BERKELEY, CALIF. — Gilbane Development Co. has broken ground on Pique, a 485-bed student housing project located at 2587 Telegraph Ave. near the University of California (UC) Berkeley campus. The eight-story community will offer 52 units with bed-to-bath parity. Shared amenities will include an indoor and outdoor fitness center and yoga studio, outdoor study space, a cabana area, two rooftop decks, a coworking lounge, smart food lockers, private study pods and 2,900 square feet of ground-floor retail space. The project will begin leasing in fall 2025 with occupancy scheduled for summer 2026. The development site was formerly occupied by retailer Buffalo Exchange. “We are focused on making every inch count with efficiency, privacy and functionality at the core of the design, driving innovation that caters to the needs of Berkeley students at an affordable price point,” says Christian Cerria, development director with Gilbane.

Multifamily

VINELAND, N.J. — New Jersey-based brokerage firm The Kislak Co. Inc. has negotiated the $12 million sale of Park Towne Apartments, a 108-unit multifamily complex located outside of Philadelphia in Vineland. Built in 1952, Park Towne Apartments comprises 63 one-bedroom units, 36 two-bedroom units, two two-bedroom units with terraces and a rental office. Joni Sweetwood of Kislak represented the seller and procured the buyer, both of which were limited liability companies, in the transaction. Park Towne Apartments was fully occupied at the time of sale.

NEW YORK CITY — Merchants Capital has provided $129.1 million in financing for the renovation of three affordable housing developments located on the east side of The Bronx borough in New York City. The renovations will total $419.6 million, according to Merchants Capital. Comprising 952 units across six residential buildings, the properties include Boston Road Plaza, Boston Secor and Middletown Plaza. The New York City Housing Authority (NYCHA), the largest public housing authority in North America, owns and manages the trio of affordable housing communities. Merchants Capital provided a New York Housing Development Corp. (NYHDC) Freddie Mac Risk Share loan under the Permanent Affordability Commitment Together (PACT) program. The properties will transition to the U.S. Department of Housing and Urban Development (HUD) Section 8 program as part of HUD’s Rental Assistance Demonstration (RAD) conversion platform. The Bronx Revitalization Collaborative (BRC), a joint venture between Beacon Communities, Kalel Cos. and MBD Community Housing Corp., is leading renovations at the properties in partnership with NYCHA. Renovations will include upgrades to interiors, exteriors and shared spaces; bathroom and kitchen improvements; new doors, flooring and paint; new roofs; modernized elevators; complimentary Wi-Fi; and upgrades to the HVAC and plumbing systems. Repairs are currently underway …

MIAMI BEACH, FLA. — A joint venture between Mast Capital and a controlled affiliate of Starwood Capital Group has secured $390 million in construction financing for The Perigon Miami Beach, a 73-unit condominium development located at 5333 Collins Ave. in Miami Beach. Eldridge Real Estate Credit, a Greenwich, Conn.-based asset manager and holding company, provided the loan. “We are proud to partner with Mast Capital and Starwood Capital Group on The Perigon Miami Beach,” said Matthew Rosenfeld, a managing director at Eldridge Real Estate Credit. “This is a project that represents the exceptional, visionary real estate we seek to finance, and further underscores the continued growth and momentum of our business.” Located in the popular Mid-Beach neighborhood, The Perigon Miami Beach will offer two-, three- and four-bedroom residences ranging from 2,100 to 6,700 square feet, each featuring 10- to 12-foot wraparound balconies. The property will also offer eight private guest suites. Roughly 75 percent of the condos have been sold. The building will offer approximately 40,000 square feet of indoor and outdoor amenities. Planned community amenities include a pool with cabanas, spa with sauna, salon, fitness center, children’s playroom, screening room, wine room and a lobby lounge. Residents will also …

TERRELL, TEXAS — An affiliate of DPG Investments LLC, a family office, merchant banking and private capital advisory firm, has arranged $56.2 million in financing for a 1,036-unit manufactured housing project in Terrell, about 35 miles east of Dallas. The financing includes senior debt, mezzanine debt and preferred equity that will be used to both acquire and develop the property, which will be known as Post Oak. The borrower, is an affiliate of K8H Ventures, a metro Houston-based owner-operator of manufactured housing. Additional project details were not disclosed.

