PITTSBURGH — PNC Bank plans to invest approximately $1 billion to open more than 100 new branches and renovate 1,200 existing locations by 2028. Expansion plans call for new locations in key cities such as Austin, Dallas, Denver, Houston, Miami and San Antonio, among others, to establish a coast-to-coast network. According to PNC Bank, the goal of the renovations is to create a better customer experience when conducting transactions or meeting with bankers to discuss financial goals. PNC Bank is a member of The PNC Financial Services Group Inc. (NYSE: PNC), which is headquartered in Pittsburgh. PNC bank currently has approximately 2,300 brick-and-mortar locations across the country, in addition to 60,000 PNC and partner ATMs. According to Forbes Advisor, PNC Bank is the sixth largest bank in the country, with $553 billion in total assets. “As one of the largest retail banks in the United States, our vast branch network, alongside our other core banking channels, plays a key role in how we serve and provide solutions to our customers across the country,” says Alex Overstrom, head of PNC Retail Banking. PNC Bank’s announcement comes on the heels of last week’s news that JPMorgan Chase has made a multi-billion dollar investment in its own …

Search results for

"stock"

MESA, GILBERT AND QUEEN CREEK, ARIZ. — Banner Health has completed the disposition of an outpatient medical building portfolio in Arizona totaling 80,315 square feet. Stockdale Capital Partners acquired the portfolio for $32 million. Banner Health fully occupies the three assets in Mesa, Gilbert and Queen Creek. The properties were constructed in 2013 and 2014. Mindy Berman, Pat Williams, Matt DiCesare and Liam Sorensen of the JLL Medical Properties Group investment advisory sales team represented the seller. John Chun, Daniel Digerness and Liam Sorensen of the JLL Medical Properties Group debt advisory team secured $25 million in acquisition financing for the buyer.

TOLEDO, OHIO — Welltower Inc. (NYSE: WELL) has agreed to acquire 25 active adult properties from Affinity Living Communities for $969 million. The off-market transaction is part of a long-term strategic partnership between the two companies, with plans for future development activity together. The portfolio encompasses nearly 3,900 units predominately located in the Pacific Northwest. Welltower says the acquisition will enable the company to strategically scale the geographic reach of its active adult portfolio into markets with a five-year projected population growth in the 55-plus demographic that is more than 2.5 times higher than the U.S. average. Post-closing, Affinity will continue to manage the portfolio subject to a terminable management contract. Welltower plans to fund the acquisition using cash on hand and the assumption of $523 million of below-market-rate debt with an average interest rate of 3.8 percent and a nine-year weighted average maturity. The purchase price of approximately $249,000 per unit represents a significant discount to replacement cost, according to Welltower. The average property age is eight years. The transaction is expected to close in tranches over the next several months with timing dependent on property-level loan assumption approvals. The deal will expand Welltower’s in-place and under-development active adult …

WICHITA, KAN. — Equity Bancshares Inc. (NYSE: EQBK), the Wichita-based holding company of Equity Bank, has finalized its merger with Rockhold BanCorp, the parent company of the Bank of Kirksville in Kirksville, Mo. Bank of Kirksville’s locations opened as Equity Bank locations on Saturday, Feb. 10. The company will consolidate the core banking system and digital banking platform in May. Equity previously announced the merger with Rockhold on Wednesday, Dec. 6. Equity has approximately $5.3 billion in consolidated total assets and operates 74 locations in Kansas, Missouri, Arkansas and Oklahoma. There are now 24 Missouri locations. Equity’s stock price opened at $32.32 per share Monday, Feb. 12, up slightly from $30.87 per share one year ago.

Greystar Delivers $282M Student Housing Development at UC Law in Downtown San Francisco

by John Nelson

SAN FRANCISCO — Real estate development firm Greystar has delivered Academe at 198, a $282 million student housing property in downtown San Francisco. Located at 198 McAllister St. in the city’s Civic Center district, the mixed-use property is Phase I of the Academic Village expansion at UC Law San Francisco, formerly known as UC Hastings College of the Law. Academe at 198 spans 14 stories and features 656 units (667 beds) for students at UC Law SF, as well as faculty and staff. The property website also says students from nearby University of California San Francisco, San Francisco State University, University of San Francisco and University of the Pacific Dugoni School of Dentistry can apply for housing. The units come in a variety of layouts: efficiency (232 square feet); studio (275 square feet); one-bedroom (397 square feet); and two-bedroom (568 square feet). Monthly rental rates begin at $1,850 for an efficiency apartment, which is below market rates, according to the property website. In addition to housing, the 365,000-square-foot property includes 43,000 square feet of office and academic space that is leased and operated by UC Law, including an incubator space for start-up tech firms that doubles as event space called LexLab. …

ROSWELL, GA. — Red Door Revivals, a locally based development firm led by Will Coley, has broken ground on Roswell Junction, a new food hall in Roswell’s historic district. The site of the 12,000-square-foot venue formerly housed Atlanta Street Baptist Church, which moved to a church in nearby Woodstock, Ga. Red Door is retrofitting the church building for the venue and is working on integrating parking and other infrastructural elements into Roswell Junction. Roswell Mayor Kurt Wilson and other city officials participated in the groundbreaking ceremony. Slated for completion this summer, the venue will house eight different food concepts and three bars, including an indoor/outdoor bar. The food hall will feature a bandstand, covered patio, arcade, big screen media, outdoor games, children’s play space and a fenced dog area. Pat Garza of National Food Hall Solutions will operate Roswell Junction upon completion.

