AUSTIN, TEXAS — Pennsylvania-based private equity firm PPR Capital Management has completed The Residences at Rubi, a 101-unit mixed-income housing project in East Austin. The development is valued at $21.7 million. The unit mix will be split evenly between market-rate and affordable units, with the latter component carrying income restrictions between 30 to 70 percent of the area median income. IE2 Construction served as the general contractor for the project, and Avita Property Management is handling lease-up and property management duties.

Multifamily

BOSTON — M&T Realty Capital Corp. has provided $44.8 million in financing for 247 Hancock, a 47-unit mixed-income housing project that will be located in the Dorchester area of Boston. The six-story building will offer studio, one-, two- and three-bedroom units. Amenities will include a fitness studio, tenant lounge and rooftop deck. The financing includes a $6.3 million Freddie Mac unfunded forward commitment under the 9 percent Low-Income Housing Tax Credit program, a $19.2 million construction loan and a $19.3 million tax credit equity investment, with the latter two components being executed by M&T Bank. Construction is slated for an early 2027 completion.

Madison Capital Arranges Equity for $84M Multifamily Development Underway in North Miami, Florida

by John Nelson

NORTH MIAMI, FLA. — Madison Capital Group has arranged preferred equity financing for Urbania NoMi 125th, an $84 million luxury multifamily development in North Miami. The equity source was not released. The developers of the 12-story, 195-unit community include Continua Development and Oldtown Capital Partners. Construction is underway and the development is expected to come on line in 2026. Amenities at Urbania NoMi 125th will include a pool, fitness center, media lounge, outdoor gathering spaces and ground-level retail space.

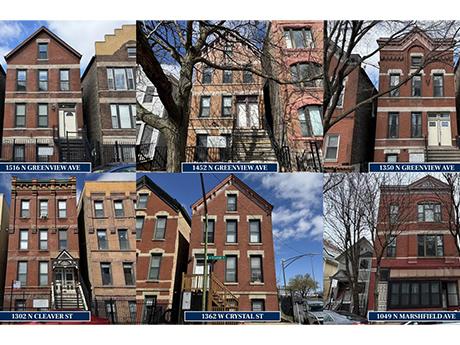

CHICAGO — Marcus & Millichap has brokered the $7.9 million sale of a six-property, 38-unit multifamily portfolio in Chicago’s Noble Square neighborhood. The assets are located at 1516 N. Greenview Ave., 1452 N. Greenview Ave., 1350 N. Greenview Ave., 1302 N. Cleaver St., 1362 W. Crystal St. and 1049 N. Marshfield Ave. The properties feature a mix of one-, two- and three-bedroom units, many of which have been recently renovated. The portfolio also includes 10 income-producing garage spaces. Tyler Preissing and James Ziegler of Marcus & Millichap represented the seller, a private investor, and procured the buyer, a local investment group.

SOUTH ELGIN, ILL. — Lee & Associates of Illinois has negotiated the $6.5 million sale of 84.4 acres of residential land at 325 Umbdenstock Road in South Elgin. John Cassidy, Jay Farnam and Ken Franzese of Lee & Associates represented the seller, Spohr Family Trust. The buyer, Lennar/CalAtlantic Group LLC, was self-represented. The site was previously marketed for an industrial use for more than a decade, according to Farnam. Lee & Associates secured a residential home builder to purchase the site and worked with the village on a land entitlement and approval process.

DALLAS — Fort Worth-based owner-operator Crescent Real Estate has completed 2811 Maple in Uptown Dallas. The 31-story apartment tower houses 177 units in one-, two- and three-bedroom floor plans that range in size from 950 to 1,900 square feet, as well as 12 penthouses with an average size of 2,300 square feet. Residences are furnished with Bosch appliance packages, designer Italian cabinetry and quartz countertops. Amenities include a pool, fitness center, private library with a coffee bar, outdoor dining areas, study spaces and a dog park. Rents start at $4,000 per month for a one-bedroom apartment.

SAN ANTONIO — Westmount Realty Capital has sold Westmount at Houston Street, a 200-unit townhome complex located at 4611 E. Houston St. in San Antonio’s East submarket. Developed on 18 acres in 2003 and acquired by Westmount in 2019, the 37-building property offers two-, three- and four-bedroom units with garages. Amenities include a pool, playground, dog park and a clubhouse with a business and fitness center. The buyer and sales price were not disclosed. The property was 91.5 percent occupied at the time of sale.

FRISCO, TEXAS — CAP Multifamily has completed an 18-unit project in Frisco’s historic Rail District. Known as Beacon Rail District, the property offers one- and two-bedroom units, the former of which have an average size of about 745 square feet. Amenities include a coworking space, fitness center and a hotel-style lounge. Rents start at $1,980 per month for a one-bedroom apartment.

POHATCONG, N.J. — Locally based developer Larken Associates has completed the lease-up of Monte View at Pohatcong, a 120-unit apartment complex located near the Pennsylvania-New Jersey border near Easton. The garden-style property consists of three multi-story buildings and one four-story building with a ground-floor clubhouse. Units come in one- and two-bedroom floor plans. Amenities include a pool, fitness center, game room, coworking space, grilling stations and a dog run. Construction began in November 2023. Leasing commenced last fall, at which time rents started at roughly $2,000 per month for a one-bedroom apartment.

WEST HAVEN, CONN. — Regional brokerage firm Northeast Private Client Group (NEPCG) has arranged the $5.2 million sale of a 40-unit apartment building in the southern coastal Connecticut city of West Haven. According to Apartments.com, the three-story building at 295 Elm St. was originally constructed in 1960. Bradley Balletto, Rich Edwards, Jeff Wright and Derek Mahabir of NEPCG represented the local seller, CT Realty Trust, in the transaction and procured the buyer, an undisclosed, New York City-based private investor.