CHARLOTTE, N.C. — Alliance Residential Co. has opened Broadstone Craft, a 297-unit apartment community located at 1015 N. Alexander St. in Charlotte’s Optimist Park neighborhood. The property is situated adjacent to Birdsong Brewery and a stop on the Parkwood LYNX Blue Line. Cline Design Associates and interior designer LS3P designed the property with a 1980s aesthetic that incorporates elements of craft beer culture. The property’s public spaces include a two-tap kegerator system serving cold brew and kombucha for residents, a custom retro TV wall and beer barrel seating booths. Other amenities include a resort-style saltwater pool with two grilling stations and an exterior courtyard featuring a beer fermentation tank, as well as coworking and private focus rooms, a mailroom with 24-7 package access, bike storage, electric vehicle charging stations and a fenced pet park. Broadstone Craft offers a mix of studio, one- and two-bedroom apartments averaging 716 square feet in size. Monthly rental rates range from $1,471 to $2,866, according to the property website.

Southeast

PORT CHARLOTTE, FLA. — JBM Institutional Multifamily Advisors has brokered the sale of Charlotte Commons, a 264-unit apartment community located in the Southwest Florida city of Port Charlotte. An unnamed New York-based company and Image Capital purchased the Class A property for $66.5 million. The seller, Indiana-based SC Bodner Co., developed Charlotte Commons in 2022. The property comprises 11 three-story buildings with studios, one- and two-bedroom apartments averaging 846 square feet in size. Amenities include a resort-style pool with a sun deck, grilling stations, shaded outdoor lounge area, fitness center, clubhouse with a business center, bark park, pickleball courts and 57 garages available for rent.

Berkadia Arranges Sale of 112-Unit Seniors Housing Community in Atlanta’s Buckhead District

by John Nelson

ATLANTA — Berkadia’s Seniors Housing & Healthcare team has arranged the sale of Brighton Gardens of Buckhead, a 112-unit seniors housing community in Atlanta’s Buckhead district. Metro Atlanta-based PruittHealth purchased the asset from Indianapolis-based Prime Care One LLC for an undisclosed price. Cody Tremper, Mike Garbers, Dave Fasano and Ross Sanders of Berkadia represented the seller in the transaction. Additionally, Jay Healy of Berkadia arranged a $13 million bridge-to-HUD loan for the acquisition of Brighton Gardens, as well as the refinancing of two separate skilled nursing facilities in Georgia. The three-year, fixed-rate loan features interest-only payments for the full term and is prepayable at any time. Built in 1996, Brighton Gardens features both assisted living and memory care units.

LAKE WORTH, FLA. — SRS Real Estate Partners has negotiated the $2.8 million sale of a single-tenant retail property located at 9955 Lake Worth Road in Lake Worth, a suburb of West Palm Beach. The South Florida store, which opened on a 0.6-acre parcel in August, has a 10-year corporate-guaranteed lease in place with MD Now, an urgent care provider with more than 60 locations. Patrick Nutt and William Wamble of SRS represented the seller, a locally based development firm, in the transaction. An unnamed private investor based in Florida purchased the store in a 1031 exchange. The 3,250-square-foot store is situated within Woods Walk Plaza, an 88,000-square-foot shopping center anchored by Publix.

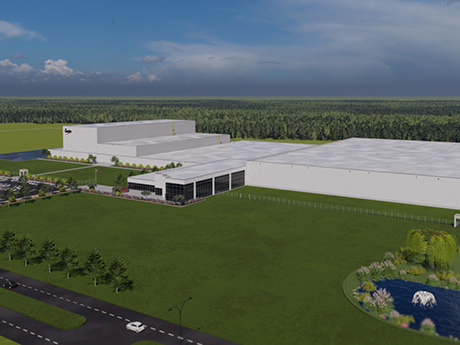

GREENVILLE, S.C. — EnerSys, an industrial technology company, has announced plans to develop a new manufacturing facility in Greenville. EnerSys expects to break ground on the $500 million project next year. Upon completion, the facility will total 500,000 square feet on 140 acres within the August Grove Business Park. Operations are slated to begin at the property in late 2027. Reading, Pa.-based EnerSys manufactures batteries, chargers and power systems for use in the telecommunications, broadband, data center, industrial utilities, warehouse, logistics, aerospace, defense and transportation industries. The new operations will focus on producing lithium-ion cells, with a projected annual production capacity of four gigawatt hours (GWh). This will mark the second facility in the state for the company, which operates in 14 other locations throughout North America. EnerSys says the new facility will create 500 jobs, presumably including both the permanent employees and temporary construction workers. — Hayden Spiess

