ROSENBERG, TEXAS — Berkadia has negotiated the sale of Town Center Lofts, a 309-unit apartment community in the southwestern Houston suburb of Rosenberg. Developed in 2021 by Sueba USA, the property offers studio, one- and two-bedroom units ranging in size from 560 to 1,207 square feet. Amenities include two pools, a 24-hour fitness center, a community clubroom with a chef-inspired kitchen and package lockers. Jeffrey Skipworth, Todd Marix, Chris Curry, Joey Rippel, Chris Young and Kyle Whitney of Berkadia represented Sueba USA in the sale. A joint venture between Chicago-based Redwood Capital Group and global investment management firm Heitman purchased the asset for an undisclosed price.

Multifamily

LAS VEGAS — Avison Young has arranged the sale of AYA Apartments, a multifamily property in Las Vegas. The community traded for $105.9 million, or $190,126 per unit. The names of the seller and buyer were not released. Built in 1973 and renovated in 2019, AYA Apartments features 557 apartments in a mix of studio, one-, two- and three-bedroom layouts spread across 42 two-story, garden-style buildings. The property was previously an affordable housing community. However, restrictions expired several years ago and the three-year tail period that required keeping tenants in place expired in March 2021. As a result, the units are transitioning to market-rate apartments. Patrick Sauter, Art Carll-Tangora and Steve Nosrat of Avison Young represented the seller and facilitated the sale of the property.

Pacific Partners Residential Sells 280-Unit Prelude at Paramount Apartments in Meridian, Idaho

by Amy Works

MERIDIAN, IDAHO — Pacific Partners Residential has completed the disposition of Prelude at Paramount, an apartment community in Meridian. Pacific Development Partners acquired the asset for an undisclosed price. Danny Shin, Brock Zylstra, Timothy Ufkes, Rich Day and Jake Miles of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the deal. Adam Lewis served as Marcus & Millichap’s broker of record in Idaho. Built in 2019, Prelude at Paramount features 280 apartments in a mix of one-, two- and three-bedroom layouts with smart home technology, washers/dryers, stainless steel appliances and vinyl wood-style flooring. Community amenities include a pool, spa, playground, 24-hour fitness center, clubhouse and dog parks.

NEW YORK CITY — Los Angeles-based investment firm CIM Group, in partnership with locally based developer LIVWRK, has sold a 320-unit apartment community located at 85 Jay St. in Brooklyn’s Dumbo neighborhood for $220 million. The community is part of a larger development that includes 407 for-sale condos, 140,000 square feet of retail space that is anchored by a 77,000-square-foot Life Time Fitness and a 660-space parking garage. New York City-based RXR Realty purchased the rental complex. CIM Group has retained ownership of the condos and retail space.

Yardi Matrix: Student Housing Leasing Surpasses Pre-Pandemic Levels, Outlook Bright for 2022

by Katie Sloan

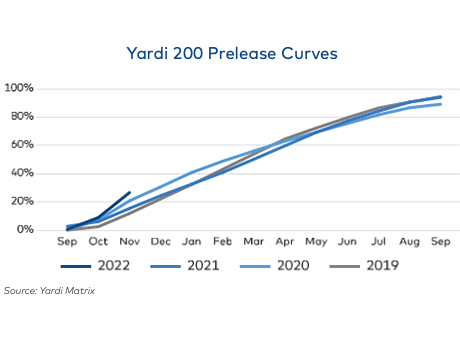

Often lauded as a recession-resistant asset class, the student housing sector was able to add another feather to its cap over the course of the past year, proving that it is also pandemic-resistant. The fall 2021 pre-leasing period ended in September at an occupancy rate of 94 percent, up from 89 percent in 2020 and 0.4 percent from levels seen prior to the start of the COVID-19 pandemic in fall 2019, according to the Yardi Matrix National Student Housing Report January 2022. These numbers were seen within the company’s ‘Yardi 200’ markets, which include the top 200 investment-grade universities across all major collegiate conferences. Pre-leasing for the fall 2022 term is already underway with levels at 27 percent as of November — an 11 percent increase over the same time in 2020, and a 6 percent increase over levels seen in 2019. Yardi reports that the top five universities with the greatest year-over-year growth in percentage of beds pre-leased are the University of Wisconsin-Madison with 66 percent growth; the University of Nevada-Las Vegas with 48 percent growth; Purdue University with 43 percent growth; the University of Pittsburgh with 31 percent growth; and the University of North Carolina at Chapel Hill …

