NEW YORK CITY — M&T Realty Capital Corp., a wholly owned subsidiary of Buffalo, N.Y.-based M&T Bank (NYSE: MTB), has provided a $414.8 million Freddie Mac conventional loan to refinance Brooklyn Crossing, a 51-story, 858-unit apartment tower in Brooklyn. The borrower is The Brodsky Organization, an owner and developer of luxury apartments, condos and retail properties in New York City. While the majority of the apartments at Brooklyn Crossing are luxury units, 258 are affordable. Located in the posh Prospect Heights neighborhood, the building is immediately adjacent to Barclays Center, home of the NBA’s Brooklyn Nets and WNBA’s New York Liberty. The property offers studio, one-, two- and three-bedroom apartments. Amenities include a screening room, large fitness center, rooftop terrace and lounge, and outdoor pool. According to the property website, studio apartments rent for approximately $3,500 a month and three-bedroom units rent for approximately $9,000 monthly. Robert Barry, senior vice president in M&T Realty Capital’s New York City office, led the refinancing. Andrea Wagonseller of M&T Bank led the initial construction loan, which this transaction refinanced. “With its unparalleled amenities and convenient access to multiple subway lines, Brooklyn Crossing has transformed the Prospect Heights neighborhood,” says Michael Edelman, CEO of …

Multifamily

By Antonio Marquez, managing partner, Comunidad Partners Amenities are important when it comes to renter appeal. However, what residents want from their apartment complexes is based on different issues, like socioeconomic status. Indeed, a resort-style pool, yoga rooms and fitness centers are nice. But residents at properties owned by Comunidad Partners, an operator of workforce housing communities across Sun Belt markets, want more than these features in their community. To understand our residents — our customer base — we asked them questions, tried programs and obtained feedback. From this, we determined that our residents’ top three concerns were health, community safety and managing finances. However, expense management didn’t involve debt restructuring or financial literacy. Instead, access to the financial system was the issue. Thanks to this feedback, we’ve developed and are implementing programs at two of our properties in Texas — Villas at Alameda in Fort Worth and the Villas at Shadow Oaks in Austin — to help residents access financial services like high-interest savings accounts. These intangible amenities help build and enrich communities while strengthening resident retention and other operational factors that benefit investors. Sensing Residents’ Priorities In determining the right amenities to support residents, it’s essential to understand …

ATLANTA — GID has welcomed the first residents at Windsor Brompton and Windsor Avery, two apartment communities underway within the $2 billion High Street mixed-use development in Atlanta. Located in the city’s Central Perimeter submarket, the two apartment communities total 598 units. Windsor Communities, GID’s property management division, operates both properties. More than 100 leases have been signed at the communities prior to delivery. Apartments at Windsor Brompton and Windsor Avery come in 16 different floor plans comprising studio, one-bedroom and two-bedroom configurations. Monthly rental rates start at $1,538, according to the property website. Amenities include a fitness and yoga studio, pool and sundeck, catering kitchen and private dining room, coworking spaces, an outdoor dog run and dog wash, outdoor gaming lawn, bike lounge and a bike repair station. Residents will also have direct access to High Street’s lineup of shops and restaurants, which will include Puttshack, Jaguar Bolera, Nando’s PERi-PERi, Velvet Taco, Allen Edmonds, Skin Spirit, The Hampton Social, Agave Bandido, Cuddlefish, Ben & Jerry’s and Sugar Coat.

FLORENCE, KY. — Berkadia has arranged the sale of a 104-unit assisted living and memory care community in Florence, approximately 10 miles southwest of Cincinnati. Mike Garbers, Cody Tremper, Dave Fasano and Ross Sanders of Berkadia represented the seller, a publicly traded REIT, in the transaction. A private equity group purchased the asset for an undisclosed price.

