CHARLOTTE, N.C. — Northmarq has arranged the $41.8 million sale of South Tryon Apartments, a 216-unit multifamily community located at 7601 Holliswood Court in Charlotte. McDowell Properties acquired the asset from MAA. Andrea Howard, Allan Lynch, John Currin, Caylor Mark, Jeff Glenn and Austin Jackson of Northmarq’s Carolinas Multifamily Investment Sales team represented the seller in the transaction. Additionally, Faron Thompson, Grant Harris and Cabell Thomas of Northmarq secured a $24.8 million acquisition loan on behalf of the buyer. The permanent, fixed-rate loan features a five-year term with a 35-year amortization schedule. Built in 2002 and renovated in 2022, South Tryon Apartments features units in one-, two- and three-bedroom layouts. Amenities at the property include 36 detached garages, 42 storage spaces, a fitness center, pool, dog park, grilling area, car care center and playground. The community is situated roughly nine miles from both Charlotte Douglas International Airport and Uptown Charlotte.

Southeast

MLG Capital Acquires 180-Unit Venetian at Capri Isles Multifamily Community in Venice, Florida

by John Nelson

VENICE, FLA. — MLG Capital has acquired Venetian at Capri Isles, a 180-unit multifamily community located at 1050 Capri Isles Blvd. in Venice. MLG purchase the property from an undisclosed buyer through its Legacy Fund, which offers a tax-deferred exit strategy for private real estate owners. The sales price was also not disclosed. The buyer plans to make capital improvements to the property, including upgrades to the unit interiors, exteriors and amenities. This marks MLG’s 24th acquisition in the state of Florida.

KISSIMMEE, FLA. — Cushman & Wakefield has brokered the $21 million sale of a flex office portfolio located in Kissimmee. Comprising two buildings — 3600 and 3700 Commerce Boulevard — the portfolio totals 193,571 square feet. Realife Real Estate Group acquired the properties from the Speer Foundation. Rick Colon, Rick Brugge, Mike Davis and Mark Stratman of Cushman & Wakefield represented the seller in the transaction. Built in 2001, the buildings were 93 percent leased at the time of sale. The properties, which include both office and warehouse space, feature 24- and 28-foot clear heights and a mix of dock-high and grade-level loading.

ATHENS, GA. — Cove Capital Investments, a Delaware Statutory Trust (DST) sponsor company, has completed the purchase of an industrial property located in Athens, roughly 70 miles northeast of Atlanta. Situated within the 35-acre General Time mixed-use development, the property totals 113,157 square feet. Originally built in 1990, the asset was redeveloped between 2018 and 2021. The property was acquired as part of Cove Capital’s growing portfolio of debt-free DST real estate assets for 1031 exchange and direct-cash investors, according to Dwight Kay, managing member and founding partner of Cove Capital Investments. The seller and sales price were not disclosed.

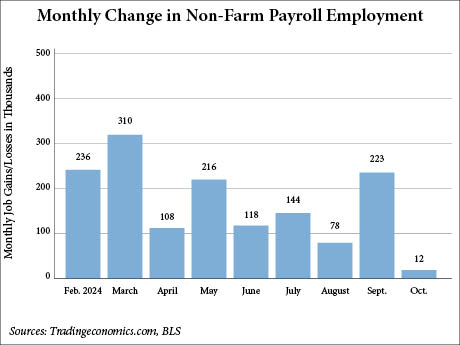

WASHINGTON, D.C. — The U.S. economy added 12,000 nonfarm payroll jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). This figure falls drastically short of expectations as CNBC reports that the Dow Jones economists previously predicted an increase of 100,000 jobs for the month. In its report, the BLS noted that strike activity significantly impacted employment in the manufacturing sector, which saw the loss of 46,000 jobs. Of those jobs, 44,000 were within the transportation equipment manufacturing field, reflecting the impact of the Boeing strike. Temporary help services, a subsect of professional and business services, saw a decline of 49,000 jobs in October. Government employment and healthcare added 40,000 and 52,000 jobs, respectively, while construction employment increased by a less significant 8,000 jobs. Other major industries saw little to no change. The BLS report also cited the potential impact of Hurricanes Helene and Milton on October’s employment situation, though it noted that “it is not possible to quantify the net effect on the over-the-month change in national employment, hours or earnings estimate.” The unemployment rate for October remained unchanged at 4.1 percent. According to Lawrence Yun, chief economist of the National Association of Realtors (NAR), the jobs …