LeCesse Development, Broad Oak to Develop 252-Unit Apartment Community in Oviedo, Florida

by John Nelson

OVIEDO, FLA. — A partnership between LeCesse Development and Broad Oak Development plans to soon break ground on Broad Oak Oviedo, a 252-unit apartment development in the Central Florida city of Oviedo. The property will feature a mix of four-story, elevator-serviced buildings and carriage house buildings that also feature garages. Amenities will include a fitness center, game room, valet trash service, coworking space, golf simulator, infinity edge pool, dog park, recreational trail and an outdoor summer kitchen. The development will be situated near Oviedo Mall, Oviedo on the Park, the Cross Seminole Trail and FBC Mortgage Stadium, among other attractions. LeCesse and Broad Oak plan to deliver the community in summer 2026. The project team includes Slocum Platts Architects, Kimley-Horn, Dix.Hite+Partners, Beasley & Henley and Walker & Co. Synovus Bank is providing debt construction financing, and Marble Capital is investing preferred equity into the development.

Northmarq Arranges Four Loans Totaling $68.5M for Refinancing of Two Jersey City Apartment Complexes

JERSEY CITY, N.J. — Northmarq has arranged four loans totaling $68.5 million for the refinancing of CityLine East and West, two apartment complexes totaling 342 units in Jersey City. For CityLine East, which was built in 2021 and totals 198 units, Northmarq arranged a $34 million senior loan and an $8 million mezzanine loan. For CityLine West, which was completed in 2019 and totals 144 units, Northmarq placed a $21.5 million senior loan and a $5 million mezzanine loan. Both properties offer studio, one- and two-bedroom units. All loans carried fixed interest rates. John Banas and Kris Wood of Northmarq arranged the debt on behalf of the borrower, The PRC Group. The direct lenders were not disclosed.

ENGLEWOOD, COLO. — A joint venture between DPC Cos. and Ogilvie Partners has acquired Englewood CityCenter for an undisclosed price. Brad Lyons of CBRE handled the transaction. Englewood CityCenter offers 220,000 square feet of office, retail and multifamily space. The joint venture is working with the City of Englewood on a master redevelopment plan to transform Englewood CityCenter into a community center with multifamily housing, open space for community gathering and a walkable live/work/shop area with retail, services, restaurants and a hotel within the 12-acre site. At the time of sale, the property was 40 percent leased. Current tenants include Harbor Freight, Ross Dress for Less, Petco, Tokyo Joe’s, Jersey Mike’s Subs and Einstein Bros.

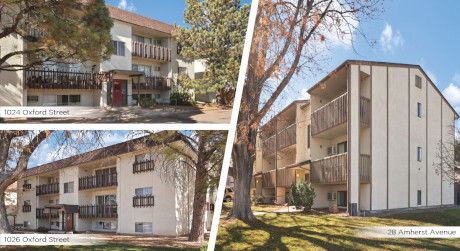

Pinnacle Real Estate Advisors Negotiates Sale of Oxford Pines Apartments in Pueblo, Colorado

by Amy Works

PUEBLO, COLO. — Pinnacle Real Estate Advisors has arranged the sale of Oxford Pines Apartments, located at 1024-1026 Oxford St. and 28 Amherst Ave. in Pueblo. The three-building property offers 35 one- and two-bedroom units, many with private balconies, as well as 23 carports and two garages. Chris Knowlton of Pinnacle Real Estate Advisors represented the undisclosed seller and undisclosed buyer in the deal. The asset traded for $3.1 million, or $90,000 per unit.

NOBLESVILLE, IND. — CBRE has arranged the sale of Federal Hill Apartments, a 222-unit multifamily property in the Indianapolis suburb of Noblesville. The sales price was undisclosed. Built in 2024, the asset features a range of studio, one- and two-bedroom floor plans averaging 863 square feet. Amenities include a fitness center, pool, indoor pet grooming spa, electric vehicle charging stations and an outdoor grilling area. There are three onsite retailers — Indie Coffee Roasters, Café Noricha and Bocado. Hannah Ott, George Tikijian, Cam Benz, Clair Hassfurther, Ryan Stockamp and Sean Pingel of CBRE represented the seller, Old Town Cos. Summit Equity Investments was the buyer.