CHICAGO — Greystone Monticello, a bridge lending platform serving as a one-stop-shop provider of capital finance products and services for the multifamily and seniors housing sectors, has provided bridge financing for the $150 million acquisition of a portfolio of eight supportive living facilities in Illinois. The portfolio was financed with a two-year bridge loan and is intended to transition to long-term, fixed-rate financing with Greystone. Comprising 921 beds, the facilities are located in Elk Grove Village, Melrose Park, Country Club Hills, Bartlett, Vernon Hills and Chicago. The supportive living program in Illinois is an alternative to nursing home care for low-income persons requiring mid-range care needs. Eric Rosenstock of Greystone worked with both the buyer and seller and originated the bridge financing.

Search results for

"stock"

LINDEN, N.J. — SRS Real Estate Partners has brokered the sale of a ground lease for a 185,682-square-foot retail building in the Northern New Jersey community of Linden that is occupied by Walmart. The building was constructed on 14 acres in 2019, and there are 17 years remaining on the corporate-guaranteed lease. Matthew Mousavi, Patrick Luther, Britt Raymond and Kyle Fant of SRS represented the sellers, Dallas-based developer Cypress Equities and San Francisco-based investment firm Stockbridge Capital Group, in the deal. David Chasin of Pegasus Investments Real Estate Advisory represented the buyer.

Joint Venture Sells 442,780 SF Tropical Logistics Phase II Industrial Facility in North Las Vegas

by Jeff Shaw

NORTH LAS VEGAS, NEV. — A joint venture between Ares Management Corp. and CapRock Partners has sold Tropical Logistics Phase II, an industrial warehouse complex in North Las Vegas. The 442,780-square-foot, Class A facility includes three single-tenant buildings. The buyer was institutional investor Stockbridge Capital Group. At the time of the sale, the property was fully leased to three tenants. Tropical Logistics Phase II is the joint venture’s third completed development. The firms have partnered in the development of Tropical Logistics Phase I, a 1.1-million-square-foot, Class A logistics facility that was completed and sold in the second quarter of 2022, and Spanish Ridge Industrial Park, a recently completed, partially leased, 230,899-square-foot industrial complex in Southwest Las Vegas. Cushman & Wakefield represented the seller, with local representation by JLL. The price was not disclosed.

There’s no denying the office sector is undergoing a critical period marked by myriad challenges. The question is, how will it all turn out? Currently, the inventory of U.S. office space is 5.56 billion square feet — and will likely reach over 5.68 billion square feet by the end of the decade. But today’s “flexible” workforce will only require 4.61 billion square feet to accommodate its needs, according to a Cushman & Wakefield report titled “Obsolescence Equals Opportunity.” “The U.S. will end the decade with 1.1 billion square feet of vacant office space, 740 million square feet of which qualifies as normal or natural vacancy and 330 million square feet of which qualifies as excess vacancy attributable to remote and hybrid strategies,” the report states. “The overall level of vacancy will therefore be 55 percent higher than was observed prior to the pandemic.” Those numbers are jarring, but opportunists say the office sector just needs to evolve and adapt, much like the retail market has done. “Just as retail didn’t die in the years following the e-commerce boom, the office sector is not in danger of demise,” states the Cushman & Wakefield report. “Recognizing the challenges and opportunities head-on with …

BOSTON — Alexandria Real Estate Equities Inc. (NYSE: ARE) has sold 268,000 rentable square feet within 421 Park Drive, a 660,034-square-foot life sciences development to be built in Boston. An affiliate of Boston Children’s Hospital was the buyer. Upon completion, 421 Park Drive will be part of the larger Alexandria Center for Life Science-Fenway mega campus, which will total more than 2 million square feet at full build-out. The campus, developed in partnership with Samuels & Associates, boasts numerous amenities, proximity to both Cambridge and the Longwood Medical Area, and convenient transportation access. Alexandria will develop and operate 421 Park Drive, which will feature open space, direct connections to the Massachusetts Bay Transportation Authority (MBTA) Fenway station, bicycle and pedestrian paths, and retail space on the ground floor. The price of the portion sold to Boston Children’s Hospital is approximately $155 million, along with development fees to be earned by Alexandria over the next three years. Boston Children’s Hospital will continue to fund its pro rata share of the costs to develop 421 Park Drive. Vertical construction is scheduled to begin later this year and to be substantially completed in 2026. The transaction with Boston Children’s Hospital results in 48.5 …

SEATTLE — Amazon Web Services (AWS), a division of Amazon (NASDAQ: AMZN) that offers on-demand cloud computing platforms to individuals, companies and governments, plans to make a big investment in Central Ohio. The company, along with Ohio Gov. Mike DeWine and Lt. Gov. Jon Husted, announced the firm will invest approximately $7.8 billion to expand its data center operations in the region by the end of 2029. AWS is currently undertaking a site selection process across numerous localities in Central Ohio for the new data center campuses, the total number of facilities of which was not disclosed. Final site selections will be decided and announced at a later date. The move is expected to create 230 new jobs and an estimated 1,000 support jobs, according to J.P. Nauseef, president and CEO of JobsOhio, an economic development corporation based in Columbus. The AWS data center project represents the second-largest single private sector company investment in Ohio’s history, according to the governor’s office. The new data centers will contain computer servers, data storage drives, networking equipment and other forms of technology infrastructure used to power cloud computing. “Amazon is already one of the largest private-sector employers in Ohio, and the company’s continued growth …

