BALTIMORE — Dallas-based Topgolf plans to open its first Baltimore venue and third location in Maryland this Friday, bringing its global count to 81. Located at the intersection of Stockholm and Warner streets in the newly branded Walk at Warner Street entertainment district, the three-level venue sits adjacent to Horseshoe Casino Baltimore and M&T Bank Stadium, home of the Baltimore Ravens. Local media outlets report that construction is underway for a concert venue at the district called The Paramount Theater. The new Topgolf will employ around 500 staffers and include 90 outdoor hitting bays, food, beverages, private event rooms, rooftop terrace with a skylit atrium and a large video wall.

Search results for

"stock"

By Cody Roskelley, senior developer at Pennrose Texas has experienced tremendous residential growth over the last few years. Families are leaving high-cost, high-tax areas like New York and California for more affordable alternatives. According to The Tax Foundation, Texas was one of the Top 10 U.S. states for inbound migration in 2021, posting population growth around 1.3 percent on a year-over-year basis. With population increase also comes opportunities for economic growth and regional investment. However, having high-quality, affordable and workforce housing stock is key to the state successfully capitalizing on this moment. Between historically high rates of inflation and single-family home prices, as well as aggressive interest rate hikes, having the affordable housing infrastructure in place to attract new residents is critical. While most people generally agree that there is a need for more affordable housing, there is often local pushback once such communities are proposed in their neighborhoods. Much of the opposition stems from a lack of understanding of what affordable housing is — and isn’t. For example, individuals making anywhere between 30 to 80 percent of the area median income (AMI) can qualify for affordable housing. There are also several different subcategories of affordable housing: Low-Income Public Housing: …

Dwight Capital Provides $37.7M Construction Loan for InterUrban Apartment Homes Expansion in Billings, Montana

by Amy Works

BILLINGS, MONT. — Dwight Capital has provided a $37.7 million HUD 221(d)(4) construction loan for InterUrban Apartment Homes Phase II, a proposed multifamily expansion project in Billings. The borrower is Montana-based Stock Development. Situated on more than 10 acres, the community will feature six three-story, garden-style buildings and a one-story clubhouse. The 216 units will offer patios, soundproofing, in-unit washers/dryers and smart home packages, which include remote access to HVAC, lighting and security. The buildings will be constructed to National Green Building Standard Bronze guidelines, which enabled the borrower to qualify for a Green Mortgage Insurance Premium Reduction set at 25 basis points. Brandon Baksh of Dwight Capital originated the transaction for the borrower. Dwight Capital also provided a $24.4 million HUD 223(a)(7) loan for the first phase of the property in April 2020.

CHARLOTTE, N.C. — Charlotte-based Extended Stay America has signed a development agreement with a partnership comprising Concord Hospitality and Whitman Peterson to build 15 new Extended Stay America Premier Suites hotels. The properties will be located in major markets throughout the West, including Denver, Phoenix, Las Vegas and Salt Lake City. Concord Hospitality is a hotel management and development company based in Raleigh, N.C., and will handle the development, branding and operations of the properties. Whitman Peterson is a private real estate equity company based in Westlake Village, Calif. The firm will provide equity, identify markets and assist with development. “Extended Stay America Premier Suites has a unique business model that will allow us to reach business and corporate extended-stay travelers looking for a higher level of amenities,” says Mark Laport, CEO and president of Concord. “This agreement is the first step in increasing our presence in the higher-end extended-stay segment.” The Extended Stay America Premier Suites brand comprises both new construction and renovated properties with upgraded amenities, including fully equipped kitchens, apartment-style layouts for working and dining, free in-room Wi-Fi, cable, onsite guest laundry, free breakfast and upgraded design elements such as larger TVs, increased storage space and a …

DALLAS — Northmarq has arranged the sale of Verge Apartments, a 217-unit multifamily property in North Dallas. Built in 1980, the complex houses studio, one- and two-bedroom units with an average size of 700 square feet. Amenities include two pools, outdoor grilling and dining areas, a fitness center, business center and onsite laundry facilities. Taylor Snoddy, Charles Hubbard, Eric Stockley and Philip Wiegand represented the seller in the transaction. Patrick Elliott and Lauren Bresky, also with Northmarq, originated Freddie Mac acquisition financing on behalf of the buyer. Both parties requested anonymity.

