ENGLEWOOD, COLO. — Kaufman Hagan has negotiated the sale of a 16-unit multifamily building located at 1690 W. Girard Ave. in Englewood. The asset traded for $2 million, or $125,000 per unit. Andrew Vollert of Kaufman Hagan represented the undisclosed buyer and undisclosed seller in the deal.

Multifamily

WEST LAFAYETTE, IND. — Landmark Properties, in partnership with Manulife Investment Management, has broken ground on The Standard at West Lafayette, a 678-bed student housing project located adjacent to Purdue University in West Lafayette. Peninsula Investments also partnered on the project. Landmark Urban Construction, the in-house general contractor for Landmark Properties, is building the development. The 253-unit community is slated to deliver in time for the 2027 academic year. The Standard at West Lafayette will offer fully furnished residences with floor plans ranging from studios to four-bedroom units. Spanning 18,234 square feet, amenities will include a rooftop clubhouse with an outdoor heated pool and fitness center as well as a fourth-floor amenity level with seating, a gaming lounge and interior courtyard. The property will feature more study spaces than any other student housing community in West Lafayette, according to Landmark. The garage will feature parking for 207 vehicles. BKV Group is the architect. The project marks Landmark’s second student housing development in Indiana, following The Standard at Bloomington, which opened in fall 2023.

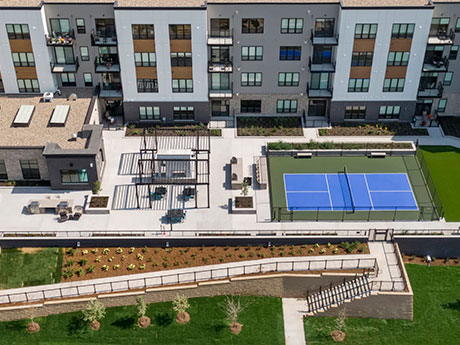

MAPLE GROVE, MINN. — JLL Capital Markets has provided a $33.2 million Fannie Mae loan for the refinancing of Risor of Maple Grove, a luxury 55+ community in the Minneapolis suburb of Maple Grove. The 169-unit property, completed in June 2023, rises four stories with a mix of studios, one- and two-bedroom units averaging 1,002 square feet. Amenities include a clubroom, golf simulator, wine bar, indoor pool and spa, pickleball court and top-floor sky lounge. Scott Loving, Scott Streiff, Gary Marchiori and Will Hintz of JLL originated the five-year, fixed-rate loan on behalf of the borrower, Roers Cos.

MIAMI — The Miami-Dade County Commission has granted final approval for Little River District, a $3 billion mixed-use development in Miami’s Little River and Little Haiti neighborhoods. SG Holdings, a joint venture between Swerdlow Group, SJM Partners and Alben Duffie, is the developer. Spanning 63 acres, the project is slated to include more than 5,700 affordable and workforce housing units alongside big box retail stores, small businesses, a major grocery operator, green public space and transit infrastructure with the addition of a new train station. Construction is expected to begin in 2026, with a projected development timeline of eight years. Little River District is considered the largest affordable housing development in Miami-Dade County’s history, according to a news release. Plans call for 2,284 affordable housing units for residents earning up to 60 percent of the area median income (AMI), 1,398 workforce rental units for those making 120 percent of AMI and 2,048 potential workforce condo units, which would allow the buyers to obtain significant subsidies to meet the purchase price at up to 140 percent AMI. Current residents of existing public housing complexes situated within the development site are guaranteed the right to return to new units at Little River …

WACO, TEXAS — Blueprint Healthcare Real Estate Advisors has arranged the sale of a vacant, 106-unit seniors housing property in Waco. Built in 2015, the community offered assisted living and skilled nursing care before closing in 2018. Amenities at the facility include an outdoor courtyard, patio and a putting green. Amy Sitzman and Giancarlo Riso of Blueprint represented the undisclosed seller in the transaction. The buyer and sales price were also not disclosed.

Marcus & Millichap Negotiates $13.4M Sale of Hurstbourne Heights Apartments in Louisville

by John Nelson

LOUISVILLE, KY. — Marcus & Millichap has negotiated the $13.4 million sale of Hurstbourne Heights, an 84-unit apartment community located at 7603 Downs Farm Way in Louisville. Situated on 6.8 acres in the city’s Highview neighborhood, Hurstbourne Heights was delivered in 2019 and features one-, two- and three-bedroom apartments, as well as a dog park and walking trail. The buyer, a South Carolina-based investor, assumed a HUD-insured loan as part of the transaction. Aaron Johnson and David Badgett of Marcus & Millichap’s Louisville office represented the seller, a locally based developer, and procured the buyer in the transaction. Both parties requested anonymity.

