JERSEY CITY, N.J. — Cleveland-based developer The NRP Group has opened The Sawyer, a 131-unit apartment complex in Jersey City. Units come in studio, one- and two-bedroom formats. Amenities include a fitness center, rooftop terrace, a children’s playroom, outdoor grilling and dining areas and a pet spa. NRP Group developed the project in partnership with Hoboken Brownstone Co. Monthly rents start at approximately $2,150 for a studio unit.

Multifamily

PHOENIX — Davlyn Investments has purchased The Boulevard, an apartment property in Phoenix, for $112.5 million. The California-based buyer plans to rebrand the 294-unit community as Boulders at Lookout Mountain. Built in 1994 on 16.7 acres, the property features central heating and air conditioning, in-unit laundry, wood-burning fireplaces, walk-in closets with built-in shelving, arid landscaping, parking and an expansive community amenity package. Steve Gebing and Cliff David of Institutional Property Advisors, a division of Marcus & Millichap, represented the undisclosed seller. Eric Flyckt of Northmarq arranged acquisition financing, which New York Life provided.

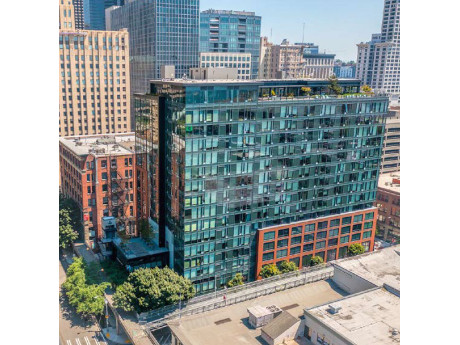

PCCP Provides $75M Acquisition, Repositioning Loan for The Post Apartments in Downtown Seattle

by Amy Works

SEATTLE — PCCP has provided a $75 million senior loan to Griffis Residential for the acquisition and repositioning of The Post, a 16-story multifamily community located at 888 Western Ave. in downtown Seattle. Situated in the Seattle Central Business District, Waterfront and Pioneer Square submarkets, The Post features 208 apartments with quartz countertops, vinyl-plank flooring, steel appliances, floor-to-ceiling windows and views of downtown Seattle, Elliott Bay and the Olympic Mountains. Community amenities include a rooftop deck with grilling areas and a reflection pool, multiple rooftop lounges, a media room, dog run, yoga studio, library and fitness center.

Lument Funds $25.1M in Fannie Mae Financing for Affordable Housing Portfolio in Colorado

by Amy Works

LAKEWOOD, ARVADA, DENVER AND FOUNTAIN, COLO. — Lument has closed five Fannie Mae conventional multifamily housing loans totaling $25.1 million to refinance the Archway Portfolio, five affordable housing communities near Denver and Colorado Springs. The borrower is Archway Communities, which manages the portfolio. Andrew Ellis of Lument led the transactions. Fountain Ridge, the largest of the portfolio, received a 10-year loan with a fixed interest rate and a 30-year amortization schedule. The other four loans feature fixed interest rates, 12-year terms, two years of interest-only payments and 30-year amortization schedules. The portfolio includes the 72-unit Foothills Green in Lakewood, the 60-unit Willow Green in Arvada, the 65-unit Sheridan Ridge in Arvada, the 60-unit Arapahoe Green in Denver and the 111-unit Fountain Ridge in Fountain.

LAKE OSWEGO, ORE. — CBRE National Senior Housing has arranged a refinancing for The Springs at Lake Oswego, a 216-unit independent living, assisted living and memory care community in Lake Oswego. The borrower is a joint venture between Harrison Street and The Springs Living. Aron Will, Austin Sacco and Tim Root arranged the non-recourse, four-year, floating-rate loan with three years of interest-only payments through a national bank. CBRE previously arranged construction financing for the community in 2017. The amount was not disclosed. The community opened in 2019 in a highly affluent city approximately eight miles south of downtown Portland.

HOUSTON — Houston-based developer BHW Capital has sold The Park at Tour 18, a 241-unit apartment community located on the city’s northeast side. Units at the property come in one- and two-bedroom floor plans that, according to Apartments.com, range in size from 700 to 1,198 square feet. Amenities include two pools, a fitness center, game room, dog park, indoor and outdoor grilling stations and a conference room. Dallas-based Civitas Capital acquired the asset for an undisclosed price.

JACKSONVILLE, FLA. — An affiliate of Bristol Development Group and Hallmark Partners have sold Vista Brooklyn, 308-unit multifamily property in Jacksonville. The buyer, an entity known as CS 1031 Vista Brooklyn Apartments DST, an affiliate of Capital Square, purchased the property for $126.3 million. Built in 2021, Vista Brooklyn is a 10-story apartment community offering studio, one-, two- and three-bedroom floorplans, as well as 12,687 square feet of ground floor commercial and retail space. Community amenities include a resort-style rooftop pool and beer garden, fitness studio with yoga room, gaming area, grilling stations, gift wrapping room, coworking spaces, dog park, pet spa and a meditation suite. Located at 200 Riverside Ave., Vista Brooklyn is situated adjacent to downtown Jacksonville. The property is also near retailers and restaurants such as The Fresh Market, Burrito Gallery Brooklyn, Chipotle Mexican Grill, Navy Federal Credit Union and Winston Family YMCA.

ROSWELL, GA. — New York-based Eastern Union has secured a $71.3 million acquisition loan for Crest at Riverside, a 396-unit multifamily property in Roswell. Michael Muller of Eastern Union arranged the loan through New York-based Arbor Realty on behalf of the buyer, Atlanta-based MSC Properties. With a full sale price of $87.5 million, the transaction’s loan-to-cost ratio equaled 81 percent. The non-recourse loan carries a three-year term with options for two one-year extensions, and repayment is interest-only over its full term. Built in 1965 and renovated in 2016, The Crest at Riverside was rebranded to Grace Apartment Homes Roswell. The property offers one-, two- and three-bedroom floorplans with 18 one-bedroom units that are 882 square feet in size; 247 two-bedroom units that range from 1,258 to 1,408 square feet in size and 131 three-bedroom units that range from 1,290 to 1,408 square feet in size. Unit features include white or stainless steel appliances, laminate or solid surface counters, wood cabinets and tile backsplashes. Community amenities include two pools, business center, fitness center, playground, grills and a pet park. The property was 96 percent occupied at the time of sale. Located at 100 Chattahoochee Circle, the 518,460-square-foot property is situated 20.4 …

FORT WORTH, TEXAS — Marcus & Millichap has brokered the sale of The Villas at Cantamar, a 265-unit apartment community located on the west side of Fort Worth. The property features one-, two- and three-bedroom units and amenities such as two pools, a playground and onsite laundry facilities. Al Silva and Ford Braly of Marcus & Millichap represented the locally based buyer and seller, both of which requested anonymity, in the transaction.

MARSHFIELD, MASS. — Newmark has brokered the sale of Modera Marshfield, a 248-unit apartment community located in the South Shore city of Marshfield. Built in 2021, the property features one-, two- and three-bedroom units and amenities such as a pool, fitness center, multiple outdoor dining and lounge areas and shared workspaces. Michael Byrne, Thomas Greeley, Devlin Man and Casey Griffin of Newmark represented the seller, a partnership between Mill Creek Residential Trust and CrossHarbor Capital Partners, in the transaction. Boston-based TA Realty purchased Modera Marshfield, which was 90 percent occupied at the time of sale, for an undisclosed price.