STOCKTON, CALIF. — First Industrial Realty Trust has released plans for First Stockton Logistics Center, a cross-dock distribution center at 6201 Newcastle Road in Stockton. Completion for the project is slated for early 2024. The 1 million-square-foot facility will feature 42-foot clear heights, 204 loading docks, 509 trailer stalls, 590 auto spaces, ESFR sprinklers and LED lighting. Total investment for the distribution center is estimated to be $126 million. The site offers immediate access to Highway 99 and Interstate 5 and proximity to BNSF & Union Pacific Intermodal Facilities, Stockton Metro Airport and the Port of Stockton. The project team includes Millie and Severson as general contractor, HPA as architect and Keir + Wright as civil engineer. Mike Goldstein, Ryan McShane and Gregory O’Leary of Colliers will assist with leasing the project.

Search results for

"castle "

Joint Venture Completes Acquisition of Metrocenter Mall in Phoenix, Begins $850M Redevelopment

by Jeff Shaw

PHOENIX — Concord Wilshire Capital and TLG Investment Partners, in partnership with Carl DeSantis’ CDS International Holdings Inc., have completed the acquisition of the Metrocenter Mall in Phoenix. The development group has formed a strategic alliance with Hines, an international real estate firm, to redevelop and repurpose the Metrocenter Mall into a walkable village that will be home to apartments, condominiums, curated boutiques, popular retail stores, restaurants, bars, a town-center park and other commercial and entertainment venues. The property spans approximately 64.2 acres of land in a Qualified Opportunity Zone. The plans for the village include over 2,600 multifamily units, 150,000 square feet of commercial space and 4,100 surface and garage-deck parking spaces. The development team has also signed agreements with the City of Phoenix for a public-private partnership for public improvements. The purchase includes both the Dillard’s building and U-Haul building, which formerly housed a Macy’s. Developers confirmed the planned $850 million redevelopment of the property will begin immediately. The redeveloped Metrocenter will be designed as a transit-oriented community, encompassing the city’s new light rail station currently under construction on the site. The City of Phoenix invested approximately $150 million to build the station, which is scheduled for completion …

By Taylor Williams Success in today’s office sector is all about creating incentives. Some companies, from small professional services outfits to tech giants like Salesforce and Airbnb, have completely capitulated to remote work and have aggressively slashed their office footprints. Others remain dogged in their commitments to nonresidential (and nonretail) workspaces. What works for one company may not work for its competitors, and there remains a fundamental need for at least some traditional office space across all major markets. Against this backdrop, what separates the winners from the losers is the ability to create a draw, to give people legitimately good reasons to get up earlier, spend more time getting ready, endure traffic, put costly mileage on their cars, then deal with whatever quirky goings-on define their office experience. Needless to say, this can be a tough sell, especially for employees with families and suburban commutes. Which is why owners, both of businesses and of the office buildings that house them, are getting creative. These corporate leaders and landlords are working in tandem to ensure that the spaces meet the precise needs of their workforces, from design and layout within the suite to access to onsite amenities and surrounding retail, …

MIDDLETOWN, DEL. — Alcohol distributor Breakthru Beverage Group has opened a 282,500-square-foot distribution facility in Middletown, located in Delaware’s New Castle County. The facility features a clear height of 36 feet and a 29,350-square-foot, temperature-controlled room for cold storage, as well as 29,790 square feet of offices, training and break rooms. Lastly, the facility houses an experience center where clients can taste new products. MRP Industrial developed the project, with Ware Malcomb and Penntex Construction respectively serving as the architect and general contractor.

ILLINOIS AND INDIANA — Morgan Properties has acquired two multifamily portfolios totaling eight communities and 2,986 units in Illinois and Indiana for $410 million. With the addition of these new assets, Morgan Properties now owns and operates 2,035 units in Illinois, 3,692 units in Indiana and more than 95,000 units nationwide. The Illinois portfolio consists of The Lakes of Schaumburg in Schaumburg, Blackhawk Apartments in Elgin and The Gates of Deer Grove in Palatine. The Indiana portfolio consists of The Boardwalk at Westlake, Parkside at Castleton Square, Lakeside Crossing at Eagle Creek, The Elliott at College Park and The Preserve on Allisonville. Morgan Properties plans to invest more than $40 million in capital improvements across the two portfolios. The seller was undisclosed.