LOS ANGELES — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of The Perch, a five-story apartment asset located on the border of the Eagle Rock and Highland Park neighborhoods in Los Angeles. Roundhouse sold the property to ABRA Management for $28.7 million, or $486,441 per unit. Completed in 2018, The Perch features 59 one-, two- and three-bedroom layouts, two levels of structured parking, an outdoor lounge with firepit, gated parking and electric vehicle charging stations. Additionally, the property features 2,646 square feet of retail space, which Hilltop Coffee + Kitchen and Perch Salon occupy. Paul Darrow of Marcus & Millichap, along with Kevin Green, Joseph Grabiec and Greg Harris of IPA, represented the seller and procured the buyer in transaction.

Draper Property Management Sells Royal Lani Apartment Community in Colorado Springs for $11.3M

by Amy Works

COLORADO SPRINGS, COLO. — Draper Property Management has completed the disposition of Royal Lani, a multifamily property in Colorado Springs. California-based Turnstone Capital acquired the asset for $11.3 million. Located at 2010 Carmel Drive, the Royal Lani features two three-story buildings offering a total of 77 two-bedroom apartments, averaging 783 square feet. Since 2015, the property has undergone renovations, including new windows, new gates and roof repair. Saul Levy, Kevin McKenna, Mackenzie Walker and Jessica Graham of CBRE represented the seller in the deal.

SANDY SPRINGS, GA. — Cushman & Wakefield has arranged the sale of Park at Abernathy Square, a 484-unit apartment community located in Sandy Springs, about 16.4 miles north of downtown Atlanta. The sales price was $132.6 million, or more than $274,000 per unit. Mike Kemether, Travis Presnell and James Wilber of Cushman & Wakefield represented the seller, Atlanta-based Clark Ventures, in the transaction. San Francisco-based Stockbridge Capital Group acquired the property. Built in 1977 and renovated in 2019, Park at Abernathy Square offers one-, two- and three-bedroom floorplans with an average unit size of more than 1,100 square feet. Unit features include walk-in closets, patios and balconies, granite countertops, stainless steel appliances, pantries, dishwashers and washer and dryer hookups. Community amenities include a clubhouse, pool, laundry facilities, tennis court, picnic area, fitness center, business center, playground and a car charging station. Located at 6925 Roswell Road, the property is located off Ga. Highway 400 and is situated close to Buckhead, Roswell and Alpharetta. The apartment community is also 5.9 miles from Georgia Perimeter College and 3.1 miles from the Art Institute of Atlanta.

SANTA ROSA BEACH, FLA. — Lument has provided a $48.8 million Freddie Mac conventional loan to refinance Sanctuary at 331, a 264-unit multifamily community in Santa Rosa Beach. Steve Beltran of Lument led the loan transaction on behalf of the borrower, an affiliate of Hunt Cos. The loan features a 10-year term, 30-year amortization schedule and a low fixed interest rate with 60 months of interest-only payments. The loan is a refinance of an existing HUD loan. Sanctuary at 331 features 11 buildings on nearly 32 acres. The apartment property offers one- and two-bedroom floorplans with features such as stainless steel appliances, private patios and in-unit washers and dryers. Community amenities include a 24-hour fitness center, swimming pool, clubhouse, a dog park and garage storage units. Cushman and Wakefield manages the property, which was 97 percent occupied at the time of the loan transaction.

HOUSTON — DLP Capital, a Florida-based investment and finance firm, has provided $74 million in acquisition financing for two Houston-area apartment complexes totaling 1,062 units. Palms at Westheimer totals 798 units and is located on the city’s west side, while Huntington at Stonefield spans 264 units and is located on the city’s north side. The borrower was locally based investment firm Kalkan Capital. The seller was not disclosed.