LAURENS, S.C. — Appian Investments, a real estate investment group founded by commercial real estate services firm NAI Earle Furman, has completed a new 621,468-square-foot industrial building in Laurens. The speculative facility is situated along the I-385 corridor within Hunter Industrial Park, a logistics campus in the Upstate South Carolina region. Laurens County Development Corp. partnered with Appian Investments on the cross-dock development, which features 40-foot clear heights, 2,500 square feet of office space, 54- by 50-foot column spacing, 136 exterior dock doors, four drive-in bays, 186 trailer storage spaces and 468 automobile parking spaces. Hunter Garrett, John Staunton and Josh Kenyon of NAI Earle Furman are marketing the facility for lease or sale. Tom Daniel and James Malm of NAI Earle Furman were part of the construction team.

Southeast

APEX, N.C. — Boston-based Rockpoint has sold Building I at Apex Commerce Center, a four-building industrial park totaling 845,000 square feet in Apex, a city roughly 15 miles southwest of Raleigh. LaSalle Investment Management purchased the 233,818-square-foot facility for an undisclosed price. Dave Andrews and Pete Pittroff of JLL represented Rockpoint in the transaction. Building I at Apex Commerce Center was built in 2023 and was fully leased at the time of sale. The rear-load facility features 32-foot clear heights, ESFR sprinklers and LED lighting. Building I is the first of four buildings at Apex Commerce Center, which Rockpoint developed in partnership with Oppidan Investment Co.

ALPHARETTA, GA. — Coro Realty Advisors has sold North Point Village, a 57,219-square-foot shopping center in the northern Atlanta suburb of Alpharetta. Mimms Enterprises purchased the property from Coro Realty for $19 million. Fred Victor of Atlantic Retail brokered the transaction. Situated on 5.2 acres near Ga. Highway 400, North Point Village’s tenant roster includes Talbots, Kohler and Learning Express. The 1.3 million-square-foot North Point Mall is immediately adjacent to the center.

BOYNTON BEACH AND JUPITER, FLA. — Redfearn Capital has purchased two industrial facilities in South Florida for a total of $10.8 million. The Delray Beach, Fla.-based investment firm acquired a 17,215-square-foot, multi-tenant facility at 4875 Park Ridge Road in Boynton Beach for $3.4 million and a 30,920-square-foot property at 1445-1449 Jupiter Park Drive in Jupiter for $7.4 million. The seller(s) was not disclosed.

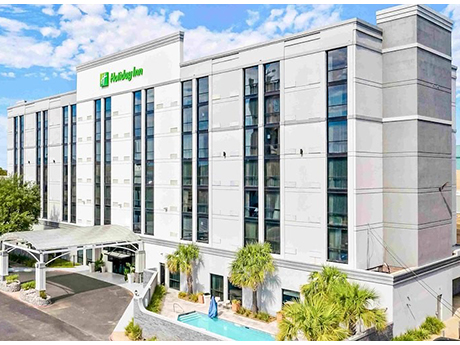

ALEXANDRIA, LA. — Marcus & Millichap has brokered the $9.8 million sale of Holiday Inn Alexandria Downtown, a 169-room hotel located at 701 4th St. in downtown Alexandria that fronts the Red River. The seller was Sharpco Hotels, an investment firm based in Natchitoches, La., that purchased the formerly vacant hotel from the City of Alexandria and revitalized and rebranded the property. A partnership between Tennessee-based VJ Hotels and Texas-based ARK Hospitality purchased the hotel. David Altman of Marcus & Millichap represented the seller in the transaction. Steve Greer served as Marcus & Millichap’s broker of record in Louisiana for the transaction. Holiday Inn Alexandria Downtown features 11,000 square feet of meeting space, a restaurant and Tesla car chargers, as well as direct access to the Randolph Riverfront Convention Center.

WASHINGTON, D.C. — Milbank, an international law firm, has signed a 65,000-square-foot lease at 1101 New York Avenue, a 388,000-square-foot office building in Washington, D.C.’s East End. The office building is now 94 percent leased to firms including A&O Shearman, National Retail Federation, EY and Bloomberg. Dale Schlather, Malcolm Marshall and Alson Offutt of Cushman & Wakefield represented Milbank in the lease deal. Kyle Luby, Matt Pacinelli, John Klinke and Tim McCarty of Stream Realty Partners represented the landlord, a partnership between Oxford Properties Group and Norges Bank Investment Management. Jim Potocki of Oxford Properties was also part of the leasing team at 1101 New York Avenue, which has 28,000 square feet of availability.