2021 was a banner year for the Memphis industrial market by virtually every measure. Leasing exceeded 32 million square feet, easily doubling the average of 12.8 million square feet per year; annual net absorption reached 12.7 million square feet, the highest ever recorded; 14.6 million square feet of inventory delivered to the market; rental rates reached historic highs; and investment volume topped $2.2 billion. The potent demand that carried the market to such record-setting extremes continued into the beginning of 2022, with leasing activity in the first quarter approaching 6 million square feet and net absorption surpassing 3.3 million square feet. Sustaining the steady upward trend the Memphis market has followed since the beginning of 2019, the direct vacancy rate rose 50 basis points from last year to 6.8 percent, but this increase is largely due to the profusion of spec product rather than any significant moves out of the market. In typical fashion, the bulk of leasing activity occurred in the Southeast, DeSoto County and Marshall/Fayette County submarkets, comprising more than 75 percent of the quarter’s total volume. But even the Northwest submarket has seen more action recently with the delivery of Amazon’s 181,500-square-foot last-mile facility in the Raleigh …

INDIANA — Cushman & Wakefield has brokered the sale of a six-property multifamily portfolio totaling 2,103 units in Indiana for an undisclosed price. The portfolio includes Boardwalk at Westlake, Elliot at College Park, Lakeshore Reserve off 86th, Lakeside Crossing at Eagle Creek, Parkside at Castleton Square and Preserve at Allisonville. George Tikijian, Hannah Ott and Cameron Benz of Cushman & Wakefield represented the seller, a joint venture between Wilkinson Corp. and Torchlight Investors. Morgan Properties was the buyer. The seller renovated a number of units, and the buyer plans to continue doing so.

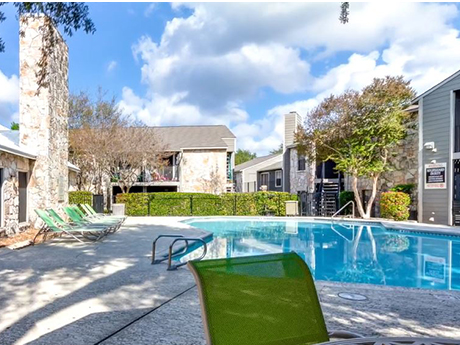

SAN ANTONIO — Walker & Dunlop has arranged a loan of an undisclosed amount for the refinancing of The Place at Castle Hills, a 680-unit apartment community located on the north side of San Antonio. Built in 1984, the garden-style property comprises 52 buildings that house one- and two-bedroom units with walk-in closets and private balconies/patios. Amenities include four pools, a fitness center, outdoor picnic areas and a Wi-Fi lounge. Alex Inman, Jon Hyduke, René Jaubert, Harrison Hoskins and Hannah Coen of Walker & Dunlop arranged the loan on behalf of the borrower, Arizona-based investment firm MC Cos.

NEWBURGH, N.Y. — Cushman & Wakefield has brokered the sale of Farrell Communities at Lakeside, a 102-unit active adult community in the Hudson Valley city of Newburgh. The community opened in 2020 and features 30 one-bedroom units and 72 two-bedroom units. Cushman & Wakefield’s Adam Spies, Brian Whitmer, Niko Nicolaou, Ryan Dowd and Peter Welch represented the seller, Farrell Communities, and procured the buyer, Castle Lanterra Properties, in the transaction. The sales price was not disclosed.

WEST PALM BEACH, FLA. — Tortoise Properties LLC has obtained an $88.5 million construction loan for a new multifamily development in downtown West Palm Beach. Acore Capital provided the loan to Tortoise, a privately held developer based in Palm Beach County. The unnamed property will comprise two eight-story towers located at 740 and 840 N. Dixie Highway that will be connected via a skybridge over Eucalyptus Street. The luxury apartment community will feature 264 studio, one- and two-bedroom residences, as well as 3,400 square feet of retail space and 371 parking spaces. The project team includes architect MSA Architects, general contractor Verdex Construction, landscape architect EDSA, project manager Hensel Phelps, civil engineer Keshavarz & Associates, structural engineer McNamara Salvia, general engineer WGI, property manager Castle Residential and entitlements and permitting overseer Managed Land Entitlements. No construction timeline was disclosed.