By Nellie Day Today’s multifamily investment market can feel like a three-ring circus thanks to leveled-off rents, increased costs and more competition in many regions. Performers in this circus are often walking on a tightrope. On one side, there are repairs to be made and renovations that can lead to justified rent increases. On the other side, costs and reality must reign supreme. “Pre- and post-COVID markets have forced an evolution when it comes to investing in an asset,” says Sarah Connolly, vice president of operations at Capital Square Living in Glen Allen, Virginia. “Owners now have to ask themselves, ‘What is actually going to bring a return, and what should be incorporated into programming due to muted rent growth?’” It’s a challenging landscape, to be sure. National rent growth has slowed down significantly, with year-over-year increases hovering around 1 percent as of late 2024, according to the fourth-quarter multifamily report from Apartments.com. This is a stark contrast to the double-digit surges posted in 2021 and 2022. At the same time, construction costs have escalated, with Crescent Insurance Advisers noting that the average cost of building a multifamily property is about $398 per square foot. For context, the national average …

Search results for

"castle "

BOSTON — A partnership between local nonprofit organization Castle Square Tenants Organization (CSTO) and regional owner-operator WinnDevelopment has begun the $40 million repositioning of Eva White Apartments, a 102-unit affordable housing complex in Boston’s South End. The project will encompass upgrades to unit interiors and the creation of new amenity spaces, as well as energy system retrofits to the property’s two seven-story buildings. Specifically, each of the property’s 34 studios, 57 one-bedroom units and 11 two-bedroom units will be improved with modern kitchens, bathrooms and living room flooring. New health and wellness spaces and a new fitness room will be created for residents. The current common laundry room, community room and management office will also be renovated. Bank of America, MassHousing and Citizens Bank are financing construction, with BoA also serving as the federal Low-Income Housing Tax Credit investor. Completion is scheduled for 2026. Eva White Apartments originally opened in 1967 and serves seniors and people with disabilities. The Boston Housing Authority holds a 99-year ground lease on the complex, which protects the property’s long-term affordability status. CSTO became the 99 percent owner of the property in December after securing the financing for the project. This venture marks the organization’s …

WAPPINGERS FALLS, N.Y. — Kaplan Career Academy has signed a 15-year, 38,500-square-foot lease in Wappingers Falls, about 85 miles north of New York City. The school, which is part of the Greenburgh North-Castle Union Free School District, will relocate from nearby New Windsor to the building at 29 Marshall Road. The new space will serve as the new home for the Special Act School, which serves students with disabilities. Stephen Powers, Alexander Smith and Kate Whitman of OPEN Impact Real Estate represented Kaplan Career Academy in the lease negotiations. Thylan Associates represented the undisclosed landlord.

DALLAS — Virginia-based multifamily REIT AvalonBay Communities (NYSE: AVB) has agreed to acquire a portfolio of six multifamily properties totaling 1,844 units in the Dallas-Fort Worth (DFW) metroplex for $431.5 million. The seller is BSR REIT, and the deal is expected to close in the second quarter. The properties — Auberry at Twin Creeks, Satori Frisco, Vale Frisco, Aura Benbrook, Lakeway Castle Hills and Wimberly — were all built between 1995 and 2021 and range in size from 216 to 349 units. AvalonBay acquired the portfolio in conjunction with two Austin-area communities that sold for $187 million.

