CANTON, GA. — Matthews Real Estate Investment Services has negotiated the sale of Woodmont Village, an 85,639-square-foot shopping center located in Canton, approximately 40 miles north of Atlanta. Kroger anchors the center, which was 75 percent leased at the time of sale. Other tenants at the property include The UPS Store, Anytime Fitness, Pizza Hut, Ace Hardware, Advance Auto Parts, Fabricare Cleaners and Las Palmas Mexican restaurant. Kyle Stonis, Pierce Mayson and Boris Shilkrot of Matthews brokered the transaction. The buyer, Aubuchon Realty Co., purchased Woodmont Village for an undisclosed price. The seller was also not released.

Southeast

Cushman & Wakefield Commercial Advisors Arranges Sale-Leaseback of Two Memphis Industrial Facilities

by John Nelson

MEMPHIS, TENN. — Cushman & Wakefield Commercial Advisors has arranged the sale-leaseback of two industrial facilities in Memphis totaling 250,000 square feet. AIC purchased the facilities, located at 2149 Harbor Ave. and 2172 Wharf St., from the tenant, Red Dot Corp. Red Dot designs and manufactures HVAC systems for commercial and military vehicles. Landon Williams and Katie Hargett of Cushman & Wakefield Commercial Advisors, along with Frank Maldonado and Dan Johnsen of Cushman & Wakefield, represented Red Dot in the sale and long-term lease of the two facilities. Terms of the transaction were not released.

CORAL SPRINGS, FLA. — Granite REIT has purchased Coral Springs Logistics Center, a 124,500-square-foot industrial property located at 3850-3872 N.W. 126th St. in Coral Springs, a city in South Florida’s Broward County. A joint venture between Barings Real Estate and Arkadia Property Group sold the property to Granite REIT for an undisclosed price. Luis Castillo, Cody Brais, Taylor Osborne and David Orta Jr. of JLL represented the seller in the transaction. Built in 2021, Coral Springs Logistics Center comprises two rear-load buildings that were fully leased at the time of sale to building materials wholesaler Exclusive Trim Inc. and commercial refrigerator manufacturer Marc Refrigeration.

CHARLOTTE, N.C. — Coldwell Banker Commercial Realty has brokered the $3.4 million sale of a 3.4-acre, multifamily-zoned parcel at 5703-5707 N. Tryon St. in Charlotte. The buyer, The Annex Group, plans to develop a 200-unit affordable housing community on the site. Capital partners for the project include City of Charlotte, Bank of America and the North Carolina Housing Financing Authority (NCHFA). The construction timeline was not released. Ryan Pilsy of Coldwell Banker represented the land seller, an entity doing business as Kilbros3 LLC, in the transaction. Annex Group was represented internally by Joy Skidmore and Ryan Clark.

Charlotte: “The Queen City” named after Queen Charlotte, wife of George III, has been on a tear post-COVID with new and expanding retail concepts. Vacancy rates have hovered under 4 percent the last few years, with little signs of changing , according to research from Institutional Property Advisors (IPA). Much of that vacancy has occurred in less desirable markets, or in junior and big-box bankruptcies (JOANN, Big Lots, Party City, etc.) that are being snatched up as quickly as they become vacant. Tenants are desperate and clamoring for new locations to keep up with the strong residential growth (24,000+ new residents in the city limits in 2024 and 46,000 in the CSA), making charlotte the 14th largest city in the country, and 19th-largest CSA in terms of overall population. This factor combined with unemployment hovering in the low 4 percent range, plus household income growth has called for desperate measures to ID new space or weakness in the market. We as local experts have seen a slight uptick, over the past 12 months, in some “shadow inventory.” This occurring when an existing retailer or restaurant might be struggling with sales, or in partial default, and the landlord has the opportunity …

RINCON, GA. — JLL has negotiated the sale of NFI Distribution Center Savannah, a 1 million-square-foot distribution facility located at 1200 Logistics Parkway in Rincon. The distribution center is fully leased to National Distribution Centers LLC, a major subsidiary of New Jersey-based supply chains solutions provider NFI Industries. Britton Burdette, John Huguenard, Dennis Mitchell, Jim Freeman and Maggie Dominguez of JLL represented the seller, a joint venture between Becknell Industrial and Goldman Sachs Alternatives, in the transaction. Stockbridge purchased the Class A facility for an undisclosed price. Situated within Old Augusta Commerce Center, the cross-dock property is situated 10.7 miles from the Port of Savannah’s Garden City Terminal and within five miles of I-95. The property was completed in 2022 and features 40-foot clear heights, 190-foot truck courts, 270 trailer parking spaces (expandable to 307) and 102 dock levelers.

