RIVERSIDE, CALIF. — Innovative Housing Opportunities (IHO) has opened The Aspire, an affordable residential community in Riverside. Situated at the corner of Third Street and Fairmount Boulevard, The Aspire features 33 fully furnished units for transitional age youth, including young people aging out of the foster care system. The furnished one-bedroom units are approximately 450 square feet and include a patio or deck. Community amenities include an interior courtyard, roof terrace, communal living room and public art. Additionally, The Aspire is in a walkable neighborhood close to transit, employment, recreation, retail and cultural options. The Aspire will offer onsite education services and programs, provided by the California Family Life Center. Riverside Community College District is also offering academic, career and financial aid counseling, as well as job placement assistance. The $25 million development was funded with Housing Authority funds from the City of Riverside, project-based housing choice vouchers from Riverside County and California’s Housing and Community Development/Multifamily Housing Program.

Multifamily

BRAINTREE, MASS. — Developer WinnCos. has broken ground on The Eastwalk, an affordable housing project in the southern Boston suburb of Braintree that is valued at $47 million. Of the development’s 56 total units, 30 will be reserved for households earning 60 percent or less of the area median income (AMI). Another 20 residences will be earmarked for renters earning 120 percent or less of AMI, and the remaining six units will be rented at market rates. Residences will come in one-, two- and three-bedroom floor plans, and amenities will include a community room with a kitchen, onsite resident workspace, fitness room and a patio lounge with grills. The Eastwalk is expected to be available for occupancy in summer 2026. WinnCos. is developing the project in partnership with Arch Communities, with Webster Bank financing construction. The capital stack also includes both state- and federal-issued Low-Income Housing Tax Credits, and the investors of those securities are U.S. Bank and Boston Financial, respectively.

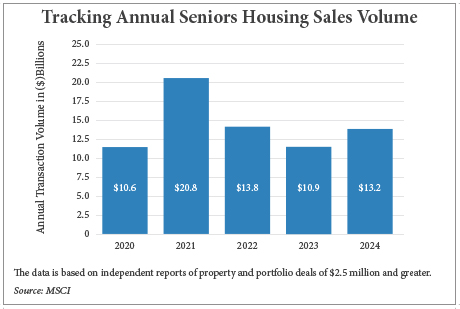

By Hayden Spiess To say that the seniors housing sector has encountered strong headwinds over the past few years would be an understatement. The property sector was uniquely impacted by the COVID-19 pandemic. It scarcely had a chance to recover and enjoy rebounding occupancy before being faced with the reality of heightened interest rates. Amid all the challenges, industry professionals adopted a motivational yet pragmatic mantra and strategy: “Stay Alive Until ’25.” Now that 2025 has arrived, the sentiment among seniors housing investors is one of growing optimism. Brokers and investors alike say that more favorable conditions are leading to an uptick in transaction activity, even as some debt difficulties linger. Azhar Jameeli, managing director of investments at IRA Capital and head of the firm’s seniors housing segment, is particularly bullish on the current prospects for the sector. “I don’t think that the opportunity has ever been better than what it is today,” asserts Jameeli, who has multiple decades of experience in seniors housing and cites the supply-demand balance as one of the main sources of his confidence. Data from MSCI supports this optimism. U.S. property and portfolio sales totaled $13.2 billion in 2024, up from $10.9 billion the prior …

COLLEGE STATION, TEXAS — An investor doing business as 950 TL Midtown LLC has purchased an apartment complex located about seven miles from the Texas A&M University campus in College Station for $40.8 million. The number of units at Nine50 Town Lake at Midtown was not disclosed, but the property’s residences come in one-, two- and three-bedroom floor plans and range in size from 527 to 1,371 square feet. Amenities include a pool, outdoor grilling kitchen, fitness center, business center, dog park, Wi-Fi café and a game lounge with shuffleboard and a billiards table. The seller was also not disclosed.