FORT LAUDERDALE, FLA. — Hall of Fame Partners has obtained a $54 million credit-tenant lease loan for the construction and permanent financing of Phase I of the International Swimming Hall of Fame (ISHOF) complex. ISHOF is the planned $200 million redevelopment of the Ft. Lauderdale Aquatics facility, which was originally built in Fort Lauderdale in 1965. Phase I of the ISHOF complex will include the reconstruction of a foundational sea wall, as well as the development of a new building that will serve as the headquarters for the city’s Ocean Rescue department. The ground level of the 10,000-square-foot building will serve as storage for Ocean Rescue equipment such as paddleboards and jet skis. The second floor will consist of offices for the chief and lieutenants, a conference room, showers and locker rooms. According to Miami-based architect Arquitectonica, which designed the facility, subsequent phases will include the construction of two buildings that will house the museum, an aquatic facility with a covered teaching pool, restrooms and an administrative office, as well as restaurant and retail space. The ISHOF Museum will include a 20,000-square-foot museum space, along with ballrooms, event spaces and a rooftop restaurant. The building will also include parking facilities …

Columnar Begins Construction on 965-Acre Double Branch Mixed-Use Development in Metro Tampa

by John Nelson

SAN ANTONIO, FLA. — Columnar has begun construction on the first phase of Double Branch, a mixed-use development spanning 965 acres in San Antonio, a suburb of Tampa in Pasco County. Phase I comprises 75 Logistics at Double Branch, an industrial park entitled up to 4.5 million square feet of space that will be developed over multiple phases. Nathan Lynch and Mike Sogluizzo of Colliers arranged an undisclosed amount of construction financing through a life insurance company to finance the first phase of 75 Logistics at Double Branch. Concrete has been poured for the first phase, which is located at the intersection of I-75 and State Road 52. Phase I will comprise three rear-load facilities spanning more than 480,000 square feet combined. Additional plans for the industrial park call for a 1.6 million-square-foot build-to-suit distribution building and a 400,000-square-foot cross-dock facility. Future phases for Double Branch will include 1 million square feet of office space; 3,500 multifamily, townhomes and lifestyle residential units; 500,000 square feet of retail, restaurant and entertainment space; two hotels; 250 acres of healthcare, wellness and life sciences development; and more than 200 acres of parks and trails.

Emergent Properties, RNGD Break Ground on $50M Adaptive Reuse Project in Downtown Huntsville

by John Nelson

HUNTSVILLE, ALA. — Emergent Properties and RNGD have broken ground on The Lewter District, a $50 million adaptive reuse project in downtown Huntsville. Situated on 1.5 acres, the mixed-use development is a conversion and restoration of the historic Lewter Hardware Co. store that closed in 2022 after nearly a century of operation. Phase I of the development will feature 14 luxury residences along Washington Street called Lewter District Townhomes. Sanders Pace Architecture designed the residential community, which is expected to be completed by late 2025. Phase II comprises a renovation of the original hardware store building. The restored building will house farm-to-table restaurant Brick & Tin on the ground level and outdoor patio spaces as well as offices for RNGD on the second floor. Phase III calls for a ground-up, five-story office building. National law firm Maybard Nexsen has committed to occupying the top two floors of the office building, which will also feature ground-level retail space. EskewDumezRipple is the architect for the second and third phases of The Lewter District. Phases I and II are underway and Phase III is slated to break ground before the end of the year.

FCP Sells Atlanta Apartment Community to Monday Properties, RSN Property Group for $36.8M

by John Nelson

ATLANTA — FCP has sold Villas at Princeton Lakes, a 210-unit apartment community located at 751 Fairburn Road SW in west Atlanta. A partnership between Monday Properties and RSN Property Group purchased the garden-style complex for $36.8 million. Travis Presnell and James Wilber of Cushman & Wakefield represented FCP in the transaction. Built in 2004, Villas at Princeton Lakes offers a mix of one-, two- and three-bedroom floor plans. FCP had originally purchased the community in late 2020 for $30 million, including the assumption of an existing mortgage, and implemented upgrades to the property’s common areas and exteriors.