CLERMONT, FLA. — GBT Realty Corp. has broken ground on Hammock Ridge Commons, a 30,500-square-foot shopping center located in Clermont, approximately 25 miles east of Orlando. An entity doing business as Shoppes at Hammock Ridge Crossing LLC sold the original 3.7-acre land parcel to the Brentwood, Tenn.-based developer for $2.5 million. A 23,273-square-foot Sprouts Farmers Market will anchor Hammock Ridge Commons, which will be the first store in Lake County for the Arizona-based specialty grocer. Additional tenants will include a dentist and nail salon, and roughly 1,700 square feet of inline space is still available for lease at the center. The general contractor, J. Raymond Construction Corp., plans to deliver Hammock Ridge Commons in spring 2026.

Boulder Group Arranges $3.7M Sale of Single-Tenant Retail Property in Louisville Leased to Chase Bank

by John Nelson

LOUISVILLE, KY. — The Boulder Group has arranged the $3.7 million sale of a single-tenant retail property located at 3600 Bardstown Road in Louisville. Chase Bank occupies the 3,176-square-foot property on a triple-net lease, which has more than 11 years remaining on the term and two five-year renewal options with built-in 10 percent rental escalations. Randy Blankstein and Jimmy Goodman of The Boulder Group represented the buyer, a Midwest-based institution, and the seller, a private family from the Midwest, in the transaction. Both parties requested anonymity. The Chase Bank property serves as an outparcel to a Lowe’s Home Improvement store and is situated within one mile of I-264.

WASHINGTON, D.C. — SRS Real Estate Partners has brokered the nearly $3 million sale of a restaurant property located at 301 Massachusetts Ave. in Washington, D.C.’s Capitol Hill neighborhood. Pupatella Neapolitan Pizza has occupied the 4,154-square-foot restaurant since fall 2024 on a triple-net lease. Rick Fernandez and Andrew Fallon of SRS represented the seller, a private owner based in New York City, in the transaction. The buyer was a local private investor. Both parties requested anonymity. Sandy Spring Bank provided an undisclosed amount of acquisition financing to the buyer. The restaurant was recently renovated and features 1,500 square feet of outdoor patio space.

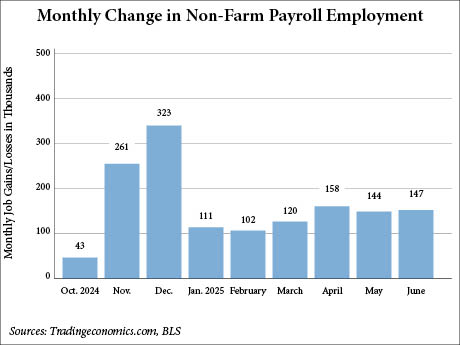

WASHINGTON, D.C. — The U.S. economy added 147,000 jobs in June, according to the U.S. Bureau of Labor Statistics (BLS). The monthly figure surpasses the estimated 110,000 jobs by Dow Jones economists, according to CNBC. The total also contrasts ADP’s report yesterday that the private sector lost 33,000 jobs in June, which CNBC reported was a surprise to economists who were forecasting an increase of 100,000 jobs. While surpassing expectations, the June total is on target with the average 146,000 jobs added over the prior 12 months, according to the BLS. The leading employment sector this past month was government, which added 73,000 jobs. State governments added 47,000 jobs, mostly in education (+40,000), and local governments added 23,000 jobs. Job losses continued at the federal level as 7,000 jobs were lost in June. Other sectors that saw job gains in June included healthcare (+39,000) and social assistance (+19,000). Employment changed little in most other fields, including construction, manufacturing, retail trade, transportation and warehousing, professional and business services and leisure and hospitality. The BLS also reported that the unemployment rate changed little at 4.1 percent, which marks 13 consecutive months where the unemployment rate has landed between 4 and 4.2 percent. …