LAKE WORTH, FLA. — The Milestone Group has acquired Casa Brera at Toscana Isles, a 206-unit apartment complex located in Lake Worth, approximately 35 miles north of Fort Lauderdale. The purchase price was not disclosed. Hampton Beebe and Avery Klann of Newmark marketed the property on behalf of the undisclosed seller. Casa Brera at Toscana Isles offers one-, two- and three-bedroom floorplans, ranging in size from 870 square feet to 1,430 square feet, according to Apartments.com. Amenities include a resort-style swimming pool, fitness center, clubhouse, social lounge, private movie theater, entertainment bar, multi-purpose sports court and a dog park.

Multifamily

CONSHOHOCKEN, PA. AND TORONTO — An affiliate of Morgan Properties LP, a multifamily investment firm based in metro Philadelphia, has entered into an agreement to acquire Toronto-based Dream Residential Real Estate Investment Trust (Dream Residential REIT). The all-cash transaction is valued at $354 million and is expected to close by the end of the year. Dream Residential REIT owns 15 garden-style multifamily communities totaling more than 3,300 units. The portfolio is concentrated in three markets: Cincinnati (six), Oklahoma City (five) and Dallas-Fort Worth (four). Morgan Properties will acquire all of Dream Residential REIT’s assets and assume the company’s liabilities as part of the acquisition agreement. Jonathan Morgan and Jason Morgan, co-presidents of Morgan Properties, said in a prepared statement that the company “looks forward to welcoming these new communities, enhancing the physical assets and providing best-in-class customer service for the residents.” The agreement requires Morgan Properties to pay all unit holders of Dream Residential REIT, which trades on the Toronto Stock Exchange, as well as unit holders of the REIT’s subsidiary DRR Holdings LLC, $10.80 per unit. The price represents a 60 percent premium to the REIT’s closing price on Feb. 19, 2025, which is the day the company announced …

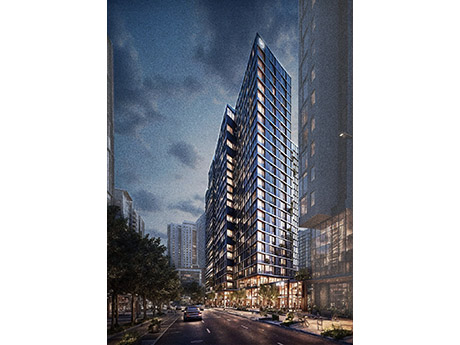

Core Spaces, Capstone to Break Ground on 1,600-Bed Student Housing Development Near Georgia Tech

by Abby Cox

ATLANTA — A joint venture between Core Spaces and Capstone Communities is set to break ground on a multi-phase mixed-use project located near the Georgia Tech campus in Midtown Atlanta. The first phase of the development — which is being led by Core Spaces — will include 1,600 beds of student housing and 5,000 square feet of ground floor retail. The community will also feature a third-floor amenity deck. Dwell Design Studio has been selected as the architect for Phase I, which is scheduled for completion in 2029. Capstone Communities will lead Phase II of the project, a timeline for which was not released.

MARINA DEL RAY, CALIF. — BWE has secured $43.4 million in acquisition financing for Villa Del Mar, a multifamily property in Marina del Ray. Initially constructed in 1872, Villa Del Mar consists of four three-story apartment buildings over at-garage parking, a five-story parking structure and a 209-slip marina. The property offers 198 one- and two-bedroom apartments with hardwood-style flooring, marina-view balconies and in-unit washers/dryers. Community amenities include a clubhouse, fitness center, pool and spa, basketball and tennis courts and barbecue areas. Mike Guterman of BWE arranged the acquisition financing from a life company on behalf of VDM Partners. The loan features a five-year, fixed-rate term with prepayment flexibility and two years of interest-only payments.

