NEW YORK CITY — Lument has provided a $117.4 million Freddie Mac loan for the refinancing of Hope Gardens, a 949-unit affordable housing community in Brooklyn’s Bushwick neighborhood. Built between 1980 and 1987, the garden-style property comprises 60 buildings totaling 1,321 units that are all subsidized by Section 8 contracts and includes a daycare and two senior centers. The loan, which carries a fixed interest rate, 30-year term and 40-year amortization schedule, retires the construction debt attached to 47 of the buildings that house 949 units. Josh Reiss of Lument originated the loan for the sponsor, a joint venture between Pennrose Holdings, Acacia Real Estate Development and an affiliate of The New York City Housing Authority (NYCHA).

Multifamily

PASADENA, CALIF. — R.D. Olson Construction, on behalf of owner BRIDGE Housing, has broken ground on Heritage Square South, a seniors housing property located at 710 N. Fair Oaks Ave. in Pasadena. Slated for completion by September 2023, the $28 million, 70,000-square-foot community will feature three three-story buildings offering 69 one-bedroom units and one two-bedroom unit. The three buildings are interconnected with walking bridges. Onsite amenities will include walking trails, flex rooms, a community room and 2,200 square feet of retail space. Additionally, the site has a bus stop on the front of Fair Oaks Avenue. KTGY is serving as architect for the project.

NEW YORK CITY — Stav Equities, a New York City-based brokerage firm, has negotiated the $5.4 million sale of a multifamily building that comprises 12 market-rate units and one vacant retail space in Brooklyn’s Crown Heights neighborhood. The buyer, Neue Urban, plans to implement a value-add program. The seller was not disclosed. Adam Traub of Curb Capital and Jacob Stavsky of Stav Equities brokered the deal.

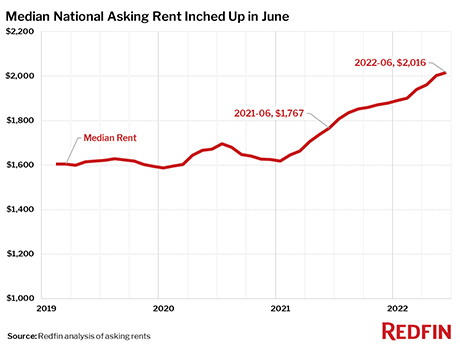

SEATTLE — Redfin, the residential real estate brokerage giant, has reported that the national median asking rent in June is $2,016 per month, a 14.1 percent increase year-over-year. The Seattle-based company analyzed data from 20,000 separate multifamily and single-family properties from its RentPath platform across the top 50 U.S. metro areas. The June figure is a slight increase from May at 0.7 percent, which represents the smallest month-over-month gain since the start of the year. The median asking rate is also the smallest annual increase since October 2021. Daryl Fairweather, Redfin’s chief economist, says while still elevated, the current slowdown in rent growth could be anticipatory on the part of landlords in reaction to overall inflation. (The Consumer Price Index saw its biggest annual gain since 1981 in May, according to the U.S. Bureau of Labor Statistics). “Rent growth is likely slowing because landlords are seeing demand start to ease as renters get pinched by inflation,” says Fairweather. “With the cost of gas, food and other products soaring, renters have less money to spend on housing.” “This slowdown in rent increases is likely to continue, however rents are still climbing at unprecedented rates in strong job markets like New York …

By Adam Schmitt, First Vice President, CBRE | Multifamily Investment Properties The multifamily construction pipeline in Las Vegas has ramped up in recent years and continues to be robust. Apartment developers have long capitalized on the growth of the Las Vegas market, and with the vast potential remaining in the city, multifamily builders are continuing to place their bets in Vegas. Our team at CBRE tracked a total of 4,317 multifamily units constructed in 2021, and are projecting more than 8,000 in 2022, with at least 16,000 in 2023 and beyond. For reference, over the past 10 years, the Las Vegas multifamily market has delivered about 3,700 annual units on average. The projects being built in Las Vegas are predominately luxury, Class A developments that tend to cater to the lifestyle renter or renter-by-choice demographic. The locations of these developments are mostly concentrated in the Southwest and Henderson submarkets, comprising 62 percent of the construction pipeline. Developers have historically flocked to these submarkets because of the areas’ respective demographics, perpetual growth and strong multifamily fundamentals. More recently, multifamily developers have found opportunities in the Northwest and North Las Vegas submarkets as those regions have seen years of high rent growth, and the rent …

CORPUS CHRISTI, TEXAS — The residential branch of Thompson Thrift, a development and investment firm with offices in Indiana, Phoenix and Houston, has sold The Retreat, a 324-unit apartment community in Corpus Christi. Developed in 2017, the community comprises 14 three-story buildings with one-, two- and three-bedroom units. Residences feature granite countertops, full-sized washers and dryers, private balconies and detached garages. Amenities include a pool, fitness center, clubhouse, technology center, movie lounge, gaming den, a bark park and a package handling system. Kelly Witherspoon, Justin Cole and Adam Sumrall of Berkadia brokered the sale. The buyer and sales price were not disclosed. The Retreat was 96 percent occupied at the time of sale.

SAN ANTONIO — Prime Finance has provided a $47.3 million acquisition loan for Lantower Alamo Heights, a 312-unit multifamily property in San Antonio. Built in 2015, Lantower Alamo Heights offers one-, two- and three-bedroom units and was 93 percent occupied at the time of sale. The amenity package consists of a pool, conference room, courtyard, dog park, pet wash station, fire pit, fitness center, a game room and outdoor grilling areas. Marko Kazanjian, Chris McColpin, Max Herzog and Andrew Cohen of JLL arranged the floating-rate loan, as well as a preferred equity investment with Connecticut-based Sound Mark Partners, on behalf of the borrower, Austin-based Old Three Hundred Capital.

Colliers Mortgage Provides $25.4M HUD-Insured Construction Loan for Metro Dallas Multifamily Project

GARLAND, TEXAS — Colliers Mortgage has provided a $25.4 million HUD-insured construction loan for The Draper, a 155-unit multifamily project that will be located in the northeastern Dallas suburb of Garland. The Draper will offer a mix of one- and two-bedroom, market-rate units. Colliers arranged the loan, which carries a 40-year term and amortization schedule, through HUD’s 221(d)(4) program. The borrower was an entity doing business as GFNT Opportunity II LP.

KINGSTON, MASS. — Trammell Crow Residential has opened Alexan Kingston, a 282-unit apartment community in Kingston, about 35 miles south of Boston. The property features one-, two- and three-bedroom floor plans and amenities such as a pool, fitness center, private workspaces, conference rooms, an event room, outdoor grilling areas and Amazon package lockers. Syracuse-based Pyramid Management Group is managing the property. The first move-ins began in June. Rents start at $2,350 per month for a one-bedroom unit.

NEWBURGH, N.Y. — Cushman & Wakefield has brokered the sale of Farrell Communities at Lakeside, a 102-unit active adult community in the Hudson Valley city of Newburgh. The community opened in 2020 and features 30 one-bedroom units and 72 two-bedroom units. Cushman & Wakefield’s Adam Spies, Brian Whitmer, Niko Nicolaou, Ryan Dowd and Peter Welch represented the seller, Farrell Communities, and procured the buyer, Castle Lanterra Properties, in the transaction. The sales price was not disclosed.