By Will Mathews and Mike Kidd of Colliers

What is the reason behind Atlanta’s explosive growth over the last 20 to 30 years? Simply put, it’s been the exponential increase in population driven by an influx of new residents from the Northeast, Midwest and Mid-Atlantic. Atlanta is home to 17 Fortune 500 companies (the third-largest market in the nation), numerous high-paying jobs, a culturally diverse population and multiple prestigious universities, laying a strong foundation for incredible net migration.

Multifamily investors are drawn to Atlanta, evidenced by the region’s high volume of multifamily transactions. According to MSCI Real Capital Analytics, Atlanta is currently ranked No. 4 in the country behind New York City, Dallas and Los Angeles in transactions. Despite challenges related to new supply and systematic traffic problems, the future of Atlanta’s multifamily market is very bright for a number of reasons.

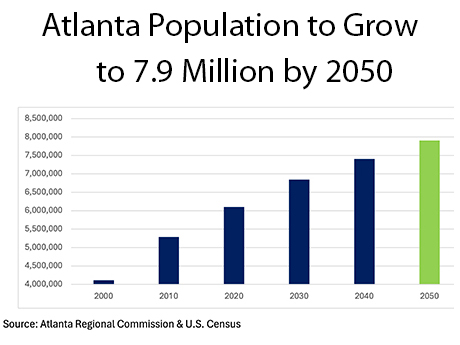

7.9 Million by 2050

According to the Atlanta Regional Commission, the population of Atlanta will grow to 7.9 million, or an increase of 1.8 million people from 2020 to 2050. One of the direct beneficiaries of population growth is multifamily rent growth. Reflecting recent population trends, rent growth is forecasted to peak in the suburban counties east of Atlanta.

Demand Keeps Pace with New Supply

Over 22,000 market-rate units were delivered across the Atlanta MSA in 2023, with more than 34,000 units set to deliver in 2024 and 2025, according to Yardi Matrix. This makes Atlanta one of the highest new supply markets in the country behind New York City, Dallas, Austin, Phoenix and Houston.

Even with record new supply in Atlanta, demand is projected to keep pace or even exceed new supply largely due to substantial population growth and net migration. Starting in 2026, new supply is expected to diminish as interest rates impact the availability of construction financing.

2.8 Million Jobs Attracts New Residents

The allure of Atlanta’s labor market, which is projected to grow by an additional 856,000 jobs by 2050, according to Atlanta Regional Commission, serves as a magnet for the substantial wave of incoming residents. Home to the world’s busiest airport and Fortune 500 companies, such as Delta Air Lines, The Home Depot, Coca-Cola and UPS, Atlanta is buoyed by a strong academic base, including Emory University, Georgia Tech and Georgia State University.

Large tech companies like Microsoft, Google, Equifax and Visa continue to expand their footprint throughout Atlanta, giving the city its nickname “Silicon Valley of the South.”

Rapidly Increasing Home Prices Help Multifamily Owners

Average home prices in Atlanta have increased 65 percent since the beginning of 2017, according to Zillow, far exceeding average rent growth over the same time period. Combined with the highest mortgage rates in more than 10 years, housing affordability has become increasingly difficult yet is a potential boon for multifamily owners.

Many residents forego buying a house and continue to rent out of necessity. If housing prices and interest rates do not subside by the time record new supply dwindles in 2026, there is the potential for a spike in rental rates similar to 2021 and 2022.

Build-to-Rent Is Taking Off

Fueled by a large millennial population expanding households and, therefore, seeking more space, build-to-rent communities are popping up throughout the Atlanta MSA. Mainly concentrated in suburban and exurban areas, where land is cheaper and permitting and zoning are more attractive, build-to-rent units grew by 1,500 units between 2017 and 2023, a 380 percent increase according to The Atlanta Voice. Build-to-rent communities offer larger units, typically with a private yard and garage, a neighborhood ambiance, community amenities and flexibility and affordability in the face of the rapidly rising home prices.

New Developments Spark Growth Opportunities

Spearheaded by CIM Group, Centennial Yards represents a strategic partnership between the City of Atlanta and private equity to revitalize a key part of Atlanta real estate. Located adjacent to Mercedes-Benz Stadium and State Farm Arena, Centennial Yards will transform acres of parking lots and railroad tracks into a dynamic mixed-use entertainment district. Costing an estimated $5 billion, Centennial Yards will create a “mini-city” and serve as a catalyst for economic growth in downtown Atlanta. With a multi-phase delivery, the goal is for the majority of the Centennial Yards project to be ready for the 2026 FIFA World Cup, which Atlanta will host along with other U.S. cities.

Together, Atlanta’s numerous attractions, abundant job opportunities and good weather will continue to attract waves of new residents. Rapid population growth will continue to fuel rent growth and stable occupancy rates. Leveraging strong market fundaments, Atlanta’s multifamily market represents an excellent investment for years to come.

— Will Mathews is vice chair and principal of Colliers, and Mike Kidd is vice president of multifamily operations at Colliers. This article is set to appear in the July 2024 issue of Southeast Real Estate Business.