NEW YORK CITY AND SALT LAKE CITY — Global alternative asset manager and private equity firm Apollo (NYSE: APO) has entered into an agreement to acquire Bridge Investment Group Holdings Inc. (NYSE: BRDG) in an all-stock transaction valued at approximately $1.5 billion. The deal is expected to close in the third quarter. Based in Salt Lake City, Bridge operates nearly a dozen offices nationwide and has approximately $49 billion in assets under management. In addition to some 13.5 million square feet of industrial holdings, the company’s portfolio includes nearly 65,000 residential units across the market-rate, workforce/affordable housing, seniors housing and single-family rental verticals. Bridge was ranked No. 21 on the American Seniors Housing Association’s (ASHA) 2024 list of largest seniors housing owners. Under the terms of the agreement, Bridge stockholders will receive 0.07081 shares of Apollo common stock for each share of Bridge common stock at closing. Both parties value the per-share price at $11.50, which represents a premium of about 45 percent over the company’s closing stock price of $7.92 per share on Friday, Feb. 21. Upon closing, Bridge will operate as a standalone platform within Apollo’s asset management business. Bob Morse, the current executive chairman of Bridge, will …

Search results for

"stock"

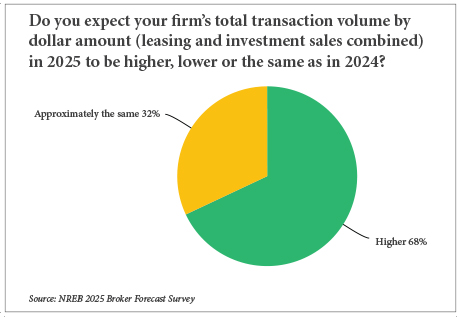

By Taylor Williams They may not be ready to do cartwheels and pop champagne, but when it comes to business expectations for 2025, commercial real estate professionals in the Northeast have a decidedly brighter outlook than in recent years. The last two years have been defined by barriers to economic growth on numerous levels. Pick your post-COVID geopolitical or macroeconomic poison — stubborn inflation, crushing interest rate hikes, multiple wars, restarting of global supply chains — all culminating with an incredibly heated U.S. presidential election. Is it any wonder that “survive till ’25” became the rallying cry of the commercial real estate industry? And while 2025 has arrived, the election has been decided and the Federal Reserve has strung together a series of small, yet meaningful cuts to short-term interest rates, the hangover from the aforementioned disruptors has not fully evaporated. Donald Trump’s return to the Oval Office brings a fresh slate of questions about how certain policies — namely tariffs and mass deportations — will impact business at both the national and local levels. And the expectation-smashing December jobs report proved sufficient to immediately pause the Fed’s would-be pattern of rate cuts. And it’s only been one month. As …

VICI Properties Provides $300M Financing for $5B One Beverly Hills Project in Metro Los Angeles

by Katie Sloan

BEVERLY HILLS, CALIF. — Cain International and Eldridge Industries have secured a $300 million investment from VICI Properties Inc. (NYSE: VICI) for the development of One Beverly Hills, a luxury mixed-use development located in the Los Angeles County community of Beverly Hills. Construction on One Beverly Hills, which was originally announced in 2021, is currently underway with recent local coverage valuing the development at $5 billion. Foster + Partners master-planned the 17.5-acre project, which will include hospitality, residential, retail and restaurant space. One Beverly Hills will be anchored by a luxury Aman-branded hotel and two Aman-branded residential towers designed by Kerry Hill Architects. The hotel will offer 78 all-suite guest rooms overlooking the Los Angeles Country Club. The three towers will offer access to private gardens and a 100,000-square-foot Aman Club, the brand’s private membership club offering wellness, dining and social spaces. The project will also include a full-scale refurbishment of The Beverly Hilton, an iconic hotel that hosts the Golden Globes awards show and Milken Institute conference annually. Renovations are being led by David Collins Studio and will integrate designs that play homage to the property’s legacy. One Beverly Hills will also include curated luxury retail and dining space to …

