RALEIGH, N.C. — Kane Realty Corp. has broken ground on The Strand, a new 20-story apartment high-rise in Midtown Raleigh’s North Hills district. The multifamily tower, which will feature 362 apartments and 9,000 square feet of retail space, will be situated adjacent to the recently sold Advance Auto Parts Tower. The Strand will comprise studio, one-, two- and three-bedroom apartments, as well as top-floor penthouses. The community will also feature an amenity deck on the sixth floor that will include a resort-style pool, grilling area, activity lawn, fitness center and club room, as well as a clubroom on the 18th floor and a speakeasy on the top level that is exclusive for penthouse residents. The project team includes development partner Mitsui Fudosan America, architect Rule Joy Trammell + Rubio, general contractor Balfour Beatty and civil engineer McAdams. Kane Realty plans to welcome first residents at The Strand in summer 2027. The locally based development and management firm is also underway on planning for Phase II of the site.

Southeast

JLL Secures Refinancings for Three Southeast Student Housing Communities Totaling $134.9M

by John Nelson

TAMPA, FLA. — JLL Capital Markets has secured refinancings totaling a combined $134.9 million for three student housing communities across the Southeast. Lee Weaver, Melissa Marcolini Quinn, Rob Rothaug and Jade Starkey of JLL worked on behalf of Commercial Street Partners to secure a $97.5 million refinancing for Apella on Newport in Tampa. The three-year, floating-rate loan was placed through MF1/Limekiln Real Estate Investment Management. The newly constructed community spans 195,076 square feet at 311 North Newport Ave. near the University of Tampa campus. The property offers 576 beds across 150 fully furnished units in two-, three-, four- and six-bedroom configurations. Shared amenities include a rooftop pool, fitness center, study lounges and secured garage parking. Weaver and Quinn, along with Kenny Cutler, Rob Rothaug and Cristian Sieman of JLL, also secured a $22 million refinancing for Preserve at Tech near Louisiana Tech University in Ruston, La. Prime Finance provided the two-year, floating-rate loan to borrower RISE: A Real Estate Co. Completed in 2021 at 1913 West Alabama Ave., the community offers 588 beds across 168 units in three- and four-bedroom configurations. Shared amenities include a resort-style pool, 24-hour clubhouse, computer lab, fitness center and a gaming lounge. JLL also worked on …

Cushman & Wakefield Brokers Sale of Multifamily Development Site in Asheville, North Carolina

by John Nelson

ASHEVILLE, N.C. — Cushman & Wakefield has brokered the sale of an eight-acre multifamily development site in Asheville. Atlanta-based Shelton McNally Real Estate Partners purchased the shovel-ready site from Golden Hour Collective with plans to develop a new 210-unit apartment community. Alex Phillips, Battle Smith, Alex McDermott and Sparling Davis of Cushman & Wakefield’s Sunbelt Multifamily Advisory Group represented Golden Hour in the land deal. Specific plans and construction timelines for the development were not released. The site is located within Overlook at Ashville, a 98.8-acre master-planned community that is approved for the 210 apartments, as well as 130 build-to-rent townhomes and up to 176 duplex units. The development is situated on a sloping mountainside within a few miles of downtown Asheville.

ATLANTA — Patterson Real Estate Advisory Group has arranged the refinancing for Old Highland Bakery, a two-building adaptive reuse project in Atlanta’s Old Fourth Ward district. Ameris Bank provided an undisclosed amount of financing to the borrowers, Vantage Realty Partners and Braden Fellman Group. Originally constructed in 1930, the all-brick structure was recently renovated to prepare the space for incoming tenants. The 51,000-square-foot property includes redeveloped office and retail space that houses 14 tenants, including Communidad Taqueria and BodyRok. Vantage and Braden Fellman preserved historical features at Old Highland Bakery, including the property’s original wood, metal beams and skylight windows.

ROCK HILL, S.C. — A joint venture between ShopOne Centers REIT, Pantheon and a global institutional investor has acquired Riverview Commons, a 59,020-square-foot shopping center located in Rock Hill, roughly 15 miles south of Charlotte. Food Lion and Dollar General anchor the property, which was 96 percent leased at the time of sale. Additional retailers at the center include Computer CPR, Exquisite Nails & Spa, Hair Savvy Salon, Big Wok II, Rock Hill Bagels & Deli, Ivy Rehab and ISI Elite Training. The joint venture now owns 21 retail centers. Riverview Commons marks ShopOne’s first acquisition in the Charlotte metro area.

