GRANBURY, TEXAS — Locally based investment firm Skywalker Property Partners has purchased a 60,000-square-foot industrial facility in Granbury, located southwest of Fort Worth. Old Granbury Industrial Park consists of 11 buildings on a 9.3-acre site that were fully leased at the time of sale. Trevor Short of Trinity Real Estate Investment Services represented the undisclosed seller in the transaction. Jack Mock represented Skywalker on an internal basis.

Texas

CELINA, TEXAS — CBRE has brokered the sale of Bobcat Crossing, a 29,309-square-foot retail center located in the North Texas city of Celina. The center is located within the Carter Ranch master-planned development and is home to 13 tenants, including Sherwin-Williams and Subway. Michael Austry and Jared Aubrey of CBRE represented the seller, Standridge Cos., in the transaction. The buyer was Houston-based investment firm Stablewood.

COLLEGE STATION, TEXAS — Walker & Dunlop has brokered the sale of The Woodlands of College Station, a 769-bed student housing property located near the Texas A&M University campus in College Station. Completed in 2006, the community offers 276 units and amenities such as a pool, fitness center, basketball and volleyball courts, study lounges and shuttle service to campus. Chris Epp, Matthew Chase, Craig Miller, Holden Penn, Ben Sarna, Sarah Foronda, Naomi Bludworth, Will Baker, William Shell, Jonathan Schwartz, Michael Ianno, Sean Reimer, Mike Shropshire and Doug McDaniel of Walker & Dunlop represented the seller, Interwest Capital, in the transaction. Walker & Dunlop also arranged an undisclosed amount of acquisition financing on behalf of the undisclosed buyer.

WACO, TEXAS — Concord Summit Capital, a South Florida-based financial intermediary, has arranged a $34 million bridge loan for Zoe Apartments, a 214-unit multifamily complex in Waco. Completed in 2024, Zoe Apartments consists of six three-story residential buildings on a 10.3-acre site. Units come in one- and two-bedroom floor plans, and amenities include a pool, clubhouse, outdoor grilling and dining areas, two pickleball courts and a dog park. David Larson and Keegan Burger of Concord Summit arranged the loan on behalf of the owner, Utah-based Surge Investment Group.

CHICAGO — Blueprint HCRE, a Chicago-based seniors housing brokerage firm, has negotiated the sale of a portfolio of five skilled nursing facilities totaling 469 beds in Texas. The names and locations of the properties were not disclosed. The portfolio was 71 percent occupied at the time of sale. A skilled nursing owner and operator acquired the portfolio for an undisclosed price. Amy Sitzman and Giancarlo Riso of Blueprint arranged the sale on behalf of the seller, which also requested anonymity.

DALLAS — New York City-based development and investment firm GTIS Partners will develop Remington 30, a 442,000-square-foot industrial project that will be situated near DFW International Airport. Building features will include a cross-dock configuration, 36-foot clear heights, 82 dock doors, four drive-in doors, 3,000 square feet of speculative office space, an ESFR sprinkler system and parking for 196 cars and 112 trailers. Construction is scheduled to begin in the fourth quarter and to last about a year.

FORT WORTH, TEXAS — A partnership between Columbia Residential and Renaissance Heights Foundation has broken ground on Columbia Renaissance Square III, a 100-unit affordable seniors housing project in southeast Fort Worth. The project represents the third and final phase of a larger mixed-income development. A portion of those residences will be reserved for renters earning between 30 and 80 percent of the area median income, and 16 units will be set aside as permanent supportive housing. Phase I of Columbia Renaissance Square totaled 140 units, and Phase II featured 120 age-restricted units.

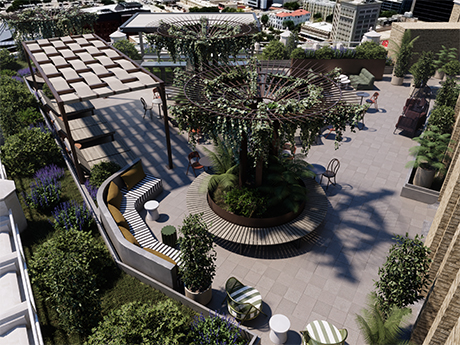

SAN ANTONIO — Locally based development and investment firm McCombs Enterprises will undertake a multifamily conversion project in downtown San Antonio. The project will transform the historic 31-story Tower Life Building at 310 S. Saint Mary’s St., which was originally built in 1929, into a 242-unit apartment complex. The development will be known as Tower Life Residences and will include penthouses and retail space. Amenities will include a library, lounges, bar spaces, workspaces, entertainment areas and private event rooms, as well as 5,000 square feet of rooftop gardens. McCombs is redeveloping the building in partnership with J. Jeffers Co. Project partners include Front Porch Design Group, Alamo Architects and Jordan Foster Construction. The first residences are expected to be available for occupancy next fall.

HOUSTON — New York-based global investment firm GTIS Partners has completed Port 225 Commerce Center, a 484,070-square-foot industrial project located near Port Houston. The 26-acre development consists of a 355,071-square-foot, cross-dock building and a 128,999-square-foot, rear-load facility. Building features include 36- and 32-foot clear heights, respectively, and combined parking for 382 cars and 93 trailers. Project partners included Angler Construction, Powers Brown Architecture, Langan Engineering and Cushman & Wakefield as the leasing agent. Construction began in February 2024.

HOUSTON — Blue Atlantic Partners, an affiliate of Atlantic Pacific Cos., has acquired the 299-unit Montecito Apartments in Houston’s Uptown-Galleria neighborhood. The property offers a mix of one-, two- and three-bedroom units that range in size from 669 to 2,091 square feet. Amenities include a pool, fitness center and a resident clubhouse. The new ownership plans to implement a multimillion-dollar renovation that will upgrade unit interiors, amenity spaces and building exteriors. The seller and sales price were not disclosed.