WOODSTOCK, GA. — Dwight Capital has provided a $66.3 million loan for the refinancing of Woodstock West, a 407-unit apartment community in the Atlanta suburb of Woodstock. Brandon Baksh and Karnveer Bal of Dwight Capital originated the HUD 223(f) loan for the borrower, Walton Communities. The loan includes a Green Mortgage Insurance Premium (MIP) Reduction set at 25 basis points because the property is in the process of achieving an NGBS Bronze certification. Woodstock West, which was developed in two phases in 2013 and 2017, comprises nine apartment buildings, two townhome buildings and one amenity building with a pool, cabana, grills and a fireplace. The property also features a 1,148-square-foot commercial space occupied by photography studio White Wall Studio.

Search results for

"stock"

STOCKTON, CALIF. — First Industrial Realty Trust has released plans for First Stockton Logistics Center, a cross-dock distribution center at 6201 Newcastle Road in Stockton. Completion is slated for early 2024. The 1 million-square-foot facility will feature 42-foot clear heights, 204 loading docks, 509 trailer stalls, 590 auto spaces, ESFR sprinklers and LED lighting. Total investment for the distribution center is estimated to be $126 million. The site offers immediate access to Highway 99 and Interstate 5 and proximity to BNSF & Union Pacific intermodal facilities, Stockton Metro Airport and the Port of Stockton. The project team includes Millie and Severson as general contractor, HPA as architect and Keir + Wright as civil engineer. Mike Goldstein, Ryan McShane and Gregory O’Leary of Colliers will assist with leasing the project.

STOCKTON, CALIF. — First Industrial Realty Trust has released plans for First Stockton Logistics Center, a cross-dock distribution center at 6201 Newcastle Road in Stockton. Completion for the project is slated for early 2024. The 1 million-square-foot facility will feature 42-foot clear heights, 204 loading docks, 509 trailer stalls, 590 auto spaces, ESFR sprinklers and LED lighting. Total investment for the distribution center is estimated to be $126 million. The site offers immediate access to Highway 99 and Interstate 5 and proximity to BNSF & Union Pacific Intermodal Facilities, Stockton Metro Airport and the Port of Stockton. The project team includes Millie and Severson as general contractor, HPA as architect and Keir + Wright as civil engineer. Mike Goldstein, Ryan McShane and Gregory O’Leary of Colliers will assist with leasing the project.

FORT LAUDERDALE, FLA. — Tavistock Development Co. has topped off a new hotel and resort residential tower as part of the redevelopment of Pier Sixty-Six, a mixed-use waterfront destination in Fort Lauderdale. The reimagined Pier Sixty-Six Resort and The Residences at Pier Sixty-Six are set to debut next year. Situated on 32 acres along the Intracoastal Waterway, the overall development will ultimately include the resort and 62 luxury condominiums, as well as the property’s 164-slip marina, restaurants, shops and offices. The project team includes general contractors Americaribe and Moriarty, which are employing 1,000 construction workers for the redevelopment project.

LOS ANGELES — Stockdale Capital Partners has received approval from the Los Angeles City Council for the development of a 12-story Class A medical office building at 656 S. San Vicente Blvd. in Los Angeles’ Westside neighborhood. With construction slated to begin as early as late 2023, the 145,000-square-foot project will offer surgery, invasive outpatient services, laboratory space and patient-centered medical space. The property will also feature living gardens on the ground floor and upper floors, low-water usage and drip irrigation, increased plantings and greenspace, potential for building-integrated solar, use of recycled materials, high-efficiency heating and cooling systems, and energy-efficient design and green spaces throughout. Additional amenities will include electric vehicle charging stations, ample bicycle parking and 418 parking spaces with valet services.

WRENTHAM, MASS. — A partnership between Dallas-based Lincoln Property Co. and San Francisco-based private equity firm Stockbridge has begun construction on a 176,800-square-foot speculative industrial project in Wrentham, about 40 miles southwest of Boston. The site spans 34.5 acres and is located one mile from I-495. Building features will include a clear height of 32 feet, 35 dock doors, 130-foot truck court depths, 113 car parking spaces and 33 trailer parking stalls. ARCO National Construction Co. is the general contractor for the project, completion of which is slated for late 2023.

