ODESSA, TEXAS — Dallas-based brokerage firm Disney Investment Group has arranged the sale of Chimney Rock, a 294,431-square-foot retail power center located in the West Texas city of Odessa. Built in 2012 and expanded in 2016, Chimney Rock was 93 percent leased at the time of sale to tenants such as Academy Sports + Outdoors, Best Buy, Marshalls, Ulta Beauty, Petco, Northern Tool + Equipment, Mattress Firm, Kirkland’s and Longhorn Steakhouse. David Disney and Adam Crockett of Disney Investment Group represented the undisclosed seller and procured the buyer, Houston-based investment firm Fidelis, in the transaction.

Retail

WATERTOWN, MASS. — SRS Real Estate Partners has arranged the $16.1 million sale of a 14,400-square-foot retail property located in the western Boston suburb of Watertown. The property was built in 2016 and is leased to CVS on a triple-net basis. Kevin Held of SRS represented the seller, a West Coast-based family trust, in the transaction. Josh Kanter of Marcus & Millichap represented the buyer, a Massachusetts-based private investor that acquired the asset via a 1031 exchange.

LAKEMOOR, ILL. — Greenstone Partners has brokered the $2.3 million sale of a newly constructed retail property occupied by Starbucks in Lakemoor, which is located in Northeast Illinois. The net-leased property sold at a cap rate of 4.55 percent and $1,029 per square foot, marking the lowest cap rate ever for a Starbucks property in Illinois, according to CoStar. The building is situated within the larger Lakemoor Commons, which is home to tenants such as Heartland Dental, Chipotle, Buona Beef and a multi-tenant retail center. Brewster Hague and Jason St. John of Greenstone represented the seller, a Chicago-area developer. The duo also procured the buyer, a private entity based in California completing a 1031 exchange.

Cushman & Wakefield Brokers $18.9M Partial Sale of Greenfield Gateway Retail Center in Mesa, Arizona

by Amy Works

MESA, ARIZ. — Cushman & Wakefield has arranged the sale of a 67,709-square-foot portion of Greenfield Gateway, a 349,143-square-foot retail center in Mesa. Southern California-based investor Greenfield Gateway LLC sold the asset to an entity formed by the Hinkson Co. for $18.9 million. Situated on 10.1 acres, the sold portion consists of fully leased buildings, including an EoS Fitness-anchored building and two multi-tenant strip-retail buildings. Michael Hackett, Ryan Schubert and Chris Hollenbeck of Cushman & Wakefield in Phoenix represented the seller in the transaction.

ORLANDO, FLA. — Marcus & Millichap has brokered the $6.3 million sale of a store located at 3212 Curry Ford Road in Orlando. The 13,824-square-foot retail property is net leased to CVS/pharmacy. Gabriel Britti, Ricardo Esteves and Ronnie Issenberg of Marcus & Millichap’s Miami office represented the seller, a limited liability company, and the buyer. Both parties requested to remain anonymous.

TIFFIN, IOWA — The Ders Group LLC has broken ground on a two-story PinSeekers golf venue at the Park Place mixed-use development in Tiffin, about 20 miles south of Cedar Rapids. The 49,022-square-foot venue will feature 56 heated bays and Toptracer ball tracking technology, which uses high-speed cameras and computer algorithms to provide instant feedback on golf swings. The facility, which will be open year-round, also features 18 holes of mini golf, a full-service restaurant and two bars. Completion is slated for summer 2023. Innovative Construction Solutions is serving as the general contractor for the $29 million project. Park Place is a 450-acre development consisting of residential, retail, entertainment and dining space.

CANTON, OHIO — Marcus & Millichap Capital Corp. (MMCC) has arranged a $1.9 million loan for the refinancing of a 13,225-square-foot retail property occupied by CVS in Canton. The standalone building is located at 2210 W. Tuscarawas St. Christopher Marks of MMCC arranged the 10-year loan, which features a 4.5 percent interest rate, 30-year amortization schedule and 35 percent loan-to-value ratio. The lender and borrower were not provided.

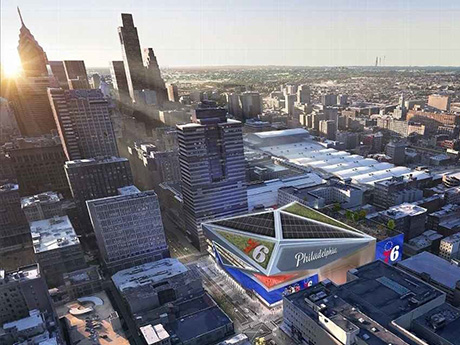

By Taylor Williams Though very much in its infancy, the Philadelphia 76ers’ recent decision to assemble a development team and file a formal proposal for a new arena at the current site of Fashion District Philadelphia has drawn the city’s retail market into speculation on how buildings, operators and streetscapes will be impacted. Known as 76 Place, the $1.3 billion venue would theoretically anchor the Market East corridor that connects Center City to Chinatown and Old City via its location atop the city’s largest public transit hub. The ability to centralize the arrival of fans, shoppers and diners from all cardinal directions, as well as multiple states, automatically sparks excitement for growth opportunities in the world of retail real estate. This project would immediately check that box. “The announcement of the new 76ers arena has generated a lot of discussion in the retail world,” says Steve Gartner, executive vice president at CBRE. “Bringing an arena to downtown Center City, especially one that’s adjacent to a convention center, will allow Philadelphia to hold more concerts and global events, like political conventions, that impact retailers and restaurants. These positive impacts will permeate the fabric of all of downtown.” “The retail community is …

MIAMI — JLL has arranged the sale of Deerwood Town Center, a grocery-anchored shopping center spanning 205,853 square feet in Miami. Core Investment Management purchased the property from Courtelis Co. for nearly $44.9 million. Courtelis has owned the center since it delivered the first phase in 1985, according to JLL. Danny Finkle, Eric Williams and Kim Flores of JLL brokered the transaction. Deerwood Town Center was fully leased at the time of sale to tenants including Fresco y Mas, Amped Fitness, Pet Supermarket and TD Bank. The center is located at 12095 SW 152nd St., which is situated across from the Zoo Miami.

MELVILLE, N.Y. — Melville-based A&G Real Estate Partners has secured the sales of 21 properties in Maryland, Delaware and Florida at a real estate bankruptcy auction. All assets were formerly owned by the late Zebulon J. and Beatrice Brodie. In the Aug. 16 bankruptcy auction, 19 properties in Maryland and one each in Delaware and Florida fetched a total of $18.4 million. The transactions included: the $6.7 million sale to different buyers of four contiguous, largely undeveloped properties in a busy commercial district on Legion Road in Denton, Md.; the $1.5 million sale of the Carter Building at 300 Market St. in downtown Denton; the $2.1 million sale of the Alexander Building at 315 High St. in Chestertown, Md.; and the $2.2 million sale of 300 Bulle Rock Farm Lane in Centreville, Md., which is a family compound formerly owned by John Raskob, builder of the Empire State Building in Manhattan. “A&G’s comprehensive marketing campaign for this middle-market disposition triggered inquiries from more than 560 prospective buyers across the country, and nearly 50 of those interested parties eventually placed baseline, qualifying and/or prevailing bids, some for multiple properties,” says Emilio Amendola, co-president of A&G. After two rounds of bidding, 13 …