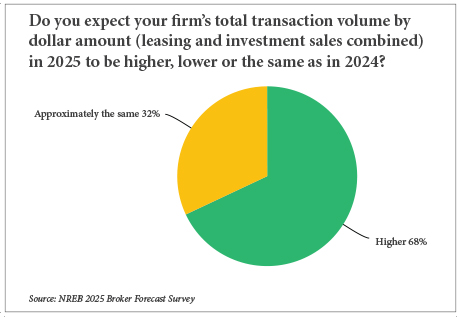

By Taylor Williams They may not be ready to do cartwheels and pop champagne, but when it comes to business expectations for 2025, commercial real estate professionals in the Northeast have a decidedly brighter outlook than in recent years. The last two years have been defined by barriers to economic growth on numerous levels. Pick your post-COVID geopolitical or macroeconomic poison — stubborn inflation, crushing interest rate hikes, multiple wars, restarting of global supply chains — all culminating with an incredibly heated U.S. presidential election. Is it any wonder that “survive till ’25” became the rallying cry of the commercial real estate industry? And while 2025 has arrived, the election has been decided and the Federal Reserve has strung together a series of small, yet meaningful cuts to short-term interest rates, the hangover from the aforementioned disruptors has not fully evaporated. Donald Trump’s return to the Oval Office brings a fresh slate of questions about how certain policies — namely tariffs and mass deportations — will impact business at both the national and local levels. And the expectation-smashing December jobs report proved sufficient to immediately pause the Fed’s would-be pattern of rate cuts. And it’s only been one month. As …

Cohen Investment Group Obtains $51.5M Financing for Industrial Complex in Virginia Beach

by John Nelson

VIRGINIA BEACH, VA. — Cohen Investment Group has obtained a $51.5 million financing package for the refinancing of Castleton Commerce Center, a 470,618-square-foot industrial complex in Virginia Beach. Eastern Union arranged the financing through Bank of America, which refinanced a $58.2 million bridge loan that Eastern Union originated when Cohen Investment Group purchased the property in 2021. Castleton Commerce Center features 409 self-storage units, 375 warehouse units totaling nearly 330,000 rentable square feet and 190 boat and RV parking spaces.

LEWISVILLE, TEXAS — Locally based developer Bright Realty has sold Valor at The Realm, a 260-unit multifamily property in the northern Dallas suburb of Lewisville. Built in 2021 within the 324-acre Realm at Castle Hills mixed-use development, the property offers one- and two-bedroom units. Amenities include a pool and a yoga studio, and the building also houses approximately 35,000 square feet of retail space. Weidner Apartment Homes purchased Valor at the Realm for an undisclosed price. JLL brokered the deal.

CARLSBAD, CALIF. — LEGOLAND California Resorts, with McCarthy Buildings Cos. as design-builder, is developing a 372,000-square-foot parking structure at LEGOLAND California Resort in Carlsbad. The team has topped out the four-story project, which is slated for completion in late 2025. The $20 million project will feature 1,130 stalls, including 57 electric-vehicle (EV) ready stalls with the option to add an additional 56 EV stalls. McCarthy’s design-build services for the project include preconstruction, marketing, scheduling, VDC, McCarthy Mapping, Castle Contracting, self-perform concrete and yard site services.

SAN ANTONIO — South Carolina-based investment firm Ziff Real Estate Partners has sold Castle Hills Market, a 97,682-square-foot shopping center in the northern-central area of San Antonio. According to LoopNet Inc., the center was built in 1986 and is home to tenants such as Allstate Insurance Co., Alamo Bridal, Edward Jones and Rainbow Language Academy. The buyer was an undisclosed Dallas-based investor. John Indelli, Whitney Snell, Chris Gerard, Ryan West and Gianna New of JLL brokered the deal. Ziff acquired the property in 2020 and implemented a value-add program prior to the sale.

KYLE, TEXAS — Locally based developer Rastegar Property Co. has unveiled plans for Inf1nity Square, a 318-acre master-planned development that will be located in the southern Austin suburb of Kyle. The development will feature roughly 1,000 single-family homes and 1,400 multifamily units as well as 185,000 square feet of commercial space. The commercial component will include retail space, an amenity center and an elementary school, all centered around a town square. In addition, Inf1nity Square will feature 61 acres of open green space that will connect to The Vybe, Kyle’s citywide trail network. CastleRock Communities and Brightland Homes will lead the development of first phase of single-family home development. Trez Capital has provided $31.7 million in construction financing for that phase of the project, which will encompass 329 lots.