WEST PALM BEACH, FLA. — JLL Capital Markets has arranged the $40 million sale-leaseback of 1100 Banyan, a 70,131-square-foot office and TV studio building in West Palm Beach. Simon Banke, Matt McCormack, Joe Judge and Anna Schaffer of JLL represented the seller, The E.W. Scripps Co., and procured the buyer, a joint venture between Related Ross, Wexford Real Estate Investors and Key International. Cincinnati-based Scripps is leasing the entire property from the new ownership for a minimum of 2.5 years. Completed in 2000, 1100 Banyan is a two-story building that houses Scripps’ WPTV news studio and office space. The fully leased property also includes a 170-space parking garage and 33 surface parking spaces.

Cushman & Wakefield | Thalhimer Brokers $7.3M Sale of Satterfield Landing Shopping Center in Outer Banks

by John Nelson

NAGS HEAD, N.C. — Cushman & Wakefield | Thalhimer’s Capital Markets Group has brokered the $7.3 million sale of Satterfield Landing Shopping Center, a 49,897-square-foot shopping center located in North Carolina’s Outer Banks region. Situated at South Croatan Highway at West Satterfield Landing Road in Nags Head, the center sits on 6.2 acres and is fully leased to T.J. Maxx, Staples and OBX Martial Arts. Clark Simpson and Erik Conradi of Thalhimer’s Virginia Beach office represented the seller, an entity doing business as Satterfield Landing LLC, in the transaction. The Overland Group was the buyer.

Colliers Mortgage Arranges $5.7M HUD-Insured Loan for Refinancing of Stanton Park Apartments in D.C.

by John Nelson

WASHINGTON, D.C. — Colliers Mortgage has arranged a $5.7 million HUD-insured loan to refinance Stanton Park Apartments, a 62-unit affordable housing community located in Washington, D.C. As part of the refinance, the Non-Profit Community Development Corp. of Washington, D.C. (NPCDC) has obtained an extension for its use restriction to preserve its affordable housing options while operating under the Low-Income Housing Tax Credit (LIHTC) program. The HUD loan features a 35-year term and amortization schedule. Stanton Park Apartments comprises three one-bedroom units, 42 two-bedroom units and 17 three-bedroom units. Laundry facilities are located in each building, while disabled-accessible units contain an in-unit washer/dryer. Additional amenities at the property include barbecue and picnic areas and onsite parking.

COVINGTON, LA. — Kia of Covington has opened a new dealership located at 69010 Highway 190 at I-12 in Covington, a city in Louisiana’s Northshore region in St. Tammany Parish. The dealership includes a spacious showroom, parts and service center and the opportunity for buyers to test drive new 2025 Kia models. Jason Reibert and Mike Saucier of Gulf States Real Estate & Construction Services led and managed Greenleaf Architects and High Tide Consultants throughout the project on behalf of Kevin Szura, president of Kia of Covington. Gulf States also helped with the site selection process for the new dealership. Kia of Convington plans to host a grand opening celebration for the general public in mid-May.

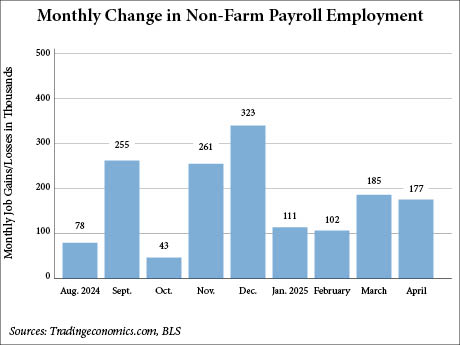

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that U.S. employment growth totaled 177,000 jobs in April, which is above the estimated 133,000 figure projected by Dow Jones economists, according to CNBC. The media outlet reports that economists were predicting fewer domestic jobs to be created due to the Trump administration’s tariffs against U.S. trade partners including China. Additionally, the BLS found that the unemployment rate for April has remained unchanged at 4.2 percent. The BLS made some hefty downward revisions for the employment gains in February and March. The change in total nonfarm payroll employment for February was revised down by 15,000 (rom 117,000 to 102,000) and March was revised down by 43,000 (from 228,000 to 185,000). With these revisions, employment in February and March combined is 58,000 lower than previously reported. The healthcare sector led the way in job creation in April with 51,000 jobs, including gains in hospitals (+22,000) and ambulatory healthcare services (+21,000). Transportation and warehousing added 29,000 jobs, with gains in warehousing and storage (+10,000), couriers and messengers (+8,000) and air transportation (+3,000). The financial sector contributed 14,000 jobs last month. The industry has added 103,000 jobs overall since its trough …