4 to 5 percent range for the majority of the new year.

Volatile movement of 10-year Treasury yields — the benchmark rate by which many commercial loans are priced — has already been a major storyline in 2025. The yield peaked at about 4.8 percent in mid-January, whereas just two months prior, it was trending below 4 percent. While interest rate cuts encourage more borrowing and general business activity, it should be noted that rate cuts also historically trigger increases in bond yields. Higher yields on risk-free treasuries discourage investment in risk-laden ventures like stocks and real estate.

“[Yields on] five- and 10-year U.S. [Treasuries] are actually 75 basis points higher since the Fed eased [interest rates by] 75 basis points,” noted respondent Greg James, director of capital markets at New Jersey-based based brokerage firm NAI James E. Hanson. “So the yield curve should actually steepen significantly in 2025.” The Fed cut interest rates another 25 basis points on Dec. 18, a few days after the survey formally closed, but subsequently held them firm at a range of 4.25 to 4.5 percent at its meeting on Jan. 29.

“[The industry] should see some increase in activity [following rate cuts], although tariffs could trigger inflation again and thus eliminate gains made,” wrote Howard Samuels, president and CEO of Samuels & Co., a full-service brokerage and advisory firm that specializes in retail and entertainment deals. Tariffs seemingly became reality on Feb. 1 when the Trump administration officially imposed 25 percent duties on all imported goods from Mexico and all non-energy products from Canada — only to then pause them on Feb. 3.

Most brokers who speculated on where the 10-year Treasury yield would sit at the end of 2025 were confident that the benchmark rate would not drop below 4 percent, despite the current volatility. This finding perhaps speaks to a premonition that rate cuts in 2025 would not be as numerous or profound as expected several months ago, as the bond yields would likely decrease if interest rates were to continue falling.

Developers Spell It Out

Commercial developers and owners who participated in the survey utilized the free-response questions to elucidate their cautious optimism.

This sentiment appears to be anchored by the idea that all parties — buyers and sellers, lenders and borrowers — have grown restless with muted deal volume and are willing to be creative and even accept lower margins in the name of getting business activity back on track. As such, much of the guarded enthusiasm stemmed from the Fed’s 2024 rate cuts.

“Lending costs are headed lower but few deals were done when they were uber high,” noted Tim Stoll, managing director at Boston-based development and investment firm Visionbridge. “Negative leverage is still a real concern, and uncertainty in valuations has put pressure on lending spreads for any non-institutional-grade tenants. Large loans need CMBS or private credit as banks are still mostly sidelined from past mistakes and working through the extension process.”

Negative leverage, which occurs when a buyer’s cap rate is below his or her all-in interest rate, has been a recurring theme during the past couple years as interest rates have risen. For select properties — usually multifamily and industrial assets with rent rolls below market averages and leases that will soon roll — investors have been willing to accept negative leverage for a year or two. Should rate cuts continue, the opposite investment position may prevail. But even so, it will still take time for prices to recalibrate, a process that some believe has already started but has yet to conclude.

“One of the big challenges [facing] the industry entering 2025 is the continued misalignment of seller and buyer pricing expectations since interest rates began rising significantly a couple years ago,” noted Robert Atkins, managing partner at New Jersey-based owner-operator Atkins Cos. “There has [since] been positive movement in this regard, and hopefully the trend will continue in 2025.”

“There is a bit of a paradigm shift in terms of capital costs,” added one developer/owner who opted to remain anonymous. “As borrowers and lenders begin to realize they cannot recapitalize and salvage their debt or equity, the opportunity logjam will begin to open up.”

One of the free-response questions centered on the impacts of Trump winning the election. On this point, owners seemed to settle on the notion that Trump’s victory would undoubtedly be good for business in general, but it’s still too early to know just how and to what extent commercial real estate might specifically benefit from his return.

“[Trump’s return to office] is a great confidence builder — investors and developers see a positive future and lower their risk premiums,” wrote Kelly Coates, president and CEO of Carpionato Group, a development and management firm that serves New England. “Rates being reset and regulations reduced is oxygen to the industry. Lots of positive investment will result.”

Others were more measured in their analysis of just how big a boon for business Trump might be.

“There might be a slight uptick [in commercial activity] in the short run,” wrote Adam Lubkin, president of IBIS Development, which is based in South Florida but active in the Northeast. “Interest rates should moderate in the short term, and this outstanding economy should have legs for [another] 12 months. That said, any president, regardless of party, has very little impact on commercial real estate.”

“The new president had rekindled the animal spirits and will instill confidence in underwriting higher occupancy and net operating income in many asset classes,” added Elie Rieder, founder and CEO of New York-based investment firm Castle Lanterra Properties. “But there is [still] the overhang of uncertainty of longer-term interest rates. Until there is clarity on where long-term rates will settle, it will be hard [to achieve] a bounceback in deal volume despite the brighter economic outlook.”

Another went so far as to acknowledge that not all of the new administration’s policies would be good for business.

“Developer confidence buoyed by Trump’s win may dissipate as new federal policies generate renewed inflation and higher five- to 10-year interest rates,” wrote one anonymous respondent.