COLLEGE PARK, MD. — Landmark Properties, a student housing owner-operator based in Athens, Ga., has unveiled plans for The Mark College Park, a 2,079-bed project that will be located adjacent to the University of Maryland’s campus. The 4.5-acre site currently houses two condo buildings that are known as College Park Towers. Landmark plans to acquire the condo buildings and land for the development in 2026. Completion of the new student housing community is slated for fall 2029. WDG Architecture is designing The Mark, and Landmark’s construction arm (Landmark Construction) is serving as the general contractor. Plans currently call for two 10-story buildings totaling 601 units that will come in studio to five-bedroom floor plans. Residences will feature stainless steel appliances, quartz countertops, hardwood-style floors and in-unit washers and dryers. Additionally, residents at The Mark will have access to covered garage parking and reserved parking for an additional charge. Amenities will include three quad-like open green spaces on the ground floor, as well as a fitness center and a paseo with tree coverage and green space. This feature will bisect the property north to south to improve pedestrian connectivity. In addition, an amenity deck atop the parking garage will offer …

Commercial Kentucky, Cushman & Wakefield Broker Sale of 1,460-Unit Multifamily Portfolio in Louisville

by John Nelson

LOUISVILLE, KY. — Cushman & Wakefield|Commercial Kentucky and Cushman & Wakefield have brokered the sale of a five-property multifamily portfolio totaling 1,460 units. MF Capital purchased the portfolio from Brown Capital for an undisclosed price. The properties include Boulder Creek Apartments, Eagles Eyrie Apartments, Lyndon Crossings, Devonshire Apartments and Partridge Meadows. The portfolio sale represents the largest real estate transaction in Kentucky this year and is also one of the largest transactions in the history of multifamily sales in the state, according to Commercial Kentucky. Craig Collins and Austin English of Commercial Kentucky, along with Mike Kemether and James Wilber of Cushman & Wakefield, represented the seller in the transaction.

Greystone Provides Two Agency Loans for Multifamily Communities in South Florida, Birmingham Totaling $103.7M

by John Nelson

TAMARAC, FLA. AND BIRMINGHAM, ALA. — Greystone has provided a pair of Freddie Mac loans totaling $103.7 million for the refinancing of two multifamily communities in South Florida and Birmingham. The deals include a $37.3 million loan for Midora at Woodmont, a 199-unit community in Tamarac, and a $66.4 million loan for Avenues of Inverness, a 586-unit property in Birmingham. The agency loans for both properties carry seven-year terms, fixed interest rates, five years of interest-only payments and 35-year amortization schedules. The borrower for both loans is Monsey, N.Y.-based White Eagle Property Group.

Capital Development Partners Delivers 160,250 SF Industrial Facility Adjacent to Port of Charleston

by John Nelson

CHARLESTON, S.C. – Capital Development Partners has delivered Shipyard Creek, a new 160,250-square-foot transload industrial facility that offers direct access to the Port of Charleston. Situated on a 42-acre site adjacent to the port’s new $1.3 billion Hugh K. Leatherman Terminal, the property was designed to handle container movement from users including retail importers. Shipyard Creek features 153 dock doors, 724 trailer parking spaces and onsite storage parking that can accommodate five stacked shipping containers. Capital Development Partners has tapped Lee Allen, Kevin Coats and Tyler Smith of JLL to handle the project’s leasing assignment. Shipyard Creek enjoys access to the port’s marine terminals, as well as interstates and the upcoming SC Ports Navy Base Intermodal Facility, which will be dual-served by Norfolk Southern and CSX.

TAMPA, FLA. — Funds managed by Cohen & Steers and the investment management business of Acadia Realty Trust have entered into a joint venture to purchase The Walk at Highwoods, an open-air shopping center in Tampa. The seller and sales price were not disclosed. The 141,000-square-foot property was fully leased at the time of sale to national and local tenants including HomeGoods, Michael’s, F45 Training, Dunkin’ and European Wax Center.