FAYETTEVILLE, GA. — CBRE’s National Retail Partners team has arranged the sale of Fayette Pavilion, an open-air retail center in Fayetteville, a city about 22 miles south of Atlanta. At nearly 1.1 million square feet, Fayette Pavilion is the largest open-air retail center in Georgia and also the most visited with approximately 8.3 million annual visitors, according to CBRE. Chris Decoufle, Kevin Hurley and Matt Karempelis of CBRE’s National Retail Partners’ Southeast team represented the seller, Chicago-based Nuveen Real Estate, and procured the buyer, Houston-based 5Rivers CRE, in the transaction. The sales price was not disclosed. Developed on 106 acres from 1995 to 2003, Fayette Pavilion’s tenant roster includes Publix, Hobby Lobby, Burlington, Ross Dress for Less, Marshalls, PetSmart, Old Navy, pOpshelf, Dollar Tree and Five Below.

ARLINGTON, VA. — CoStar Group has purchased Central Place Tower, a 552,000-square-foot office building located at 1201 Wilson Blvd. in Arlington. The seller and sales price were not disclosed, but media outlets report JBG Smith, which developed the 31-story tower in 2018, and joint venture partner PGIM Real Estate sold the tower for $339 million. The office building sits directly above the Rosslyn Metro station. The Richmond-based commercial real estate research giant plans to move 650 Washington, D.C.-area employees to the building as the company’s current lease is set to expire in 2025. CoStar previously acquired an office building at 1331 L St. NW in D.C. in 2011 before executing a sale-leaseback. The company will occupy about 150,000 square feet in the Arlington building and pay about $14 million to Arlington County for sole rights of use of the building’s observation deck, according to Arlington Economic Development. The building was

MARTINSVILLE, VA. — An affiliate of Phoenix Investors has purchased an 813,000-square-foot industrial building located at 1 Walker Road in Martinsville, a city in southern Virginia. Resurgence Properties sold the property for an undisclosed price. The facility previously served as a textile plant for Bassett-Walker before shuttering in 2002. Situated on 53 acres, the property is located 10 miles from the Virginia-North Carolina border and less than 12 miles from Blue Ridge Regional Airport. The facility features six dock doors and four grade-level drive-in doors, as well as 200 parking spaces. Grant Bates of Newmark is handling the leasing assignment for 1 Walker Road, which has more than 700,000 square feet of availability at the time of sale.

WASHINGTON, D.C. — Preliminary estimates from Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations show that commercial and multifamily loan originations in 2023 are down 47 percent compared to 2022. The Washington, D.C.-based organization also reports that originations in fourth-quarter 2023 declined 25 percent year-over-year but increased by 13 percent from third-quarter 2023. The association released its findings during its 2024 Commercial/Multifamily Finance Convention and Expo (MBA CREF), an annual conference that concludes today. Loan volume declined for every property sector and investor type that MBA tracks in 2023. By property type, originations for healthcare properties decreased 67 percent compared to 2022; office properties decreased 65 percent; industrial properties decreased 49 percent; multifamily properties decreased 46 percent; retail properties decreased 27 percent; and hotel properties decreased 10 percent. Among investor types, originations for depositories (i.e. banks and credit unions) decreased 64 percent; originations for investor-driven lenders decreased 51 percent; loans for life insurance companies decreased 39 percent; loans for government-sponsored enterprises, including Fannie Mae and Freddie Mac, decreased 21 percent; and CMBS loans decreased 21 percent.

ATLANTA — Matthews Real Estate Investment Services has hired Pierce Mayson and Kyle Stonis as senior vice presidents, Jeff Enck as first vice president and Boris Shilkrot as associate vice president. The veteran retail specialists join the company’s shopping center division from SRS Real Estate Partners where they managed the sales of shopping centers in 17 different states across the Southeast, Midwest and Northeast. Collectively, Mayson, Stonis, Enck and Shilkrot have brokered the sales of $4 billion in career transactions over a combined 50 years. The group will operate from the Matthews’ Atlanta office off Peachtree Road and work with Matthew Wallace, the company’s national director of shopping centers.