JLL, HJ Sims Arrange $239.7M in Tax-Exempt, Taxable Bond Financing for Three-Property Seniors Housing Portfolio in Arizona, California

by Amy Works

BUCKEYE AND YUMA, ARIZ., AND SANTA CLARITA, CALIF. — JLL and HJ Sims have arranged $239.7 million in tax-exempt and taxable bond financing for the Integrated Senior Foundation — Ativo Portfolio, a seniors housing portfolio in Arizona and California. The portfolio includes 430 independent living, assisting living and memory care units. There are two ground-up development communities and one acquisition — Ativo of Sundance in Buckeye, Ativo of Yuma in Yuma and Ativo of Santa Clarita within the Sand Canyon Plaza master-planned community in Santa Clarita. On behalf of Integrated Senior Foundation, JLL’s Seniors Housing Capital Markets team, in collaboration with the bond underwriting team of HJ Sims and JLL Securities, secured fixed-rate financing with a final maturity of 40 years. The financing consisted of $218.2 million of publicly offered tax-exempt senior series 2025A bonds, $5.9 million of taxable senior series 2025B bonds and $15.5 million of tax-exempt subordinate 2025C bonds. Slated for completion in 2027, Ativo of Sundance will feature 102 independent living units, 75 assisted living units and 30 memory care beds, while Ativo of Santa Clarita will feature 51 independent living units, 65 assisted living units and 28 memory care beds, with completion scheduled for later this year. Ativo …

LYNNWOOD, WASH. — Kōz Development and MSquared have opened Kōz on Alderwood Mall Blvd, a mixed-income, transit-oriented apartment community at 4301 Alderwood Mall Blvd. in Lynnwood. The $54 million project is located adjacent to the recently opened Lynnwood Transit Center, the northern terminus of the Sound Transit Link rail extension connecting Lynnwood to downtown Seattle. Kōz on Alderwood offers 199 studio, one-bedroom and two-bedroom apartments. Half of the homes are affordable for households earning up to 80 percent of the area median income and the other half are market-rate units. Developed by Kōz Development, the project was financed with $35 million in debt from Coastal Community Bank, $13 million in equity from MSquared and $6 million in equity from Kōz Development investors. Kirtley Cole led construction of the community.

BOSTON — A partnership between regional multifamily owner-operator WinnCos. and the Boston Housing Authority (BHA) has begun work on a $70 million affordable housing project in South Boston. The 94-unit building, which carries a price tag of $62 million, will be constructed as part of the initial phase of the redevelopment of the 1,016-unit Mary Ellen McCormack public housing development, which originally opened in 1938. The partnership plans to invest another $8 million in infrastructure upgrades. Units at the new building will primarily come in one-, two- and three-bedroom floor plans. Bank of America provided the construction loan for Building A and is also the tax credit equity investor on the project. Once Building A is completed in late 2026, construction will begin on Building B, which will offer 300 mixed-income apartments, and Building C, which will offer 196 mixed-income apartments, with 172 units reserved for seniors aged 62 or older. In all, eight new residential buildings totaling 1,310 units will be built over the course of a decade during Phase I of the redevelopment, replacing 529 aging public housing apartments for BHA households and creating 781 additional apartments for middle-income and market-rate renters. Existing buildings will be demolished to …

CHICAGO — Newmark has arranged a $110 million loan for the refinancing of Cityfront Place, a 39-story luxury apartment tower in downtown Chicago. The borrowers, Strategic Properties of North America and Mirae Asset Securities, acquired the 480-unit property in 2020 and implemented a renovation plan, modernizing unit interiors and common areas while maintaining occupancy above 95 percent throughout the improvement period. The renovations contributed to a more than 60 percent increase in net operating income. Positioned along the Chicago River in the Streeterville neighborhood, Cityfront Place offers studio, one- and two-bedroom units. Amenities include a fitness center, indoor pool, rooftop terrace, resident lounge, indoor parking and direct access to the Riverwalk. Charles Han, Henry Stimler, Bill Weber, Matt Mense, Dan Sarsfield and Ricky Warner of Newmark arranged the financing.