TRENTON, N.J. — Locally based brokerage firm The Kislak Co. Inc. has arranged the $3.3 million sale of Parkview Commons, a 33-unit apartment building in Trenton. The three-story building houses a mix of studio, one- and two-bedroom units and recently underwent a capital improvement program. Barry Waisbrod of Kislak brokered the deal. The buyer and seller were not disclosed.

CHARLOTTESVILLE, VA. — KLNB Multifamily Capital Markets Group has arranged the $56.8 million sale of Barracks West Apartments & Townhomes, a 324-unit apartment community in Charlottesville. Rawles Wilcox and Jared Emery of KLNB represented the seller, Willow Creek Partners, in the transaction. The buyer, Northern Virginia-based West End Capital Group, plans to renovate the common area amenities and living spaces with new package lockers, grilling stations, a pet park and clubhouse. Situated just three miles from Charlottesville’s downtown district, Barracks West features a mix of one-, two- and three-bedroom traditional and townhome-style residences spanning 459 to 1,176 square feet. Current amenities at the property include a swimming pool, picnic and park areas, fitness center and a playground.

UPLAND, CALIF. — MJW Investments has purchased Coventry Square Apartments, located at 1012 W. Arrow Highway in Upland, from the Tsang & Chan family for $21 million. Endri Hoxha of Coldwell Banker Commercial Realty and Philip Batlin of Marcus & Millichap represented the buyer, while Sarah Hillhouse of Coldwell Banker Commercial Realty represented the seller in the deal. Constructed in 1990, Coventry Square includes 92 two-bedroom/two-bath apartments with enclosed patios and in-unit washers/dryers. The approximately 1,178-square-foot apartments are spread across 46 single-story buildings, totaling 68,400 square feet. The community features 92 carport parking spaces, a central pool with community activities and park-like grounds with mature trees and landscapes.

DOWNERS GROVE, ILL. — Laramar Group has acquired ReNew Downers Grove, a 294-unit apartment complex in the Chicago suburb of Downers Grove, for $72.1 million. An affiliate of FPA Multifamily was the seller. The 17-year-old property features a pool, sun deck, fitness center and lounge. Laramar is expected to make unit upgrades. The 16-acre complex was just over 6 percent vacant at the time of sale. Kevin Girard, Mark Stern, Zachary Kaufman and Betsy Romenesko of JLL represented the seller. JLL also provided a $46.9 million Freddie Mac loan for the acquisition.

ARCADIA, IND. — BWE has secured a $6.3 million USDA RHS 538 GRRHP loan to provide construction and permanent financing for the renovation of Hamilton Place, a 54-unit affordable housing property in Arcadia, about 45 miles north of Indianapolis. Lundat Kassa and Bob Morton of BWE arranged the loan with a 38-year term and 40-year amortization. The property’s units are spread across three single-story garden homes, two two-story townhomes and one apartment building, all of which are set to be renovated. The units are reserved for tenants earning up to 60 percent of the area median income. Renovated amenities will include a community room, computer center, playground, basketball court, exercise room and walking path. The project received additional financing through the use of 9 percent Low-Income Housing Tax Credits provided by the Indiana Housing and Community Development Authority.

SAN ANTONIO, FLA. — Coastal Ridge has broken ground on Stillwell Pasco Station, a 277-unit build-to-rent community located in San Antonio, about 30 miles north of Tampa. The development will feature a mix of one-, two and three-bedroom homes measuring up to 1,300 square feet. The single-bedroom units will be designed as attached duplex-style homes, while the two- and three-bedroom houses will be detached. The carriage-style units will feature private one-car garages. Amenities will include a 5,000-square-foot clubhouse and fitness center, lounge, game room, resort-style pool, fire pits, grilling areas, outdoor walking trails and dog parks. BBL is serving as the general contractor, the project architect is KTGY, the engineering and landscape architect is Kimley-Horn and the interior designer is HPA. The first homes are slated for completion in early 2026.