Tempur Sealy to Rebrand as Somnigroup International Following $5B Acquisition of Mattress Firm

by John Nelson

LEXINGTON, KY. AND HOUSTON — Tempur Sealy International Inc. has completed its previously announced $5 billion acquisition of Mattress Firm Group Inc., the largest mattress specialty retailer in the United States. The Lexington-based mattress manufacturer purchased the Houston-based retailer using approximately $2.7 billion in cash considerations and about $1.3 billion in stock. Tempur Sealy will change its name to Somnigroup International Inc., effective Feb. 18, and trade on the New York Stock Exchange under the ticker symbol “SGI.” Mattress Firm, Dreams and Tempur Sealy will operate as decentralized business units under Somnigroup International, with Mattress Firm and Dreams continuing to operate as multi-branded retailers and Tempur Sealy, primarily a manufacturer, continuing to serve third-party retailers as well as Mattress Firm, Dreams and its own direct-to-consumer channel. Additionally, Tempur Sealy expects to complete the previously announced sale 73 Mattress Firm retail locations and the company’s Sleep Outfitters subsidiary, which includes 103 specialty mattress retail locations and seven distribution centers, to MW SO Holdings Co. LLC (Mattress Warehouse) in the second quarter.

SAN FRANCISCO — CBRE has arranged $500 million for the refinancing of 1655 and 1725 Third Street in San Francisco’s Mission Bay area. Uber Technologies Inc. (NYSE: UBER) occupies the office property, which serves as the ridesharing company’s global headquarters. The asset comprises two 11-story, Class A office buildings totaling 586,208 square feet. The borrower is a joint venture between affiliates of Alexandria Real Estate Equities Inc., Uber and the Golden State Warriors, an NBA team that plays at the adjacent Chase Center. The joint venture refinanced the office development with a five-year, fixed-rate CMBS single-asset, single-borrower (SASB) loan. Brad Zampa and Mike Walker of CBRE secured the nonrecourse loan through Goldman Sachs and Barclays, both headquartered in New York. Both buildings are LEED Gold-certified and include a full-service, two-story café, barista-managed coffee bar, smoothie bar, event lounge and landscaped rooftop decks. Additionally, the properties are adjacent a to large fitness center, ground-floor restaurants and ample parking, and are part of Thrive City, a community gathering space. In the fourth quarter of 2024, the overall vacancy rate for San Francisco’s office market decreased by 40 basis points to 36.5 percent, according to CBRE. Net absorption turned positive for the first …

Simon Unveils Plans for Multimillion-Dollar Transformation of Smith Haven Mall on Long Island

by John Nelson

LAKE GROVE, N.Y. — Mall giant Simon Property Group (NYSE: SPG) has unveiled plans for a multimillion-dollar transformation of Smith Haven Mall in the Long Island village of Lake Grove. The redevelopment project will feature improvements to both the interior and exterior of the mall, with the addition of new retailers, restaurants, a new outdoor plaza and amenities throughout the property. The redevelopment process will begin this summer and is scheduled for completion in 2026. “At Simon, we are committed to making significant investments across our portfolio to ensure that our centers continue to deliver exceptional customer experiences for today’s shoppers,” says Mark Silvestri, president of development at Simon. Smith Haven Mall’s exterior will be repainted and will include new signage, updated entryways, landscaping and seating accommodations. The mall’s interior will receive new flooring and fixtures, as well as enhancements to Center Court and a transformation of the food court with newly installed seating. New tenants at the mall include fashion retailer Zara, which will open its first location in Eastern Long Island near Smith Haven’s Center Court next year. The square footage of the new Zara was not disclosed, but the space will be “massive,” according to Simon. Additionally, Golf …