Comstock Signs Puttshack to Lease at Reston Station Mixed-Use Project in Northern Virginia

by John Nelson

RESTON, VA. — Comstock Holding Cos. Inc. has signed mini-golf retail concept Puttshack to anchor Phase II of Reston Station, an 80-acre mixed-use project underway in Northern Virginia. Located near the Wiehle-Reston East Metro Station at 1850 Reston Row Plaza in Reston, Puttshack will be the project’s first active entertainment venue when it opens in summer 2025. The more than 29,000-square-foot space will feature four nine-hole mini-golf courses equipped with Puttshack’s proprietary Trackaball technology that keeps track of patrons scores as they play. The venue will also have a full dining menu and hand-crafted cocktails, as well as multiple bars and private event spaces for parties and business outings. Chicago-based Puttshack recently completed a growth capital round of $150 million from funds managed by BlackRock and continued support from Promethean Investments to help fuel the operator’s expansion plans.

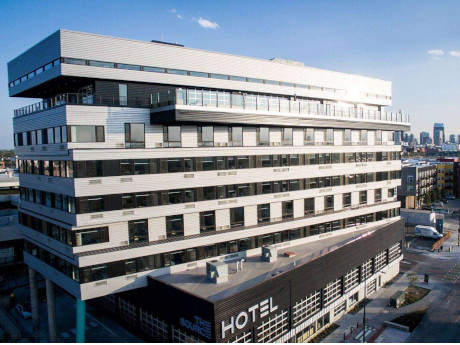

DENVER — Stockdale Capital Partners has acquired The Source, a hotel located in Denver’s River North Arts District, for $61.9 million. The transaction also included a 300-stall parking garage and 17,000-square-foot surface parking lot. The Source features 100 guest rooms, a full-service rooftop restaurant, 5,575 square feet of event space, a fitness center, rooftop pool and business center. Additionally, the hotel offers 44,000 square feet of onsite restaurant and retail space in its Market Hall I & II locations. Stockdale Capital plans to refresh guest rooms, re-imagine the rooftop restaurant, “activate the hotel lobby experience” and create additional revenue drivers for the hotel’s retail space. The name of the seller was not released.

STOCKBRIDGE, GA. — GREA has negotiated the sale of Avenue 33 Apartments, a 284-unit multifamily community located at 3386 Mount Zion Road in Stockbridge, a south Atlanta suburb. REM Acquisitions purchased the property from Peak Capital Partners for $58.2 million. Chandler Brown, Taylor Brown, Cory Caroline Sams and Walter Miller of GREA represented the seller in the transaction. Built in 1999, Avenue 33 features one-, two- and three-bedroom floor plans, as well as a clubhouse, resort-style swimming pool, fitness center, business center, dog park and outdoor grilling stations. The new ownership plans to enhance previously completed upgrades at the property.

Intercontinental Real Estate, Kennedy Wilson Purchase 877,648 SF Manufacturing Facility in Stockton, California

by Amy Works

STOCKTON, CALIF. — A joint venture between Intercontinental Real Estate Corp. and Kennedy Wilson has purchased Stockton Industrial Park, a manufacturing and distribution facility in Stockton. A New York-based owner and operator of logistics real estate sold the asset for $84 million. Located at 1604 Tillie Lewis Drive, the three-building park features 877,638 square feet of highly functional and easily divisible space. The facilities feature 24- to 28-foot clear heights, ample dock-high and grade-level loading, and a wide range of unit sizes for warehouse and/or manufacturing purpose. The largest of the buildings, totaling 570,000 square feet, offers direct rail service. At the time of sale, the property was 100 percent leased. Barbara Perrier, Darla Longo and Rebecca Perlmutter of CBRE, along with Blake Rasmussen and Tyler Vallenari of Cushman & Wakefield, marketed the property for sale on behalf of the seller. CBRE represented the seller in the transaction.