OKEMOS, MICH. — Bernard Financial Group (BFG) has arranged a $6.7 million loan for the refinancing of a 254-unit multifamily property in Okemos near Lansing. Dennis Bernard and Joshua Bernard of BFG arranged the loan through Minnesota Life Insurance Co. The borrower was an entity doing business as Cedar Creek MS LLC.

Multifamily

NEW YORK CITY — Locally based brokerage firm Stav Equities has arranged the $5.7 million sale of two multifamily redevelopment sites in Brooklyn. The buildings at 21 Montauk Ave. and 22 Milford St. were previously used as storage facilities for a local furniture business. The buyer, Moses Rabinowitz, plans to redevelop the sites into apartment buildings totaling 96 units. Jacob Stavksy of Stav Equities represented Rabinowitz and the undisclosed seller in the off-market transaction.

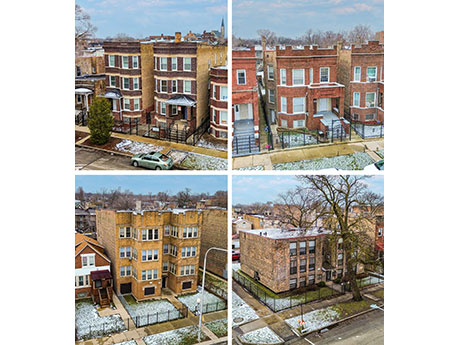

CHICAGO — Kiser Group has negotiated the $2.1 million sale of a portfolio of multifamily properties in Chicago’s West Garfield Park neighborhood. The newly renovated units were fully occupied at the time of sale. Jack Petrando and Noah Clark of Kiser brokered the transaction. Buyer and seller information was not provided.

AUSTIN, TEXAS — It’s no secret that today’s commercial real estate market can be challenging, whether you’re looking to break ground on a new project or close a transaction. But there’s plenty to be optimistic about in the student housing sector moving forward, according to Peter Katz, executive managing director of Institutional Property Advisors. Katz moderated this year’s “Power Panel,” which kicked off the first full day of the 16th annual InterFace Student Housing conference, held at the JW Marriott in Austin. The panel brought together a consortium of high-level executives to provide their thoughts on the current dynamics in the sector and their outlook for the year ahead. “I always feel the energy and the excitement in the student housing sector,” began Katz. “And while we feel a sense of tempered exuberance this year, the investment community is still extremely enthusiastic. Consumer strength is coming in hotter than expected and inflationary readings are pushing out the timing of proposed interest rate cuts from The Fed.” Two years into the cycle of tightening from The Fed, investors are recognizing that the price adjustments that have already occurred have now become an acquisition opportunity, Katz continued. “And while there’s still pain …

HOUSTON — Miami-based lender BridgeInvest has provided a $55.5 million acquisition loan for Park on Voss, an 810-unit multifamily property in West Houston that was built in 1971, according to Apartments.com. The property offers studio, one- and two-bedroom units and amenities such as a pool, fitness center, coffee bar, dog park, business center, tennis courts, outdoor grilling and dining stations and a game room. The borrower, Tara Capital, will use a portion of the proceeds to fund capital improvements. Renovations will include new unit appliances and HVAC systems, as well as exterior enhancements such as lighting, landscaping and essential repairs to elevators, sidewalks and roofing. CBRE arranged the debt.

NEW YORK CITY — Cushman & Wakefield has brokered the $7 million sale of a multifamily development site in The Bronx. The site at 3083 Webster Ave. can support approximately 100,000 buildable square feet of product. Jonathan Squires, Josh Neustadter and Austin Weiner of Cushman & Wakefield represented the seller, Atlantis Management, in the transaction. The buyer, SKF Development, plans to build an affordable housing complex that will be financed with Low-Income Housing Tax Credits and subsidies from the NYC Department of Housing Preservation & Development and NYC Housing Development Corp.

SOMERVILLE, N.J. — Marcus & Millichap has arranged the $4.2 million sale of a 10-unit apartment building in Somerville, about 50 miles southwest of Manhattan. The building at 28-32 W. Main St. offers one- and two-bedroom units and houses two retail spaces that are occupied by a bank and an art gallery. Brent Hyldahl and Alan Cafiero of Marcus & Millichap represented the undisclosed seller in the transaction and procured the buyer, Harborpoint Residential.

MINNEAPOLIS — Lupe Development has opened Wirth on the Woods, a $52 million seniors housing campus near Theodore Wirth Park in Minneapolis. The project includes 100 units of affordable seniors housing in a six-story building named The Theodore and 100 units of market-rate seniors housing in a six-story building named The Eloise. The development also includes a new regional storm pond, outdoor classroom and play area for the adjacent Anwatin Middle and Bryn Mawr Elementary schools. The two seniors housing buildings feature shared amenities such as an outdoor courtyard, garden and greenhouse. The affordable housing component was made possible with the Livable Communities Demonstration funds from Metropolitan Council, as well as loans, grants and funding participation from the City of Minneapolis, Hennepin County and the Minnesota Housing Finance Agency. Investors in the project included Great Southern Bank and Raymond James Investments. The Eloise was privately funded, and Great Southern Bank served as the senior lender. Frana Cos. was the general contractor. Wirth on the Woods is the result of master planning between Lupe Development and Swervo Development Corp. The master plan created more than 200 additional market-rate units in a combination of lofted units and townhomes called the Pennhurst Collective. …

MILWAUKEE — Marcus & Millichap has negotiated the $3.6 million sale of Grand Riverside Residences in Milwaukee’s Third Ward. The building features 16 apartment units and two retail spaces. Located at 225-229 N. Water St., the property was originally constructed in 1900 and renovated in 2006. The retail spaces are home to Sevva Salon and fitness studio Barre3. Matthew Whiteside of Marcus & Millichap represented the buyer and seller, neither of which were disclosed.

Kennedy Wilson, Haseko Purchase Two Multifamily Properties in Vancouver, Washington for $90M

by Amy Works

VANCOUVER, WASH. — Kennedy Wilson has partnered with Haseko Corp. to purchase The Farmstead and Villas at 28th Street for $90 million. Both apartment communities are located in Vancouver, just across the Columbia River from Portland, Oregon. The name of the seller was not released. Totaling 350 units, the recently completed properties feature diverse floor plans across three unit types, as well as a variety of amenities, including secure gated access, fitness centers, dog parks, a pickle ball court, pet wash stations, natural green space and walking trail. The assets are located within five minutes of each other and within 10 minutes of Portland.