ATLANTA AND NASHVILLE, TENN. — CBRE has arranged $188.3 million in acquisition financing for a 24-building industrial portfolio totaling 1.9 million square feet in metro Atlanta and Nashville. Philadelphia-based Stoltz Real Estate Partners was the borrower. The previous owner was not disclosed. The properties range in size from 12,600 to 222,683 square feet and were built between 1974 and 1998. The portfolio was 93 percent leased at the time of sale to 80 tenants with a weighted average lease term of 3.6 years. The 17 Atlanta-area assets total a little over 1 million square feet and are situated in last-mile locations. The Atlanta market offers industrial users convenient access to I-75, I-85, I-20 and the Hartsfield-Jackson Atlanta International Airport. Additionally, the Port of Savannah is approximately 250 miles away. The seven Nashville properties total 866,053 square feet and are home to 15 tenants. The Nashville market offers convenient access to 24 states and is situated within a one-day truck drive of 75 percent of U.S. markets, according to CBRE. Brian Linnihan, Mike Ryan, Richard Henry and Taylor Crowder of CBRE arranged the financing through Starwood Property Trust. Loan terms were not provided. Stoltz currently owns and manages approximately 16 million …

Southeast

EASTON, MD. — Philadelphia-based O’Donnell & Naccarato (O&N) has broken ground on UM Shore Regional Medical Center, a 408,000-square-foot hospital and outpatient facility in the coastal Maryland city of Easton. The $550 million facility is set to open in 2028 and will fully replace the Regional Medical Center’s existing facilities. The new UM Shore Regional Medical Center will comprise a six-story, 147-bed tower (325,000 square feet), a connected two-story outpatient care facility (60,000 square feet) and a central utility plant on a 230-acre campus off Longwoods Road. The new hospital and outpatient facility will operate as part of the University of Maryland (UM) Medical System. The design-build team includes HKS Architects Inc., general contractor The Whiting-Turner Contracting Co., MEP engineer Highland Associates and civil engineer Daft McCune Walker.

WASHINGTON, D.C. — The National Geographic Society has announced plans to open a 100,000-square-foot public attraction at its campus, which currently occupies a city block in downtown Washington, D.C. Dubbed the National Geographic Museum of Exploration, the attraction is scheduled to open in 2026. Upon completion, the venue will feature curated exhibitions, immersive and educational experiences, a 400-seat theater, restaurant and a retail store. The project team will include JLL, HITT Contracting and architect Hickok Cole. Design for the public attraction will feature a focus on accessibility, with instructional text in Braille, tactile and sensory maps, American Sign Language (ASL) interpretations of media, all-gender restrooms, wellness rooms and exhibition text in both English and Spanish. “The Museum of Exploration marks a historic chapter in the Society’s mission to advance exploration, science, education and storytelling,” says Jill Tiefenthaler, CEO of the National Geographic Society.

BRANDON, FLA. — Cushman & Wakefield has arranged the sale of The Collection at Brandon Boulevard, a 222,406-square-foot shopping center in Brandon. Tenants at the property, which was fully leased at the time of sale, include Home Centric, Crunch Fitness, Chuck E. Cheese and Kane’s Furniture. Substantially redeveloped in 2019, the property features three outparcels and a 30,000-square-foot anchor space that is currently unoccupied but subject to a long-term lease with Kroger. Mark Gilbert, Adam Feinstein and Mitchell Halpern of Cushman & Wakefield represented the seller, an affiliate of SITE Centers Corp., in the transaction. Alto Real Estate Funds was the buyer.

Hoffman & Associates Signs Two Retailers to Join West Falls Mixed-Use Development in Northern Virginia

by John Nelson

FALLS CHURCH, VA. — Hoffman & Associates has signed two new retail tenants to join West Falls, a 10-acre mixed-use development in Falls Church that will comprise 1.2 million square feet at full build-out. The new businesses coming to the development include Dok Khao Thai Eatery and a Chase Bank branch. The restaurant is slated to open at 180 West Falls Station Blvd. in August, and the bank is set to open at 118 West Falls Station Blvd. in April. West Falls will feature more than 120,000 square feet of shops and restaurants, as well as The Alder apartments, The Reserve at Falls Church seniors housing community, a Home2 Suites by Hilton hotel, The Oak Condominiums and The Wellness Center, a medical office building.

