CASTLE ROCK AND DENVER, COLO. — The Garrett Cos. has completed the sale of a two-property multifamily portfolio, totaling 434 apartments, to affiliates of Harbor Group International for $132.5 million. The portfolio includes The Prospector Modern Apartments at 3360 Esker Circle in Castle Rock and Ladora Modern Apartments at 18590 E. 61st Ave. in Denver. Prospector features 238 one-, two- and three-bedroom floorplans averaging 1,013 square feet, and Ladora offers 196 one-, two- and three-bedroom floorplans with an average apartment size of 1,024 square feet. Both assets were built in 2023 and are approaching lease up. Community amenities at the properties include resort-style pools, fitness centers, mail and package services, and pet parks and spas. Terrance Hunt, Shane Ozment, Andy Hellman and Justin Hunt of CBRE’s multifamily investment properties team in Denver represented the seller. Shawn Rosenthal, Jason Gaccione and Jake Salkovitz of CBRE’s New York office, along with Brady O’Donnell and Jill Haug of CBRE’s Denver office, arranged acquisition financing for the buyer.

Search results for

"castle "

RIVERHEAD, N.Y. — Chicago-based Bradford Allen Hospitality has acquired two hotels totaling 245 rooms in the Long Island community of Riverhead. The 131-suite Residence Inn by Marriott was built in 2017 and is located at 2012 Old Country Road, and the 114-key Hilton Garden Inn was constructed in 2008 at 2038 Old Country Road. Both hotels offer pools and fitness centers. The undisclosed seller in the off-market deals was the original developer of both hotels. Bradford Allen will retain New Castle Hotels & Resorts to manage the properties.

By Pam Knudsen, senior director of tax compliance services, Avalara While the dust has scarcely settled from a landmark ruling in New York City resulting in a massive crackdown on short-term rentals (STRs), the full extent of the fallout from the decision has yet to be fully grasped by many — and perhaps even by the city itself. Under the terms of Local Law 18, a resolution that passed earlier this year, hosts and owners of short-term rentals, including Airbnb, are now subject to tighter and stricter regulations. These include limits on numbers of guests, requirements to register with the city and obligations to more closely monitor guest behavior, among other regulations. The effective ban on short-term rentals will have considerable consequences on local economies, and more than anyone, it’s small lodging businesses that stand to be impacted by the resulting wave. But to fully understand the major impact this ban has on small businesses, we must first acknowledge that STRs should rightly be considered small businesses themselves. Much like any other small business, STRs are required by most communities to be licensed, registered and compliant with tax collection and remittance. Furthermore, the hosts and managers behind STRs operate in …

AUSTIN, TEXAS — Minneapolis-based developer Ryan Cos. has topped out Grand Living at The Grove, a five-story, 213-unit seniors housing project in Central Austin. The 348,353-square-foot building will house 177 independent and assisted living apartments, as well as 36 memory care apartments. Grand Living at The Grove will feature studio, one- and two-bedroom apartments that will range in size from 450 to 1,600 square feet. Ryan Cos. is co-developing the project with Grand Living and Castletop Capital. PACE Loan Group and Bankers Trust provided financing for the project. Construction began about a year ago, and delivery is slated for early 2025.

Converting Office to Life Sciences Offers Lucrative Alternative to Residential Reuse Projects

by Jeff Shaw

— By Julian Freeman, Dave Wensley and Gabe Pitassi — With steep vacancy rates impacting traditional office markets due to the headwinds of higher interest rates, short-term economic uncertainty and long-term remote/hybrid work uncertainties, underutilized traditional office buildings may become liabilities before the end of their anticipated economic life. Owners of these properties may consider a conversion — an adaptive reuse or repurposing — to access higher rents and occupancy rates. In view of nationwide housing shortages, especially in California, converting office to multifamily has received much attention as a logical move. However, such a conversion is not always viable from a financial, structural, legal or location perspective. An alternative option may be to repurpose an office building for life sciences use. Such a conversion, while posing its own unique challenges, may provide more realistic options than a conversion to residential use for many owners and properties. Challenges in converting to residential Converting an office building to residential use presents challenges on multiple fronts. Zoning laws vary based on property location and usage, and the property may need to be rezoned to a different classification to allow multifamily uses. Rezoning requires local government approval and public hearings, which can take months …

LEWISVILLE, TEXAS — Bright Realty is nearing completion of Tapestry at The Realm, a 362-unit apartment community in the northern Dallas suburb of Lewisville. The property will be situated within the locally based developer’s 324-acre Realm at Castle Hills mixed-use development. Tapestry at The Realm will feature studio, one- and two-bedroom floor plans and amenities such as a fitness center, sauna, game lounge, business center and a conference room. B2 Architecture + Design designed the project, and Andres Construction is the general contractor. Preleasing is slated to begin in November. The first units are expected to be available for occupancy in December.