CareTrust REIT Acquires Three Seniors Housing Communities in Southern California for $60M

by Jeff Shaw

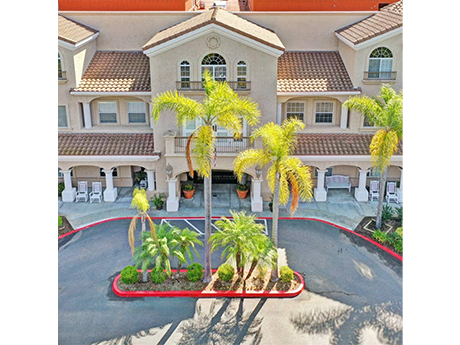

SAN CLEMENTE, Calif. — CareTrust REIT Inc. (NYSE:CTRE), a San Clemente-based seniors housing investor, has acquired three continuing care retirement communities (CCRCs) located in Los Angeles, Orange, and San Diego counties. The portfolio totals 475 assisted living, skilled nursing and memory care beds/units. Bayshire Senior Communities, an existing CareTrust tenant based in Southern California, has taken over management of all three properties. The highest profile property of the three is Torrey Pines Senior Living in San Diego. CareTrust paid $32.3 million for the asset, including transaction costs. Annual cash rent for the first year is approximately $2.6 million, increasing to approximately $3 million in the second year with CPI-based annual escalators thereafter. CareTrust completed the acquisition of the other two CCRCs through a joint-venture arrangement with a third-party regional healthcare investor. Pursuant to the arrangement, CareTrust is the managing member of the joint-venture entity. CareTrust provided a combined common equity and preferred equity investment amount totaling approximately $28 million. The joint-venture landlord has leased these facilities to Bayshire pursuant to a new, triple-net master lease agreement with an initial term of 15 years with two five-year extension options. CareTrust’s initial contractual yield on its combined preferred and common equity investments …

NORMAN, OKLA. — Marcus & Millichap has brokered the sale of Campus Lodge, a 192-unit student housing property located about two miles from the University of Oklahoma campus in Norman. Built in 2004, Campus Lodge comprises 19 buildings that house 768 beds in three- and four-bedroom layouts. Amenities include a pool, sand volleyball court, basketball court, outdoor grilling and dining stations and a coffee bar. Patrick Mullowney and Joel Dumes of Marcus & Millichap represented the seller, The Collier Cos., in the transaction. The duo also procured the buyer, Denver-based investment firm Cardinal Group. Campus Lodge was 97 percent occupied at the time of sale.

CHICAGO — A joint venture between Mavrek Development, Double Eagle Development, Luxury Living and GW Properties has opened The Saint Grand, a 248-unit luxury apartment complex in Chicago’s Streeterville neighborhood. In addition to the apartment units, the project includes 45,000 square feet of office space and 8,000 square feet of street-level retail space. The first residents began moving in last month. Amenities include a fitness center, coworking spaces, lounges and a rooftop pool deck that is scheduled to open in May. The project team included architecture firm NORR, general contractor Lendlease and interior designer Harken Interiors. Cushman & Wakefield is handling residential and commercial property management.

WELDON SPRING, MO. — New Perspective is nearing completion of a new senior living community in Weldon Spring, about 30 miles west of St. Louis. A leasing office is now open at the property, which is scheduled for completion this summer. The community will offer independent living, assisted living and memory care services. The number of units was not provided.

COLUMBUS, OHIO — United Church Homes Management (UCHM) will manage two seniors housing properties in Columbus. Alongside its current management of Wexner Heritage Village, UCHM will now provide management services for Bexley Heritage Apartments and Village Shalom Apartments. UCHM, an affiliate of United Church Homes, is headquartered in Marion, Ohio, and operates more than 90 senior living communities.

NEW YORK CITY — Locally based development and investment firm Fetner Properties has sold its remaining interest in The Victory, a 45-story apartment tower located at 561 10th Ave. in Manhattan’s Hell’s Kitchen neighborhood. The percentage and sales price were not disclosed. The building houses 417 units in studio, one- and two-bedroom formats and 12,000 square feet of commercial space. Empire State Realty Trust (NYSE: ESRT), which previously bought a majority stake in The Victory in late 2021, now owns the building outright.