CHICAGO — Salesforce Tower Chicago, a 60-story office building featuring software provider Salesforce Inc. as the anchor tenant, has opened in the Windy City. The 1.2 million-square-foot tower is situated along the Chicago River and is part of Wolf Point, a three-phase development designed by Pelli Clarke Pelli. Hines developed Wolf Point in partnership with the longtime landowner, the Joseph P. Kennedy Family. As a result of the rise of remote work during the pandemic, Salesforce has reduced its footprint in the building from 500,000 square feet to 360,000 square feet, according to Crain’s Chicago Business. The remaining 140,000 square feet of space is empty and available for sublease. Salesforce consolidated its local employees into the building from four offices downtown and one in suburban Naperville, according to Crain’s. The company’s lease runs through May 2040. Salesforce Tower Chicago features focus spaces like libraries and focus pods, as well as areas for team collaboration and connection such as event spaces and communal kitchens. Throughout the workspaces are a mix of mindfulness rooms, pods of height-adjustable desks, and meeting and training rooms. Salesforce doubled the size of the social lounges on its employee floors and added more conference rooms equipped with …

Search results for

"stock"

SAN FRANCISCO — Berkadia has secured a $67.2 million loan for California-based NP Apartments LLC to refinance debt on Northpoint Apartments in San Francisco. Andy Ahlers of Berkardia San Francisco secured the permanent five-year loan through Fannie Mae. Located at 2211 Stockton St., Northpoint Apartments features 514 studio, one- and two-bedroom floor plans with private patios or balconies and dishwashers. Community amenities include two swimming pools, a fitness center and laundry facilities.

BIRMINGHAM, ALA. — Dobbins Group will develop two apartment communities in Birmingham. The first community, Colina West Homewood, will comprise 310 units in one-, two- and three-bedroom floorplans at 80 West Oxmoor Road. Amenities at the property will include package lockers, grilling stations and outdoor kitchens, hiking trails, a fitness center, swimming pool, coworking space, car wash, lawn game area, central green space, dog spa and park, clubhouse with resident lounge and attached and detached garages. The property will also feature a Grab & Go Market. The second property, Colina Hillside, will total 475 apartments in one-, two- and three-bedroom layouts across four- and five-story buildings. Amenities at the property, which will be located at 1121 Colina St., will include two heated saltwater pools, private pool cabanas and an outdoor kitchen entertainment area, 24-hour fitness center, a pet spa and pet parks, greenspace, firepits, grilling stations, electric car charging stations, valet trash service, a 24-hour resident market and lounge and coworking spaces. Protective Life provided financing. LBYD will serve as civil engineer for both developments, with Lorberbaum McNair providing landscape architecture and Catori Design House overseeing interior design. Forestry Environmental is the sitework contractor, and Capstone Building Corp. will provide …

Cushman & Wakefield: Manhattan’s Fifth Avenue Remains Most Expensive Street in the World for Retailers

by John Nelson

NEW YORK CITY — Fifth Avenue in Manhattan has retained its No. 1 ranking as the world’s most expensive retail destination at approximately $2,000 per square foot, which is unchanged from last year. That’s according to the 33rd edition of the Cushman & Wakefield (NYSE: CWK) Main Streets Across the World, an annual report that examines retail rental rates around the world in “high street” locations, referring to bustling, high-end retail districts. Fifth Avenue is world-renowned for its luxury offerings, including Bergdorf Goodman, Prada, Saks and Tiffany, among others. Additions to Fifth Avenue’s retail store count this year include a new store for Harry Winston and newcomers to the corridor Asics, Dyson, Skechers, Johnston & Murphy and Bandier, according to online directory Visit 5th Avenue. While on par with the rents charged last year, Fifth Avenue’s average retail rate is up 14 percent from pre-pandemic levels, making it only one of three high streets in the top 10 that have increased rates since that time span. The No. 2 retail destination in Main Streets Across the World is Milan’s Via Montenapoleone at $1,766 per square foot. The district jumped a spot into second from last year’s report by pushing rental …

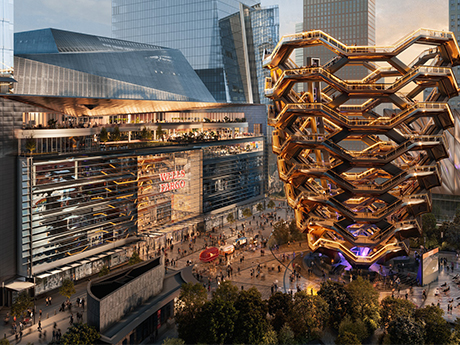

Wells Fargo Plans 400,000 SF Adaptive Reuse Office Project at Hudson Yards in Manhattan

by John Nelson

NEW YORK CITY — Wells Fargo & Co. (NYSE: WFC) has announced formal plans to expand its office footprint within Hudson Yards, a mixed-use district on Manhattan’s west side. The San Francisco-based banking giant, which already occupies space within the $25 billion Hudson Yards campus, has purchased additional space from Related Cos., the master developer behind Hudson Yards along with Oxford Properties Group. Multiple media outlets have reported that Wells Fargo purchased the space at 20 Hudson Yards, which formally housed a Neiman Marcus store, for $550 million. The bank plans to convert the 400,000 square feet of space to offices in synergy with its current 500,000-square-foot footprint at 30 Hudson Yards, according to Bloomberg News. Forbes reported that the Neiman Marcus location closed in summer 2020. Wells Fargo plans to begin moving employees from its existing office space at 150 E. 42nd St. to the new Hudson Yards office beginning in late 2026. The property is expected to house 2,300 Wells Fargo employees at full operation. The 11-story building will also include a dedicated entrance on 10th Avenue and naming rights to Wells Fargo for signage on the exterior of the property. “This investment further solidifies our longstanding commitment …

