EL PASO, TEXAS — The El Paso City Council has approved a proposal to develop an $80 million concert venue and has formed a public-private partnership with the operator, Colorado-based hospitality firm Venu (formerly known as Notes Live). The site spans 17 acres of city-owned land and will anchor the Cohen Entertainment District on the city’s northeast side. The venue will be known as Sunset Amphitheater and will have a seating capacity of 12,500. The City of El Paso is providing $30.6 million in performance-based incentives under the terms of the partnership deal. Construction is set to begin this fall and to be complete in 2026. Venu is also planning to open a $220 million concert venue in the northern Dallas suburb of McKinney.

Texas

THE WOODLANDS, TEXAS — Locally based general contractor Harvey Builders has completed the $21 million renovation of The Woodlands Resort, Curio Collection by Hilton, a 402-room hotel located about 30 miles north of Houston. All guestrooms and suites received new showers, tubs, flooring, countertops, mirrors and lighting fixtures, as well as bedding drapery and carpets. All common areas, including the lobby, restaurant, bar and meeting spaces, were also upgraded. Merriman Anderson Architects handled interior design of the project, which began in 2021 and was executed in four phases.

AMARILLO, TEXAS — Marcus & Millichap has brokered the sale of Advantage Storage, a 432-unit self-storage facility in Amarillo. Built in 2019, the facility totals 84,475 net rentable square feet across 226 climate-controlled units, 181 non-climate units, 13 enclosed parking spaces and 12 warehouse units. Gabriel Coe, Nathan Coe, Brett Hatcher and Garret Nelson of Marcus & Millichap represented the undisclosed seller in the transaction. The buyer was an out-of-state REIT that also requested anonymity.

NEW BRAUNFELS, TEXAS — Berkadia has arranged the sale of The Blake at New Braunfels, a 112-unit seniors housing property located on the northeastern outskirts of San Antonio. Built in 2021, the property features 71 assisted living units and 41 memory care units. Cody Tremper, Mike Garbers, Dave Fasano and Ross Sanders of Berkadia represented the seller, Mississippi-based LifeCare Properties, in the transaction. Arizona-based Inspired Healthcare Capital purchased The Blake for an undisclosed price.

HOUSTON — Locally based brokerage firm Oxford Partners has negotiated an 8,183-square-foot office lease in Houston’s Westchase District. According to LoopNet Inc., the property at 10333 Richmond Ave., which is known as The Frost Bank Building, was built in 1983 and totals 218,689 square feet. Ryan Hartsell of Oxford Partners represented the tenant, immigration law firm Reddy Neumann Brown PC, in the lease negotiations. Terri Torregrossa of Avison Young represented the landlord, Florida-based Accesso Partners.

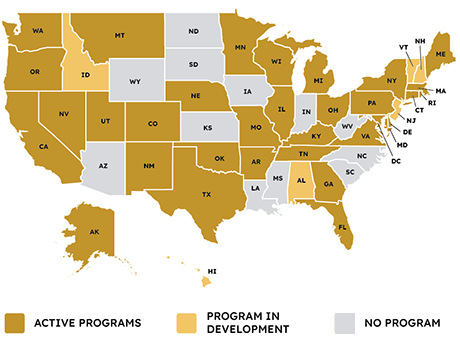

It may have taken more than a decade, but after starting out as a niche financing vehicle to create more energy-efficient and resilient buildings, the commercial property assessed clean energy (C-PACE) program has arguably achieved mainstream acceptance. Roughly 40 states and Washington, D.C., now either offer or are developing C-PACE programs. Over the last year alone, Georgia, Hawaii, New Mexico, Minnesota and Idaho passed legislation enabling or substantially improving the financing tool, points out Rafi Golberstein, CEO of PACE Loan Group, a direct lender of C-PACE headquartered in Minneapolis, Minn. What’s more, he adds, New Jersey and North Carolina are among states that in the coming months are expected to advance bills authorizing the use of C-PACE, or PACE for short. Given the current partisanship within the country, one of the most revealing characteristics of PACE’s growing appeal has been its ability to cross the political aisle, Golberstein observed. PACE’s popularity in particular has ascended over the last several months as developers have sought fresh capital to enhance their financial flexibility in a rising interest rate environment. “PACE is really turning out to be a bipartisan issue, as many state lawmakers are realizing that it is a great financing tool …

DALLAS — Dallas-headquartered SRS Real Estate Partners has named Garrett Colburn as president, responsible for the company’s continued national growth, including office productivity and culture. Colburn will partner with CEO Chris Maguire to generate growth across all platforms, including retail, capital markets and industrial. Additionally, Colburn will serve on SRS’ Executive Committee, the group responsible for setting overall strategy for the firm throughout the United States and globally. Colburn currently serves as managing principal and co-market leader of SRS’ five California offices and will continue both roles in addition to his new responsibilities. He joined the company in 2012 to grow the Southern California office and has served on the SRS Board of Directors since 2016.

FORT WORTH, TEXAS — Nashville-based developer Southern Land Co. has completed Deco, a 27-story apartment building located at 969 Commerce St. in downtown Fort Worth. The 567,000-square-foot building spans 302 units and includes ground-floor retail space that is preleased to Broadway 10 Bar & Chophouse. Units come in one-, two- and three-bedroom floor plans, as well as penthouse configurations, and range in size from 700 to 2,800 square feet. Amenities include a pool and poolside bar, rooftop lounge, fitness center, demonstration kitchen, outdoor grilling and dining stations, package room and a lobby lounge with a bar. Rents start at approximately $2,000 per month for a one-bedroom apartment.

GEORGETOWN, TEXAS — Houston-based developer Fidelis has broken ground on Berry Creek Business Park, a three-building, 520,571-square-foot industrial project located in the northern Austin suburb of Georgetown. The development will consist of two rear-load buildings ranging in size from 126,722 to 140,685 square feet with 32-foot clear heights and one cross-dock building that will span 253,164 square feet and feature 36-foot clear heights. Project partners include GSR Andrade (architect), Gordon Highlander Construction (general contractor), Westwood Civil (engineer) and Transwestern (leasing agent). Delivery is slated for early 2025.

DALLAS — Marcus & Millichap has brokered the sale of a 274-room dual-branded hotel in downtown Dallas. The hotel component of the building, which was constructed in 1910 and houses 237 apartments and 20,000 square feet of commercial space, consists of 132 rooms under the TownePlace Suites brand and 142 rooms under the Fairfield Inn & Suites brand. Shared amenities include an outdoor pool, fitness center, business center, 1,050 square feet of meeting space and a convenience store. Chris Gomes and Allan Miller of Marcus & Millichap represented the seller, Butler Brothers Hospitality Group LLC, which will continue to own and operate the apartments and commercial space, in the transaction. The duo also procured the buyer, a joint venture between Lowen Hospitality and Vashee & Associates.