ALEXANDRIA, LA. — Blueprint Healthcare Real Estate Advisors has brokered the sale of Regency House Alexandria, an assisted living and skilled nursing community in Alexandria, a city in Central Louisiana that lies on the south bank of the Red River. The seller was a local owner-operator. The buyer, a national owner-operator with an existing presence in Louisiana and experience with HUD’s transfer of physical assets (TPA) process, which involves the assumption of a HUD-insured loan, purchased the asset for an undisclosed price. Regency House Alexandria consists of 10 assisted living beds and 60 skilled nursing beds and only accepts Medicare and private pay as sources of payment.

Amidst economic uncertainty, Louisville stands out for its resilience, establishing itself as a stalwart in today’s market. According to Apartments.com, Louisville ranked No. 1 in the nation for rent growth in the second quarter of 2024. Factors such as Louisville’s non-cyclical job growth, expanding industries including EV production and the burgeoning River Ridge project in Southern Indiana all contribute to its growth. When we inspect the data, we see a basic yet fundamental market factor at play: supply and demand. Louisville’s supply is low relative to the growth in renters, resulting in upward pressure on rents despite a nationwide market that is largely declining. Supply dynamics The bulk of Louisville’s development pipeline is concentrated in Southern Indiana, with 1,039 units under construction in the Jeffersonville submarket. The Southern Indiana region has experienced solid growth with over 10,500 incoming jobs due to the economic activity from River Ridge. River Ridge Commerce Center reported an economic impact of $2.93 billion for calendar year 2023, up over $2.7 billion compared with 2022, according to Inside INdiana Business. Notable development projects in Southern Indiana include: • The Flats on 10th, 3300 Schosser Farm Way (300-units by Schuler Bauer Real Estate) • The Warren, 4501 …

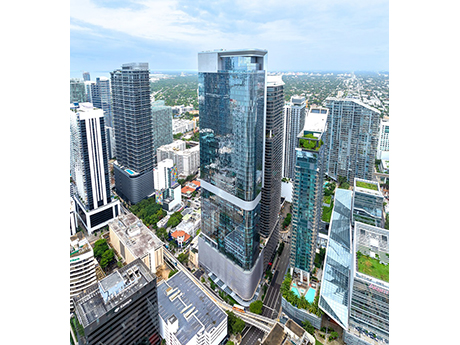

MIAMI — OKO Group and Cain International have completed the development of 830 Brickell, a 57-story office tower located in Miami. Totaling 640,000 square feet, the fully leased building has now received its temporary certificate of occupancy (TCO) from the City of Miami. Tenants — which include Microsoft, Citadel, Kirkland & Ellis LLP, Marsh Insurance, Sidley Austin LLP, CI Financial (Corient), Thoma Bravo, Santander Bank and A-CAP — will now begin build-outs and take occupancy of their respective spaces. Roughly 20 percent of the building is already occupied and operational. The project team includes architect Adriam Smith + Gordon Gill and interior designer Iosa Ghini Associati. Amenities at the building will include a Mediterranean restaurant with a private terrace, bar and private club, health and wellness center, conference facilities, an outdoor terrace and cafés and street-level retail space. Construction of 830 Brickell began in 2020.

DURHAM, N.C. — AvalonBay Communities is underway on the development of Avalon Oakridge, a 930-unit multifamily project located on Durham-Chapel Hill Boulevard in Durham. Phase I, which comprises 459 apartment units averaging 932 square feet in size, broke ground earlier this year, with move-ins scheduled to begin in fall 2026. AvalonBay Communities has now acquired 7.8 acres from Beacon Properties Group for Phases II and III of the development, which will together total 471 apartment units. Amenities at the community will include a fitness center, swimming pool, outdoor courtyards with grilling areas, a resident lounge with coworking spaces, pet spa with a dog washing station and onsite bike storage. Chester Allen, Howard Jenkins and Tiffany Hilburn of CBRE represented Beacon Properties Group in the land sale, which marks the second transaction between the seller and AvalonBay Communities at the site.

Toll Brothers Campus Living Completes $91M Student Housing Development Near Georgia Tech

by John Nelson

ATLANTA — Toll Brothers Campus Living has completed Kinetic, a $91 million student housing development located near the Georgia Institute of Technology (Georgia Tech) campus in Midtown Atlanta. US Bank provided construction financing for the 752-bed project, which broke ground in July 2022. The community offers 239 fully furnished units with bed-to-bath parity in one- through five-bedroom configurations. Shared amenities include study lounges with private and collaborative workspace; a high-tech content studio; coffee bar; community room with a large-screen TV; e-sports lounge; social lounges; and a fitness center with modern equipment and a sauna. Kinetic also features a sky lounge on the 34th floor with a swimming pool and an outdoor courtyard with grills and rooftop dining space.