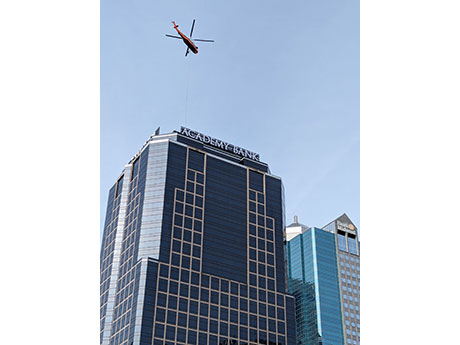

KANSAS CITY, MO. — Academy Bank, a full-service community bank and family-owned subsidiary of Dickinson Financial Corp., has opened a new retail branch within the lobby of 1201 Walnut, a 29-story office tower owned by Copaken Brooks in downtown Kansas City. The bank also moved its corporate headquarters to three contiguous floors of the building totaling roughly 50,000 square feet. Additionally, the property now features Academy Bank signage. Of Academy Bank’s 71 branches, 23 are located throughout metro Kansas City. Sister bank Armed Forces Bank will maintain its headquarters in Fort Leavenworth, Kan.

Retail

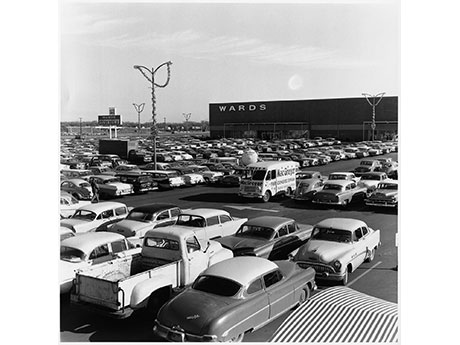

BLOOMINGTON, MINN. — Kraus-Anderson Realty & Development has begun to demolish the former Toys ‘R’ Us and Herberger’s buildings at Southtown Shopping Center in the Minneapolis suburb of Bloomington. Located at the corner of I-494 and Penn Avenue South, the shopping center opened in November 1960 and included a two-story, 150,000-square-foot Montgomery Wards, the largest in the retailer’s chain of 550 stores nationwide. The center also opened with 44 other shops, including Musicland, Red Owl, Walgreens and Texaco. The property has undergone numerous additions and renovations since then. Kraus-Anderson is demolishing the large vacant space on the northeast side of the center, often referred to as the old Herberger’s (originally Montgomery Wards) and Toys ‘R’ Us space. The demolition phase is expected to take approximately 12 weeks and is slated for completion at the end of March. The rest of the shopping center will remain open. Future plans regarding tenants or new uses were not released.

NORTH LAS VEGAS, NEV. — SRS Real Estate Partners has arranged the sale of Deer Springs Shoppes, a retail center in North Las Vegas. A Pennsylvania-based seller sold the asset to a Los Angeles-based private investor for $9.5 million. Totaling 28,224 square feet, the three-building property is located at 640 and 680 E. Deer Springs and 675 Dorrell Lane. Built in 2009 on 1.5 acres, Deer Springs Shoppes was fully leased at the time of sale. Current tenants include The UPS Store, Verizon and Pacific Dental. The transaction also includes a vacant pad site that for which a 4,000-square-foot development has been proposed. Patrick Luther of SRS Capital Markets represented the seller in the deal.

Ryan Cos. Completes 59,657 SF Publix Store at Master-Planned Development in Wesley Chapel, Florida

by John Nelson

WESLEY CHAPEL, FLA. — Ryan Cos. has opened a new Publix grocery store that serves as the anchor tenant of Innovations Commons, a retail center within the 900-acre Epperson Ranch master-planned development in Wesley Chapel. The city in Pasco County is part of the Tampa Bay metro area. In addition to Innovations Commons, Epperson Ranch will feature 4,000 single-family homes, a 200-room hotel and more than 500 apartments at full build-out. Innovation Commons will also include three outparcel developments slated for additional retail, restaurants and professional services.