CHICAGO — Kiser Group has brokered the sale of a historic multifamily property located at 2324 W. 111th St. in Chicago’s Morgan Park neighborhood for $1.9 million. Known as “The Castle” for its architecture, the property’s 16 apartment units were vacant at the time of sale. Originally constructed in the late 1800s as a funeral home, the building was later converted into a mixed-use asset in the 1920s. John George and Joe Bianchi of Kiser brokered the sale. Buyer and seller information was not provided.

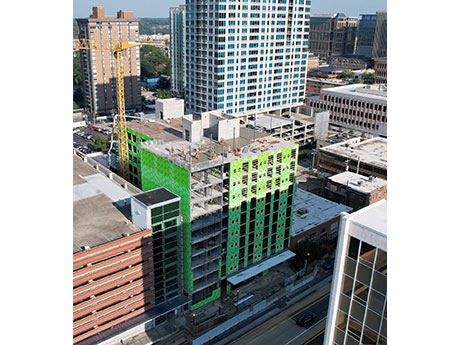

CLAYTON, MO. — Midas Construction has topped out an AC Hotel in the St. Louis suburb of Clayton. The $50 million project is slated for completion in spring 2024. The 11-story building includes 207 rooms. A team of Concord Hospitality, Homebase Partners, Koplar Properties, Eagle Realty and Midas Construction is developing the project. Designed for business and leisure travelers, the hotel will feature a rooftop bar and restaurant open to the public. The project revitalizes a historic, underutilized site that once housed the headquarters for the Clayton Police. Designed by DLR Group, the AC Hotel Clayton will feature the AC Lounge, where patrons can enjoy craft beer, handcrafted cocktails and tapas-style small plates, and the AC Kitchen, an onsite restaurant offering a European-inspired menu. The project team also includes DeLuca Plumbing LLC, Streib Co., TJ Wies Contracting Inc., Eisen Group, Acme Erectors, Jacobsmeyer Construction, Leonard Masonry, Vee-Jay, Titan Carpentry, Custom Service Crane, Grasse & Associates, Waterhout Construction and Castle Contracting.

Signorelli Co. Announces Phase I of 4,700-Acre Master-Planned Development Near Houston

by Katie Sloan

ROSENBERG, TEXAS — The Signorelli Co. has announced plans for Phase I of Austin Point, a 4,700-acre master-planned community located roughly 30 miles southwest of Houston in Rosenberg. Upon completion, the development will feature 14,000 homes and 15 million square feet of multifamily, office, medical, retail and hospitality space. The project will also include the extension of Fort Bend Parkway and Grand Parkway at the development site for more convenient access to downtown Houston. Phase I of Austin Point is set to break ground in 2024 and will include the construction of 400 homes. These residences will be built on smaller lots in an alley-loaded format, in sizes ranging from 1,300 to 4,500 square feet. The project team for Phase I includes Ashton Woods, Beazer Homes, Drees Homes, Castlerock, David Weekley Homes, Newmark Homes, Perry Homes, William David Homes and Westin Homes. Sales of homes in Phase I are expected to begin in spring 2025. Plans for Austin Point also include a community event space dubbed The 1824 — a nod to the year that the original landowner received the title to the development site. The space will include a café and wine bar with an open front porch, outdoor …

North Palisade Partners Acquires Hayward Industrial Outdoor Storage Site in California for $19.7M

by Amy Works

HAYWARD, CALIF. — North Palisade Partners has purchased a nearly 8-acre site at 4125 Breakwater Ave. in Hayward for $19.7 million. The fully leased property is a value-add industrial outdoor storage facility situated at the base of the San Mateo-Hayward Bridge. The acquisition adds an asset with in-place income to the company’s portfolio and offers a potential future redevelopment opportunity. Current tenants at the property include United Rentals, SSS Transport, Outfront Media, American Tower and Crown Castle. Dick Scott of Scott Ventures I represented the buyer, while Jay Hagglund of Cushman & Wakefield represented the undisclosed seller in the deal.