SAN MARCOS, TEXAS — Walker & Dunlop has brokered the sale of The Edge, a 553-bed student housing property located near the Texas State University campus in San Marcos. The community offers 173 units in a mix of one-, two-, three-, four- and five-bedroom configurations. Shared amenities include a 24-hour fitness center, study rooms, a gaming room, resort-style pool, basketball and volleyball courts and a dog park. Chris Epp, Matthew Chase, Craig Miller, Holden Penn, Ben Sarna and Sarah Foronda of Walker & Dunlop represented the seller, 29th Street Capital, in the transaction. Campus Realty Advisors acquired the property for an undisclosed price. BWE arranged acquisition financing for the deal.

FORT WORTH, TEXAS — PGIM Real Estate has provided a $24 million mezzanine loan for a 464-unit multifamily project that will be located in North Fort Worth. The name and address of the project were not disclosed, but the development will consist of two buildings on an 8.5-acre site. Units will be furnished with stainless steel appliances, granite countertops, individual washers and dryers and private patios. Amenities will include a pool, fitness center and a resident clubhouse. Jesse Wright of JLL arranged the loan on behalf of the borrower, Miami-based developer Resia (formerly known as AHS Residential). Bank OZK provided a $58 million senior loan for the project.

WEST LAFAYETTE, IND. — Subtext has opened EVER West Lafayette, a six-story, 449-bed student housing community located steps from Purdue University. The project at 147 W. Wood St. marks Subtext’s second development in West Lafayette and the first to launch under its new EVER brand. The 245,649-square-foot development includes 143 units ranging from studio to four-bedroom layouts, including three- and four-bedroom townhomes. Amenities include a resort-style courtyard with a pool, hot tub and jumbotron, along with a fitness center, yoga studio, coffee bar, open study lounges, outdoor kitchen, pet spa and bike storage. Subtext developed the project in partnership with Kayne Anderson Real Estate. First Mid Bank & Trust provided financing. ESG Architecture & Design served as architect and interior designer, and Brinkmann Constructors was the general contractor.

ORLANDO, FLA. — JLL Capital Markets has brokered the sale of M2 at Millenia, a 403-unit mid-rise, multifamily apartment complex in Orlando, which is adjacent to The Mall at Millenia. Ted Taylor and Kyle Butler of JLL’s Investment Sales and Advisory team represented the sellers, JSB Capital Group and BLD Group. The buyer, Independence Realty Trust, purchased the property for an undisclosed price. Built in 2019, M2 at Millenia is a five-story property offering a mix of one-, two- and three-bedroom floorplans ranging in size from 714 square feet to 2,214 square feet, according to Apartments.com. Amenities include a resort-style swimming pool, 24-hour fitness center, yoga studio, entertainment lounge with a kitchen and bar, outdoor grilling areas and 4,216 square feet of ground-floor retail space.

CHICAGO — Lamar Johnson Collaborative (LJC) has designed Humboldt Park Passive Living, a four-story, all-electric building at 750 N. Avers Ave. in Chicago’s West Humboldt Park neighborhood. Developed by 548 Capital, the project will bring 60 affordable housing units and 7,700 square feet of ground-floor retail space to the community, including space planned for a grocery store and café. It is expected to become the largest affordable housing building in Chicago constructed to meet Passive House standards, a performance-driven framework for reducing energy use while improving indoor air quality, according to LJC. The building will feature a ground-level community space, partially covered outdoor plaza and upper-floor terraces that double as communal gathering areas and rainwater collection zones. Apartments will include studio, one-, two- and three-bedroom layouts with 13 units reserved for residents with disabilities. Completion is slated for 2026.

BELMONT, N.J. — CBRE Investment Management has acquired Belmont Distribution Center, a 200,000-square-foot industrial facility in Northern New Jersey. Completed in 2023, Belmont Distribution Center features a clear height of 40 feet, 130-foot truck court depths, 46 loading positions and parking for 138 cars and 29 trailers. The facility is also divisible for multiple tenants. The seller was a fund backed by Brookfield Properties. The sales price was not disclosed.