OLIVE TOWNSHIP, IND. — A joint venture between General Motors Co. (NYSE: GM) and Samsung SDI, part of the South Korean-based Samsung Electronics group, plans to build a $3 billion electric vehicle (EV) battery plant in Olive Township. The duo plan to begin operations at the Northwest Indiana plant in 2026. The new facility will house production lines to build prismatic and cylindrical battery cells and is expected to help significantly increase the accessibility and affordability of GM’s line of EVs. Once complete, the plant will support about 1,700 full-time jobs, in addition to 1,000 construction jobs during the build-out. “We are grateful that Samsung SDI can contribute to boosting the economy of Indiana and creating new jobs here,” says Yoonho Choi, president and CEO of Samsung SDI. “Securing Indiana as a strong foothold together with GM, Samsung SDI will supply products featuring the highest level of safety and quality in a bid to help the U.S. move forward to an era of EVs.” GM and Samsung SDI announced their joint venture in April and ultimately selected Olive Township, a city in St. Joseph County near the Indiana-Michigan border and 15 miles west of South Bend, home of Notre Dame …

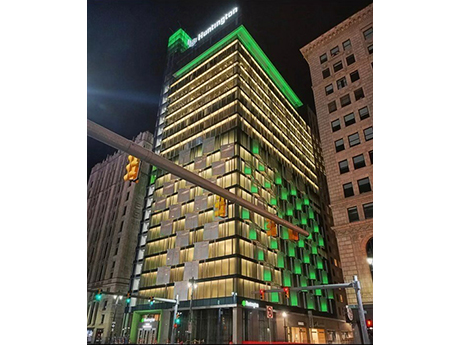

DETROIT — The Herrick Co. has acquired a 21-story office tower at 2025 Woodward Ave. in downtown Detroit for $150 million. Locally based architecture firm Neumann Smith designed the 421,481-square-foot building, which was delivered in fall 2022 and acts as a headquarters for Huntington National Bank’s (NASDAQ: HBAN) commercial division. The bank fully occupies the property on a triple-net-lease basis. The building features ground-floor retail space, including a Huntington Bank branch; 10 floors of structured parking; a cafe; and a rooftop terrace with space for movies or sporting events to be projected on the side of the tower. The deal is the largest building acquisition to close in Detroit since the start of the COVID-19 pandemic, according to Crain’s Detroit Business. The seller was not disclosed. Huntington acquired TCF Financial Corp. in 2020 for $22 billion. The combined company operates more than 1,000 branches in 11 states. The bank’s stock price closed at $11.42 per share on Wed. June 7, down from $13.10 one year ago. The Herrick Co. is a national real estate investment firm that has completed more than $6 billion in transactions. The company focuses on acquiring single-tenant buildings net leased to office, industrial and retail users, …

Ryman Hospitality to Acquire JW Marriott San Antonio Hill Country Resort from Blackstone REIT for $800M

by John Nelson

SAN ANTONIO — Ryman Hospitality Properties Inc. (NYSE: RHP) has entered into a definitive agreement with Blackstone Real Estate Income Trust Inc. (BREIT) to purchase the JW Marriott San Antonio Hill Country Resort for $800 million. The 640-acre resort opened in 2010 and includes 1,002 rooms and 268,000 square feet of indoor and outdoor meeting and event spaces. BREIT has owned the property since 2018. Ryman plans for the resort to continue to operate under the JW Marriott flag. The Nashville-based lodging and hospitality REIT now owns two of the largest group-oriented resorts in Texas, with the Gaylord Texan Resort & Convention Center in the Dallas suburb of Grapevine being the other. “We identified the JW Marriott Hill Country as an ideal acquisition target quite some time ago,” says Mark Fioravanti, president and CEO of Ryman Hospitality. “Located in an attractive and growing market with no emerging competitive supply, this beautiful resort is a natural complement to our existing Gaylord Hotels portfolio and offers significant opportunities to serve the group and leisure sides of our business.” “This sale, which generates approximately $275 million in profit over a five-year hold period through Covid, represents a terrific outcome for BREIT shareholders,” says Nadeem Meghji, head of Blackstone Real Estate …

— By Tony Solomon, Senior Vice President, District Manager, Marcus & Millichap — Industrial continues to be one of the most sought-after asset classes across the Los Angeles County commercial real estate market. This year, the metro will maintain its position as one of the tightest industrial markets in the nation. It also ranks fifth in rent growth among major markets west of the Mississippi. For the 17th time in the past 18 years, the Los Angeles metro’s industrial stock will increase by less than 1 percent, as 4.3 million square feet is slated for delivery. Supply additions will be concentrated in the South Bay and San Gabriel Valley, leaving less than 1 million square feet to come online in the rest of the county. While vacancy was below 2 percent in four of the metro’s biggest submarkets to start 2023, speculative completions and industrial users re-evaluating their space requirements will push vacancy to 3 percent by year end. This is a rate 80 basis points under the long-term mean. Rents are projected to grow by 7.6 percent as a result, bringing the average asking rate to $21 per square foot. Part of this rise in vacancy can also be …