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates Report: Final Quarter 2024 Net Absorption Trends in Industrial, Office Likely Temporary; Multifamily, Retail Net Absorption Trajectories Stickier

Lee & Associates’ 2024 Q4 North America Market Report looks back at the tenant demand, absorption rates and vacancy trends for industrial, office, retail and multifamily sectors nationwide to extrapolate what might be on the horizon for 2025 and beyond. While net absorption in industrial and retail is down from the same period in 2023, the reasons — too much supply in the pipeline versus too little — are opposite for each sector. Similar mirroring due to reverse factors can be seen in the net positive absorption last quarter in office and multifamily. Net industrial absorption was down 45 percent in the last quarter of 2024, compared to the same quarter in 2023. However, vacancy rates are likely to decline this year due to a lower volume of construction starts completing in 2025. New in-office policies among prominent companies contributed to the office market’s second consecutive quarter of positive absorption, but overall, office vacancy numbers are expected to continue rising until 2026. Low vacancy and factors challenging development meant very few options for retail tenants seeking new, high-quality space. Retail tenants in the food and beverage arena have been taking advantage of increased national spending on food outside the home …

HOUSTON — Locally based brokerage firm Oxford Partners has arranged the sale of a 41,450-square-foot industrial building in northwest Houston. According to LoopNet Inc., the building at 14199 Westfair Drive E was constructed on 2.7 acres in 2008 and features 28-foot clear heights. Perry Mazzone and Matt Rogers of Oxford Partners represented the buyer, Immobile Industrial LLC, in the transaction. Wyatt Huff, Hunter Stockard and Gray Gilbert of Partners Real Estate represented the undisclosed seller.

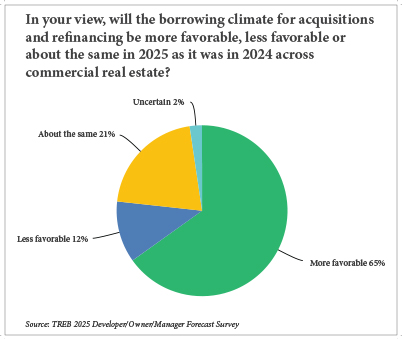

By Taylor Williams According to the results of Texas Real Estate Business’ annual reader forecast survey, to many commercial brokers and owners in Texas, the change of power in the White House is very much a good thing. In the survey, respondents across a wide range of commercial jobs, practices and asset classes shared expectations for 2025 across an even wider range of topics. But as is usually the case every fourth December, it was the results of the presidential election that generated the most insight and feedback from participants. Like the man himself, the commentary on Donald Trump was often polarizing, but it’s a welcome respite from years of focusing on inflation and interest rates. Across two separate surveys, 45 brokers and owners/developers answered, via free-response format, the same question of how Trump’s re-election would impact the industry in the short run. Though in their entirety, responses ran the gamut from effusive to disheartened and everything in between — with many respondents unsurprisingly opting to remain anonymous — the overall resulting feeling is clearly one of optimism. During his first term as president, Trump, a major commercial developer himself, routinely pressured the Federal Reserve to lower interest rates, which …

UNIVERSITY CITY, MO. — Subtext has begun development of LOCAL on Delmar, a 259-unit apartment complex in the St. Louis suburb of University City. Completion of the five-story project, located at 6650 Delmar Blvd., is slated for summer 2026. The 398,225-square-foot building will feature a mix of studio, one-, two- and three-bedroom layouts, including townhomes that walk out onto Delmar Boulevard. There will also be 399 parking spaces in a five-story garage and approximately 7,100 square feet of street-level retail space. Amenities will include a clubroom, vinyl listening station, work-from-home hub, wellness suite, gym, yoga studio, pool terrace and grilling area. Situated in the Loop, the project site is located within a 12-minute walk from Washington University. Project partners include Brinkmann Constructors, ESG Architecture & Design, Larson Capital Management, Stock and Associates Consulting Engineers Inc. and First Mid Bank & Trust.