SANTA CLARA, CALIF. — Maven Commercial has arranged the sale of University Shopping Center, a 2.9-acre retail center in the Bay Area city of Santa Clara. An entity controlled by the Bushnell family sold the asset to Bay Properties for $15.9 million, or $409 per square foot. Located at 2555 The Alameda, University Shopping Center features approximately 38,875 square feet of retail space. Tenants at the fully occupied property include Safeway, Taco Bell, Round Table Pizza and Wicked Chicken. Matthew Sheridan, Dominic Morbidelli and Santino DeRose of Maven Commercial handled the transaction.

DALLAS — A joint venture between Cohen & Steers Income Opportunities REIT and Sterling Organization has acquired a 206,926-square-foot shopping center in Dallas. The property is part of Marketplace at Highland Village, a 451,000-square-foot development that also houses a corporately owned Walmart Supercenter. The acquired portion of the property was built in 2006 was 93 percent leased at the time of sale to tenants such as T.J. Maxx, HomeGoods, LA Fitness, DSW and Petco. Chris Gerard, Barry Brown and Erin Lazarus of JLL represented the undisclosed seller in the transaction.

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Property Owners Recalibrate Expectations Following Financing Challenge, Shifting Vacancy Rates

High costs, modulating occupancies and a lack of financing options reshaped the industrial, office, retail and multifamily sectors in the fourth quarter of 2023, signaling the determining factors for 2024, according to Lee & Associates’ 2023 Q4 North America Market Report. The industrial sector saw stabilizing tenant demand — the number of new buildings delivered increased in the fourth quarter, while new construction starts slowed. Meanwhile, the office sector’s struggles deepened as more than half of the office leases signed pre-2020 approach their expiration by 2026. With low-rate loans maturing into a high-rate environment, the factors troubling the office sector seem insurmountable in this decade. In the retail market, low vacancies did not lead to booming construction in that sector in the last quarter of 2023 — financing costs plus land and labor costs have hampered new development in spite of high demand. Finally, the health of multifamily markets is tied closely to geography. Sun Belt multifamily properties and their Midwest and Northeastern market counterparts are seeing reversals from the multifamily trends of 2021: formerly fast-growing Sun Belt markets are experiencing slowed rent growth or rent decline, while rent growth for slower-growing, major North and Midwestern metros has grown steadily. Lee & Associates …

ALBUQUERQUE, N.M. — On Feb. 22, Whole Foods Market will open a new location at 2100 Carlisle Blvd. NE in Albuquerque. The store is the relocation of an existing Albuquerque store at 2103 Carlisle Blvd. NE, which has served the community for more than 30 years. The new, larger location will feature upgraded amenities, including expanded prepared foods and bakery departments, and a larger and more accessible parking lot. The new store will also carry an expanded product assortment, including more than 400 local items from New Mexico. Whole Foods Market Albuquerque will be open from 9:00 a.m. to 9:00 p.m. opening day. Regular store hours will be 7:00 a.m. until 9:00 p.m. MST daily.

DENVER AND LITTLETON, COLO. — Sidford Capital has acquired two shopping centers, totaling 111,142 square feet, in Colorado. A Southern California-based private investor sold the portfolio for $11.2 million. The portfolio includes Athmar Park Shopping Center, a 58,204-square-foot neighborhood retail center at 1865-1935 W. Mississippi Ave. in Denver, and SouthPark Shopping Center, a 52,938-square-foot property at 131-151 and 201-215 W. County Line Road in Littleton. Athmar Park was 77.5 percent occupied at the time of sale, with Family Dollar as the anchor. SouthPark was 84.5 percent occupied at the time of sale and is shadowed anchored by Dollar Tree and Goodwill. Ryan Bowlby and Drew Isaac of Marcus & Millichap’s Denver office represented the seller and procured the buyer in the deal.

MIDDLESEX, N.J. — NAI DiLeo-Bram & Co. has arranged the $8.6 million sale of a 69,750-square-foot retail center located in Middlesex. A 57,000-square-foot SuperFresh grocery store anchors the property, which sits on a 3.9-acre site. The center also features a 6,115-square-foot liquor store and 6,300 square feet of second-floor office space. Marc Shein of NAI DiLeo-Bram represented the undisclosed seller in the transaction. Bennett Realty & Development represented the buyer.