INDIANAPOLIS — RH (NYSE: RH), a home furnishings retailer formerly operating as Restoration Hardware, has opened RH Indianapolis, The Gallery at DeHaan Estate. Located at 4501 N. Michigan Road, the 151-acre property houses a 60-room, Palladian-style villa that RH has repurposed as a unique showroom and dining destination. RH Indianapolis carries home furnishing collections from the company’s Interiors, Contemporaries, Modern and Outdoor catalogues. The estate’s east and west wings include showrooms from the various RH collections, including bedroom suites on the upper level. The RH Interior Design Studio occupies the east wing’s former billiards room. Clients are able to receive professional design services via the interior design studio space, which features a private presentation room and libraries that carry RH’s various textile, furniture and lighting finishes. RH has advanced into the food-and-beverage industry in recent years, and RH Indianapolis is the latest showcase with The Dining Room restaurant and the Wine Bar and Terrace experiences. The two dining venues open onto the estate’s 35-acre private lake. The Dining Room occupies the villa’s former ballroom space, and the Wine Bar operates from the mansion’s west wing. The Terrace experience is located off the main house and includes RH Outdoor lounge spaces. …

CAMBRIDGE, MASS. — Norges Bank Investment Management has signed an agreement to acquire a 45 percent interest in two life sciences properties in Cambridge’s Kendall Square neighborhood, just across the Charles River from Boston. BXP (NYSE: BXP) was the seller. The transaction includes 290 Binney Street, a 16-story, 570,000-square-foot property currently under construction. It is fully preleased to AstraZeneca, which expects to take occupancy in April 2026. The other property is 300 Binney Street, a six-story facility undergoing redevelopment. The Broad Institute has preleased the 240,000-square-foot building and plans to take occupancy in January 2025. Norges acquired the interest for an initial payment of $212.9 million and has committed to a total project cost of $746.4 million. Upon completion, the total value of the two buildings is projected to be $1.6 billion. The assets are unencumbered by debt, and no financing was involved in the transaction. BXP will retain the remaining 55 percent interest in the assets and will manage the properties on behalf of the partnership. Cambridge is among the largest hub of life sciences properties in the United States. The home of both Harvard University and Massachusetts Institute of Technology (MIT), the city hosts a slew of major …

Greenrock Capital, Petros PACE Arrange $62.6M C-PACE Financing for Appellation Healdsburg Hotel in Sonoma County

by Amy Works

HEALDSBURG, CALIF. — Greenrock Capital and Petros PACE Finance have arranged $62.6 million in Commercial Property Assessed Clean Energy (C-PACE) financing for the construction of the Appellation Healdsburg in Sonoma County. CCS Healdsburg Hotel LLC — a partnership between Comstock Development Co., Wine Country Holdings (an affiliate of Appellation) and HVH Investment — will develop the property for the new culinary-forward luxury hotel brand and operator, Appellation. Slated to open in 2025, the 108-room hotel will offer a 160-seat Charlie Palmer signature restaurant and bar, a rooftop bar, fitness club, spa, two pools and 15,000 square feet of meeting and event space. The project is being developed as part of the broader North Village mixed-use master plan, which is located two miles north of downtown Healdsburg.

NEW YORK CITY — Coworking and office-sharing pioneer WeWork Inc. (NYSE: WE) has filed for Chapter 11 bankruptcy protection. WeWork also plans to file similar protectionary measures in Canada. WeWork has entered into a restructuring support agreement with its creditors representing approximately 92 percent of its secured notes to “drastically reduce” the company’s existing funded debt and expedite the restructuring process. Reuters reports the debt-for-equity swap deal with its creditors totals $3 billion. The New York City-based company plans to continue operations and “further rationalize its commercial office lease portfolio” with its network of office landlords. WeWork’s locations and franchisees outside of the United States and Canada are not part of this process. According to the company website, WeWork operates more than 320 locations globally across various workplace solutions platforms. As part of the filing, WeWork is requesting the ability to reject the leases of certain locations that are “non-operational,” all of which have affected members that have received advanced notice. The company has retained Hilco Real Estate, an Illinois-based real estate restructuring and advisory firm, to assist with lease renegotiations. “WeWork has a strong foundation, a dynamic business and a bright future,” says David Tolley, CEO of WeWork. “Now …

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesMidwestMultifamilyNortheastOfficeRetail

Lee & Associates: Slowing Absorption, Rent Growth Put Brakes on New Development for Most Real Estate Types, Though Retail Sector Shines

Slower absorption and rent growth plagued industrial, office and multifamily asset classes across the United States in the third quarter, as outlined in Lee & Associates’ 2023 Q3 North America Market Report. Some regional exceptions were able to buck the overdevelopment trend, but retail was the only property type to avoid the quarter’s shift toward rising vacancy rates. High interest rates, slower rent growth and fear of overbuilding have contributed to lower construction starts in every sector. The full Lee & Associates report is available — including breakdowns of factors like detailed vacancy rates, inventory square footage, cap rates outlined city by city, market rents and more — here. The analysis below provides an overview of industrial, office, retail and multifamily real estate sectors alongside sector trends, economic background as well as geographic exceptions within each property type. Industrial Overview: Absorption Continues Slowing, Inventories to Spike Demand for industrial space remained positive in the United States in the third quarter, but growth this year has lost steam compared to strong net absorption totals of the last two years. U.S. net growth in the third quarter totaled 29.9 million square feet compared to 94 million square feet for the same period last year. …