ATLANTA — Intuit (NASDAQ: INTU), a global financial technology platform, has opened its 360,000-square-foot office in Atlanta’s Old Fourth Ward neighborhood. The 10-story space will serve as a hub for the company as the only Intuit office in the Southeast, as well as the corporate headquarters for Mailchimp, a locally based email marketing platform that Intuit acquired in 2021 for $5.7 billion. Atlanta-based New City Properties delivered Intuit’s new space as part of the developer’s Fourth Ward development. The office sits along the Eastside Trail of the Atlanta BeltLine, a 22-mile rail loop that connects 45 distinct neighborhoods around the city. Mailchimp was formerly headquartered in Ponce City Market, Jamestown’s massive mixed-use redevelopment that also sits on the Eastside Trail in Old Fourth Ward, two blocks away from the new office building. The new space at Fourth Ward will accommodate nearly 1,000 current Intuit employees and provide space for future growth. The office is already one of Intuit’s top five largest campuses globally. “It’s no secret that Atlanta is a bustling tech ecosystem that Mailchimp has been central to for over 20 years,” says Rania Succar, senior vice president and general manager of Intuit Mailchimp. “Our beautiful new workspace is …

NEW YORK CITY — JPMorgan Chase & Co. (NYSE: JPM) announced plans today to expand its brick-and-mortar footprint by adding 500 Chase bank branches over the next three years. The New York City-based institution also plans to renovate 1,700 existing bank locations across the United States. New branches will expand JPMorgan Chase’s footprint in existing markets like Boston; Washington, D.C.; Charlotte, N.C.; Philadelphia; and Minneapolis. The company will also enter several new markets, including low- to moderate-income rural communities that previously had little access to traditional banking service. The multi-billion-dollar expansion effort will also contribute to local economic growth through the addition of 3,500 new employees, including construction jobs and local hiring upon completion, according to the company. JPMorgan first announced expansion efforts in 2018 with a $20 billion economic growth effort that included the addition of 400 new Chase branches over the subsequent five years. Since that time, the company has added more than 650 new branches, including 400 locations in 25 new states. Brick-and-mortar expansion efforts by JPMorgan have marked a stark shift in strategy, as a number of rival banks have been closing branches over the past few years and shifting more toward digital banking efforts. This year, Chase …

BENTONVILLE, ARK. — Walmart (NYSE: WMT) has announced plans to expand by more than 150 new stores over the next five years, both through new construction and converting existing buildings. The first two stores under this initiative — both under the company’s smaller-format Walmart Neighborhood Market banner — are scheduled to open this spring in Santa Rosa, Fla., and Atlanta. The company is currently finalizing plans for 12 new projects, one of which will be the conversion of a smaller existing location into a large-format Walmart Supercenter, which serves as both a grocery store and a full department store. Walmart simultaneously released plans to remodel 650 of its existing stores across 47 states and Puerto Rico over the next 12 months. The new and renovated locations will all feature the Bentonville-based company’s “Store of the Future” model, which includes improved layouts, expanded product selections and the integration of new technology. The “Store of the Future” features expanded pharmacies and updated vision centers, with pharmacies moved toward the front of the store; activated corners with product displays that allow customers to interact with items and visualize them in their lives; digital touch points throughout the store to provide information on products …

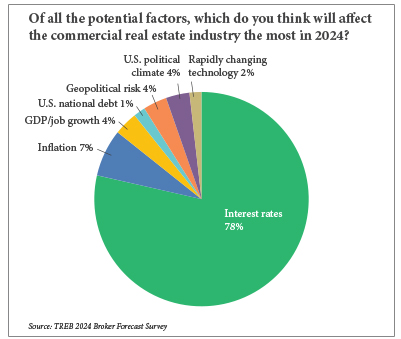

By Taylor Williams For the last several years, as COVID-19, inflation and interest rate hikes have chronologically rocked the commercial real estate industry, the term “dry powder” has increasingly factored into investment discussions. While the term generally refers to cash or capital that is parked on the sidelines, 2024 could well be the year for its deployment. There are several basic reasons for endorsing this notion. First, at its December meeting, the Federal Reserve signaled that it would cut rates three times this year, which should theoretically make debt financing more accessible and less expensive — though the extent of that depends on the magnitude of the reductions. Second, as evidenced by the stock market tear following that announcement, investors are itching to deploy capital and will rally around just about any reason to do so, proven or not. Third, there is roughly $537 billion in commercial real estate loans that will mature next year, according to New York City-based Trepp. This staggering volume of impending maturities in a high-interest-rate environment all but assures that some assets will be forced into sales, whether by owners pre-default or lenders post-default. And finally, the 10-year Treasury yield — the benchmark rate against …