RALEIGH, N.C. — CBRE has arranged two new retail leases in Raleigh on behalf of ParTee Shack, a miniature golf-focused entertainment concept. ParTee will occupy 19,590 square feet at Celebration at Six Forks and 17,000 square feet at Capital Marketplace. These mark the second and third locations in the city for the brand. Jon Stanley of CBRE represented the tenant in both lease negotiations. Charlie Coyne of CBRE represented the landlord of Capital Marketplace, Finmarc Management, and Tiffany Barrier of CBRE represented the landlord of Celebration at Six Forks, FCA Partners. Founded in 2020, ParTee offers miniature golf, go-karts, laser tag, arcade and virtual reality games, as well as food and alcoholic beverages.

Retail

THE WOODLANDS, TEXAS — Conn’s HomePlus, a home furnishing retailer based in the Houston area, has filed for Chapter 11 bankruptcy and will close at least 70 stores nationwide, according to reports from multiple media outlets including CNN and USA Today. The latter publication reports that Conn’s filed for bankruptcy protection this past Tuesday in the U.S. Bankruptcy Court for the Southern District of Texas amid slumping revenue reports and that the impacted stores are scattered across 13 states. Both news organizations report that the state with the highest concentration of closures is Florida (18), followed by Texas (nine). Conn’s was founded in 1890 and operates about 150 stores across the country, according to the company’s Wikipedia page.

MOKENA AND WOODRIDGE, ILL. — Colliers has brokered the sale of two retail strip centers in metro Chicago. The first property totals 16,482 square feet and is located in Mokena. Five of the tenants have been onsite since 2015, while the sixth has occupied space since 2003 when the property was developed. The second asset in Woodridge is anchored by a food mart and service-oriented tenants. Peter Block and Rachel Patten of Colliers represented the seller, Armco Properties. The buyer, a private investor, purchased the properties at close to asking price, which was $6.8 million.

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates Second Quarter Report: Industrial, Office Market See Continued Challenges While Retail, Multifamily Trends Follow Region-Specific Patterns

In the first half of 2024, high interest rates led to decreased demand, higher vacancy rates, reduced construction starts and lower property sales in industrial and office, according to Lee & Associates’ 2024 Q2 North America Market Report. Meanwhile, retail saw minimal development and continued low vacancies. Retail rent growth was particularly strong in the South and Southwest. Finally, high demand for multifamily, coupled with a sudden influx of supply in the second quarter of the year, has created a market where outcomes are highly tied to region. Midwest and Northeast multifamily markets have remained stronger than their counterparts in the South and Southwest, while Western markets saw mixed growth. Lee & Associates has made their full market report available here (with complete breakdowns of cap rates by city, market rents, vacancy rates, square footage information and more). The summaries for the industrial, office, retail and multifamily sectors below provide detailed insight into the trends and trajectories likely through the end of 2024. Industrial Overview: Activity, Growth Checked by High Interest Rates Industrial market performance across North America continued to downshift in the first half of this year. Although net absorption remains positive, demand for industrial space has fallen to the lowest levels …

THE WOODLANDS, TEXAS — Howard Hughes Holdings (NYSE: HHH) has begun the renovation of Grogan’s Mill Village Center, a 90,000-square-foot retail property located north of Houston in The Woodlands that was originally built in 1974. The renovation will add a new public gathering hub with a library that will feature multimedia rooms and a theater-style classroom, as well as a community center and 32,000 square feet of modern retail space. Tenants that have either extended existing leases or committed to new spaces at Grogan’s Mill include Brother’s Pizza, Ome Calli Café, Safeway Driving, The UPS Store, Woodforest National Bank, The Woodlands Cleaners, Chef Chan’s, 4H Tailor and SN Liquor. Lastly, the project team will make upgrades to the property’s existing farmers market

THE COLONY, TEXAS — A partnership between soccer training organization TOCA Football and Major League Soccer (MLS) will open the first TOCA Social entertainment venue in the United States in The Colony, a northern suburb of Dallas. Situated within the Grandscape mixed-use development, TOCA Social Dallas will feature soccer-based immersive entertainment, as well as food-and-beverage options. The venue is scheduled to open next summer, with additional TOCA Social venues planned for other U.S. cities. Berkshire Hathaway owns Grandscape via Nebraska Furniture Mart.

MILLEDGEVILLE, GA. — The Sembler Co. has delivered Lakeside Commons, a Publix-anchored shopping center located at the southeast corner of US Highway 441 (Columbia Street) and Log Cabin Road in Milledgeville, a city in Central Georgia that is home to Georgia College & State University. Situated on 9 acres, the 60,500-square-foot shopping center houses a freestanding Publix store spanning 48,387 square feet, as well as 12,000 square feet of small shop space. Committed tenants include T-Mobile (2,400 square feet) and Sugar Polish Nail Spa (3,600 square feet). Lakeside Commons will also feature two outparcels that are available for sale, ground lease or build-to-suit opportunities. Sembler broke ground on Lakeside Commons in early 2023, and the Publix opened its doors in late June.

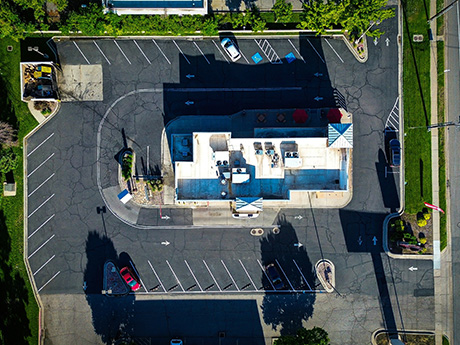

MENARD, TEXAS — Marcus & Millichap has brokered the sale of Bowie’s Truck Stop, a 4,995-square-foot retail property in Menard, about 150 miles west of Austin. Bowie’s Truck Stop sits on five acres and features a convenience store and 16 gas pumps that are operated by Valero. Sai Thakor and Jacob Luna led the Marcus & Millichap team that represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

Okland Capital, San Tan Development Break Ground on $100M Northside at SanTan Village Mixed-Use Project in Gilbert, Arizona

by Amy Works

GILBERT, ARIZ. — Okland Capital and San Tan Development Group have broken ground on Phase I of Northside at SanTan Village, a mixed-use development in the Phoenix suburb of Gilbert. The first phase will feature 37,245 square feet of retail and restaurant space spread across six buildings. Completion of phase one is slated for mid-2025, with a grand opening expected in fall 2025. The hotel component is scheduled to deliver shortly after and future uses are currently being designed. At full build-out, Northside at SanTan Village will span 20 acres and feature a 134-key hotel, retail, restaurants and community green space. Development costs were estimated at $100 million. The project team includes Okland Construction as general contractor and Aline Architecture Concepts as architect for the retail center. Bryan Babits and Alberto Caballero of Western Retail Advisors are handing leasing for the project’s retail and restaurant spaces.

EL CAJON, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has arranged a $5.6 million loan for the refinancing of a retail property located at 13578 Camino Canada in El Cajon, a suburb of San Diego. Tenants at the property include Wells Fargo, Subway, Panda Express, The UPS Store and H&R Block. Chad O’Connor of MMCC’s San Diego office secured the financing with a local credit union on behalf of a private client. Terms of the 10-year loan include a 6.5 percent fixed interest rate with 30-year amortization and a loan-to-value ratio of 65 percent.