High interest rates and economic uncertainty in the first quarter of this year contributed to lower absorption and declining rent growth in industrial, retail and multifamily sectors across the country, with some regional exceptions, according to Lee & Associates’ 2023 Q1 North America Market Report. Meanwhile office continues to struggle. The sector experienced its third-largest quarterly contraction since the beginning of the pandemic, as work-from-home preferences decoupled office occupancy from job growth numbers. The full Lee & Associates report is available (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city) here. The analysis below provides an overview of four major commercial real estate sectors alongside trends, economic background and exceptions within each sector. Industrial Overview: Sharp Decline Hits First-Quarter U.S. Demand There was a sharp first-quarter decline in U.S. tenant demand for industrial space as wholesalers and retailers reconsider their inventory levels out of caution over the economic outlook. Net absorption in the first quarter totaled 39.4 million square feet, a 57 percent drop from the record set a year ago. The overall U.S. vacancy rate settled at 4.4 percent, an increase of 40 basis points from the close of 2022, comfortably …

Retail

Content PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

RICHMOND, VA. — Cushman & Wakefield|Thalhimer’s Capital Markets Group has brokered the $7.3 million sale of Wistar Center in Richmond. Located at 8101-8157 Staples Mill Road, the portfolio comprises 49,092 square feet of industrial and retail space. Fully leased to 20 tenants, the retail property features 20,436 square feet. Totaling 28,656 square feet across two buildings, the industrial space was also fully leased at the time of sale. Bo McKown, Catharine Spangler and Eric Robison of Cushman & Wakefield|Thalhimer arranged the sale on behalf of the seller, Fernau LeBlanc Investment Partners. Prudent Growth Partners was the buyer.

WARSAW, IND. — JLL Capital Markets has brokered the sale of Warsaw Commons, an 87,858-square-foot shopping center in Warsaw, about 40 miles northwest of Fort Wayne. The sales price was undisclosed. Built in 2012, the fully occupied property is home to tenants such as TJ Maxx, PetSmart, Ulta, Dollar Tree and Shoe Carnival. Michael Nieder of JLL represented the seller, IRC Retail Centers. Nate Monson and Brandon Goodman of Colliers represented the buyer, The Lofts at 5 Points LLC.

VERMILLION, S.D. — Marcus & Millichap has arranged the $2.1 million sale of a 2,365-square-foot retail property occupied by Starbucks in Vermillion, home of the University of South Dakota. The net-leased building has a new 10-year lease with Starbucks that features 7.5 percent rental increases every five years. Mark Ruble and Chris Lind of Marcus & Millichap represented the seller, a limited liability company. Buyer information was not provided.

NEWPORT BEACH, CALIF. — RA Centers has arranged $72 million for the refinancing of a portfolio comprising four shopping centers. Located in Redlands, California, the first property, Orange Street Plaza, totals 155,000 square feet. Vons, Trader Joes, Office Depot and U.S. Bank anchor the center, which was 99 percent occupied at the time of financing. The second property, Front Gate Plaza, is located in Lancaster, California, and comprises 150,000 square feet. Stater Brothers, Goodwill, Wells Fargo, McDonalds, Taco Bell and The Habit anchor the center, which was 90 percent occupied at the time of financing. Pueblo Shopping Center in Pueblo, Colorado, was 90 percent occupied and is anchored by King Soopers, CATO, Dollar Tree, Dominos and Sally Beauty. Essencia Medical Facility, VA Clinic, Harbor Freight, Hobby Lobby, JoAnn’s Fabrics, Planet Fitness, LongHorn Steakhouse, Gate City Bank and Perkins anchor the fourth property, Gateway Fashion Mall. Located in Bismarck, North Dakota, the center totals 385,000 square feet and was 85 percent occupied at the time of financing. Raymond Arjmand of RA Centers secured the financing through JP Morgan with Logan Ahlers.

SANTA FE SPRINGS, CALIF. — Asian and Hispanic e-grocer Weee! Inc. has leased space at Prologis Mid Counties Distribution Center in Santa Fe Springs. The new space at 13215 Cambridge St. will allow the company to expand from its existing cold storage facility in La Mirada. CBRE’s Ben Seybold and Rick McGeagh represented Prologis in the lease negotiations.

HUDSON, MASS. — Brokerage firm Horvath & Tremblay has arranged the $21.9 million sale of Center at Hudson, an 84,605-square-foot shopping center located about 30 miles west of Boston. The grocery-anchored center consists of a freestanding, 58,266-square-foot Stop & Shop, which has operated out of that location since 1990 and recently extended its lease, and 26,339 square feet of inline space. Bob Horvath and Todd Tremblay of Horvath & Tremblay represented the seller and procured the buyer, both of which requested anonymity, in the transaction. The deal traded at a cap rate of 6.35 percent.

Retail is not dead. In fact, coming out of COVID-19, retail is arguably the strongest that it’s been in many years. According to S&P Global Market Intelligence data, in 2022 we saw a 13-year low in retail companies filing for bankruptcy. Here in Baltimore, we’re seeing extremely low vacancy rates and steady demand, which in turn, is cultivating a competitive environment. However, despite the challenges that retail has faced over the past several years, its resilience is where we continue to find plenty of reasons to be optimistic. A look back In March 2020, the phones stopped ringing and businesses shuttered for what was anticipated to be a few short weeks. We soon came to find that was not the case. Retail did struggle, significantly in some cases. Restaurants, service-based businesses, soft goods, fitness, entertainment and experiential concepts amongst many others, whether large corporate-owned or mom-and-pop users, struggled to stay afloat. And many did fail. Space came back on the market and concepts dwindled at an uncanny pace. But the so-called “retail apocalypse” — a common phrase that was originally coined because of the increased popularity of e-commerce — was, again, proved to be hyperbole. Retailers sought ways to enhance …

DELRAY BEACH, FLA. — PEBB Enterprises has signed new retail leases totaling 27,099 square feet at Delray Landing, a shopping center the company is currently redeveloping in Delray Beach. Retro Fitness will occupy 17,299 square feet at the property, and Crown Wine will lease 4,100 square feet. Keke’s Breakfast Café and a dentist office will also open at the center, leasing 4,200 and 1,500 square feet, respectively. Sprouts Farmers Market anchors the property, which is also leased to Burger King and Taco Bell. PEBB acquired the shopping center, which is located at 5024-5070 W. Atlantic Ave., in June 2021 in a joint venture with Topvalco Inc. A grand reopening is scheduled for this summer.

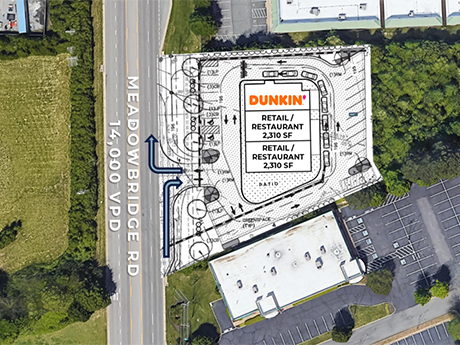

MECHANICSVILLE, VA. — WEDGE Acquisitions LLC has purchased a 1.7-acre parcel in Mechanicsville for $690,000 for the development of a retail strip center. Upon completion, the property, located at 8527 Meadowbridge Road, will comprise 6,500 square feet. Dunkin’ will anchor the center. Nathan Shor of S.L. Nusbaum represented WEDG in the transaction, and Douglas Tice III, also with S.L. Nusbaum, represented the seller, Lisa G. Waitman.