BURNSVILLE, MINN. — CrossBat, a Cricket sports brand, has opened an 18,000-square-foot location at 3150 W. County Road 42 in Burnsville, just south of Minneapolis. The location marks the launch of CrossBat’s flagship cricket facility. The company has plans to expand nationally. Jake Kelly of Cushman & Wakefield represented CrossBat in the lease, while Andrew Manthai of KW Commercial represented the owner, Metro Center LLC. The indoor cricket venue offers box cricket leagues, nine full-length lanes for practice, cricket events, corporate team-building experiences and a coaching network. Cricket is the world’s second-most popular sport and is experiencing rapid growth in the U.S., according to Cushman & Wakefield. Minnesota is home to 100-plus teams and multiple leagues.

Retail

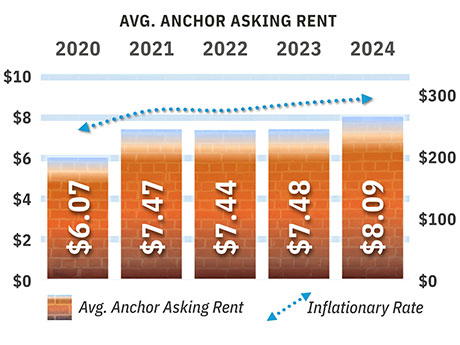

By Duke Wheeler, Reichle Klein Group The ongoing redevelopment of nonfunctional department store structures such as Sears and Elder Beerman, along with the retenanting or repurposing of structures such as Kmart, Giant Eagle and Value City, paved the way for many statistical and actual market improvements in the greater Toledo, Ohio, trade area. This positive trend and message supersede the closing announcements from over the past several months. First, the numbers: The overall retail market vacancy rate improved from 11.5 percent to 8.3 percent over the prior five-year period. This represents approximately 650,000 square feet of positive absorption. Most of this absorption occurred among anchor space, defined for the purpose of this article as space 20,000 square feet or larger. The vacancy rate for anchor space improved from 11 percent to 5.1 percent. Self-storage played a large role as roughly 300,000 square feet of anchor retail space was converted by the storage industry. The balance of positive absorption can be attributed to pent-up retail demand as occupiers compete for well-located, existing space in a market with limited new construction and increased construction costs. In some cases, landlords have found or will find themselves better off with a replacement tenant than …

PITTSBURGH AND NEW YORK CITY — DICK’S Sporting Goods Inc. (NYSE: DKS) has entered into a definitive merger agreement with footwear and apparel retailer Foot Locker Inc. (NYSE: FL). Under the agreement, sporting goods retailer DICK’S will acquire Foot Locker for an equity value of roughly $2.4 billion and an enterprise value of $2.5 billion. Foot Locker operates approximately 2,400 retail stores across 20 countries in North America, Europe, Asia, Australia and New Zealand. Foot Locker’s portfolio of brands also includes Kids Foot Locker, Champs Sports, WSS and atmos. DICK’S plans to operate Foot Locker as a standalone business unit and maintain the various Foot Locker brands. This acquisition will mark the first international expansion for the Pittsburgh-based sporting goods retailer. Upon completion of the merger, which has been unanimously approved by the boards of directors of the two companies, Foot Locker shareholders will choose to receive either $24 in cash or 0.1168 shares of DICK’S common stock for each share of Foot Locker common stock. The $24 value represents a premium of roughly 66 percent to Foot Locker’s 60-trading day volume weighted average price. “We have long admired the cultural significance and brand equity that Foot Locker and its …

DALLAS — EōS Fitness will open a 40,000-square-foot gym in South Dallas. The locally based fitness operator will be taking space at Wheatland Towne Crossing, joining tenants such as Target, Ross Dress for Less and PetSmart. Retail brokerage firm Segovia Partners represented EōS Fitness, which expects to open the facility sometime in 2026, in the lease negotiations. Dallas-based investment and development firm Rainier Cos. owns Wheatland Towne Crossing.

MAGNOLIA, TEXAS — Marcus & Millichap has brokered the sale of Windcrest Village Square, a 14,907-square-foot retail strip center in Magnolia, a northwestern suburb of Houston. Built on 1.5 acres in 2023, the center was fully leased at the time of sale to tenants such as The Toasted Yolk, Sugar Llamas, Anytime Fitness, Kitchen & Bath Shop and Ally Anne’s Kolache Kitchen. Allie Munday and Philip Levy of Marcus & Millichap represented the undisclosed seller in the transaction.

NEW YORK CITY — Whole Foods Market will open an 8,500-square-foot store in Manhattan’s Hell’s Kitchen neighborhood on Wednesday, June 4. The small-format store will be located at 301 W. 50th St. and will offer a bakery and a prepared foods section. The opening of this store follows today’s opening of a 10,000-square-foot store within the StuyTown development in the East Village.

DENVER — ALTO Real Estate Funds has completed the disposition of Quebec Square, a retail power center in east Denver. Big Ben Private Real Estate I LP, with Capital Asset Management serving as the fund manager, purchased the property for $56.7 million. Built in 2002-2003 on 22.1 acres, Quebec Square features 207,611 square feet of retail space at 7506 E. 36th Ave. Tenants at the property include Ross Dress for Less, Office Depot, PetSmart, Big 5 Sporting Goods and Five Below. The center is shadow anchored by Walmart, The Home Depot and Sam’s Club. Jason Schmidt and Austin Snedden of JLL Capital Markets’ Investment Sales and Advisory team represented the seller in the deal.

CenterCal, DRA Advisors Acquire 300,000 SF Fig Garden Village Lifestyle Center in Fresno

by Amy Works

FRESNO, CALIF. — A partnership between CenterCal Properties and DRA Advisors has acquired Fig Garden Village, a 300,000-square-foot lifestyle center located in Fresno. Originally developed in 1956 as part of the historic Fig Garden residential area, the center serves as a retail anchor for the broader Central California market. Tenants at the property include Pottery Barn, Williams-Sonoma, Banana Republic, lululemon, Whole Foods Market, Anthropologie, Madewell and Paper Source. The center was previously owned by Brookfield Properties.

WEST PALM BEACH, FLA. — Plaza Advisors has brokered the sale of Paradise Place, a 72,961-square-foot shopping center located on an 8.5-acre site in West Palm Beach. Built in 2003, the center was 98 percent leased at the time of sale to tenants including Publix, Sage Dental, Dunkin’ and Goodwill. Jim Michalak and Jeff Berkezchuk of Plaza Advisors represented the seller, Collett Capital, in the transaction. Forge Capital Partners purchased Paradise Place for an undisclosed price.

Slatt Capital Arranges $19.7M Refinancing for Sun Garden Retail Center in San Jose, California

by Amy Works

SAN JOSE, CALIF. — Slatt Capital has arranged a $19.7 million loan for the refinancing of Sun Garden Retail Center, a 107,899-square-foot retail property located in San Jose. Slatt Capital secured the fixed-rate, 12-year loan through a life insurance company on behalf of the borrower. Walmart anchors Sun Garden Retail Center, which occupies the former site of the Sun Garden Packing Co., a legacy cannery connected to San Jose’s agricultural roots. Other tenants at the property include Big 5 Sporting Goods, Chipotle Mexican Grill, Starbucks Coffee, Chevron and Jack in the Box.