CINCINNATI AND BOISE, IDAHO — Kroger Co. (NYSE: KR) and Albertsons Cos. Inc. (NYSE: ACI) have agreed to a merger under which Kroger will acquire all outstanding shares of Albertsons’ common and preferred stock for an estimated total consideration of $34.10 per share, or a total enterprise value of approximately $24.6 billion. The deal includes the assumption of $4.7 billion of Albertsons’ net debt. Both companies’ boards of directors unanimously approved the agreement. The purchase price represents an approximately 32.8 percent premium to the closing price of ACI stock on Oct. 12, and 29.7 percent to the 30-day volume-weighted average price. The exact motivation for the merger was not stated in the press release, but The Wall Street Journal notes that by combining, the companies would have greater leverage in negotiations with vendors and compete better with companies such as Walmart and Amazon. Together, Boise-based Albertsons and Cincinnati-based Kroger currently operate a total of 4,996 stores, 66 distribution centers, 52 manufacturing plants, 3,972 pharmacies and 2,015 fuel centers. The two companies employ a combined 710,000 associates. On a combined basis, the companies delivered approximately $210 billion in revenue and $3.3 billion in net earnings in the fiscal year 2021. The …

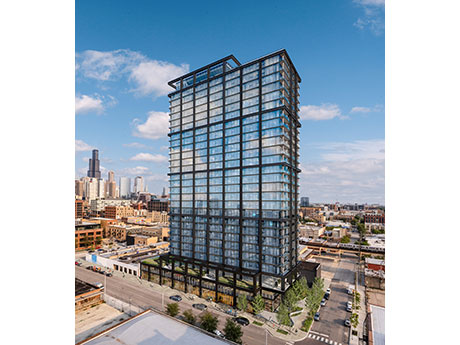

By Tyler Hague, Colliers A colleague of mine recently had to move out of her West Loop apartment quickly and she faced a conundrum: how much am I willing to pay for a one-bedroom apartment in Chicago? The unfortunate answer: not even close to the $2,700 per month rent she was continually being asked to pay. She ended up renting a studio. The average price for a one-bedroom apartment in the central business district is $2,478 per month, a figure that has grown 9.5 percent in the last year alone and equates to a $235.41 year-over-year rental increase, according to Yardi Matrix. It also translates to a national housing insecurity crisis, not just a local and presumed urbanized problem, and one that has been exacerbated by many of the detrimental housing laws and zoning regulations that exist in Chicago today. Whether it is aldermanic privilege, the Affordable Requirements Ordinance (ARO) or general NIMBYism, it is clear rent is too darn high — and it isn’t the entrepreneurial real estate professional’s doing but rather a major (and obvious) supply dilemma. This summer, for the first time in U.S. history, median rent costs in major cities surpassed $2,000 per month, according to …

FORT WORTH, TEXAS — Northmarq has brokered the sale of The Borough Apartments, a 208-unit multifamily property in Fort Worth that was built in 1981. According to Apartments.com, the property offers one- and two-bedroom units ranging in size from 500 to 1,280 square feet. Taylor Snoddy, Eric Stockley, Philip Wiegand and Charles Hubbard of Northmarq brokered the deal on behalf of the seller. Kevin Leamy, Lauren Bresky, Daniel Stickane and Patrick Elliott, also with Northmarq, arranged a nonrecourse, floating-rate acquisition loan that carried three years of interest-only payments on behalf of the buyer. Both parties requested anonymity.

JERSEY CITY, N.J. — Veris Residential Inc. (NYSE: VRE), a publicly traded REIT with offices in New Jersey and Massachusetts, has agreed to sell Harborside 1, 2 and 3, a trio of adjacent office buildings in Jersey City. The unnamed buyer will purchase the properties for an aggregate price of $420 million, subject to closing adjustments. The three office buildings anchor Harborside, a 25-acre development that fronts the Hudson River and also houses five apartment communities, a Whole Foods Market, shops, eateries, the Harborside 5 and Harborside 6 office buildings, onsite daycare, urgent care and primary care medical space, and two parking garages. Veris recently signed Collectors Holdings, parent company of Professional Sports Authenticator, to a 130,000-square-foot lease at Harborside 3. Veris recently also closed on its $346 million sale of 101 Hudson Street, a 42-story office tower in Jersey City spanning nearly 1.3 million square feet of space. With sale of this and the Harborside portfolio, Veris is taking a big step toward the corporate goal of being a “pure-play multifamily REIT.” With these office sales and the stabilization of Haus25, a 750-unit apartment community underway in Jersey City, multifamily will represent 98 percent of Veris’ net operating income, …

By Angela Adolph, Esq., of Kean Miller LLP For traditional manufacturers, the Inflation Reduction Act of 2022 (IRA) offers a mixed bag of carrots and sticks to support its green energy goals. Signed by President Biden on Aug. 16, 2022, the bill includes numerous tax credits and other incentives promoting clean energy investment. One of the IRA’s stated purposes is to incentivize and revitalize domestic manufacturing, and many of its tax credits and incentives are focused on clean energy manufacturing. The IRA directs some specific tax outcomes, like tax credits for manufacturing green components. Other outcomes may be consequential or indirect, like increased local tax revenues due to higher wages or an expanded property tax base. First, the Carrots One of the most significant benefits of the IRA is the expansion of the Advanced Energy Project Tax Credit. This provision credits up to 30 percent of the investment in property used in a “qualifying advanced energy project” that is certified by the Department of Energy, and that is placed in service within two years from certification. The IRA expands the definition of a qualifying advanced energy project to include initiatives at manufacturing facilities that reduce their greenhouse gas emissions by …