INDIANAPOLIS — In a letter sent May 10 to Indianapolis-based Duke Realty Corp. (NYSE: DRE), San Francisco-based Prologis Inc. (NYSE: PLD) offered to acquire the firm in an all-stock transaction valued at $61.68 per share, which equates to about $23.7 billion. Under the terms of the proposal, Duke Realty stockholders would receive 0.466 shares of Prologis common stock for each share of Duke Realty common stock they own. The $61.68 figure is based on Prologis’ closing price on May 9, and represents a premium of 29 percent to Duke Realty’s closing price on the same date. Hamid Moghadam, CEO and co-founder of Prologis, said he is confident that the proposed combination will be a win-win for both company’s shareholders. Prologis first sent a letter to Duke Realty on Nov. 29 regarding a potential transaction at an exchange ratio of 0.465, representing a 20 percent premium to Duke Realty’s stock price at the time. On May 3, Prologis increased the proposed exchange ratio, but Duke Realty rejected the proposal that same evening. As of March 31, logistics real estate firm Prologis owned or had investments in properties and development projects totaling roughly 1 billion square feet in 19 countries. The company’s …

Search results for

"stock"

ARLINGTON, VA. — Boeing (NYSE: BA) has chosen Arlington as the site for its new global headquarters due to the city’s proximity to Washington, D.C., and strong client and talent base in the region. The aerospace and defense giant is moving its headquarters from Chicago, where the firm plans to maintain a significant office presence. In addition to the corporate relocation, Boeing plans to develop a research and tech hub in Arlington to support and train Boeing employees in the areas of cyber security, autonomous operations, quantum sciences and software and systems engineering. Details about the campus and the construction timeline were not disclosed. Boeing’s stock price closed on Thursday, May 5 at $150.47 per share, down from $229.81 a year ago, a 34.5 percent decline.

Build-to-RentConference CoverageDevelopmentFeaturesMultifamilyNorth CarolinaSingle-Family RentalSouth CarolinaSoutheastSoutheast Feature Archive

Speed to Market is ‘Almost the Only Priority’ for Multifamily Developers Looking to Avoid Cost Risks, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — Multifamily developers are pushing their chips in and aggressively looking for new development deals, especially for sites in and around high-growth markets in the Southeast. Michael Tubridy, senior managing director of Crescent Communities, said his firm isn’t leaving anything to chance and is looking to move quickly on development opportunities. “We’re trying to get as many units on the ground today as possible, because tomorrow will be more expensive,” said Tubridy. “I like the chances of today’s cost environment a lot better than I like the unknown of where we’ll be a year from now or two years from now. Putting a premium on speed to market is something that we are much more focused on; it’s almost the only priority right now.” Tubridy’s comments came during the development panel at InterFace Carolinas Multifamily 2022. The half-day event was held on April 14 at the Hilton Uptown Charlotte hotel and attracted more than 260 attendees from all facets of the multifamily industry in North Carolina and South Carolina. Michael Saclarides, director of Cushman & Wakefield’s Multifamily Advisory Group, moderated the discussion. Crescent Communities is far from the only multifamily developer pursuing ground-up construction opportunities in earnest. In …

NEW YORK CITY AND CHICAGO — Private real estate funds managed by Brookfield Asset Management (NYSE: BAM) have agreed to acquire Chicago-based hospitality REIT Watermark Lodging Trust for $3.8 billion. Watermark’s portfolio was constructed over the past decade and currently consists of 25 luxury hotels and resorts totaling 8,100 rooms across 14 states. The properties are primarily located in Sun Belt markets. Under the terms of the deal, Brookfield will acquire all outstanding shares of Watermark’s common stock for approximately $6.73 per share. The purchase price represents a premium of more than 7.5 percent from the most recently published net asset values per share as of Dec. 31, 2021. The deal is expected to close in the fourth quarter. “Hotels and resorts of this scale and quality are difficult to replicate,” says Lowell Baron, managing partner and chief investment officer in Brookfield’s real estate group. “This portfolio is well positioned given its concentration in the Sun Belt, as well as in coastal destinations and gateway cities with high barriers to entry.” Morgan Stanley & Co. LLC is serving as exclusive financial advisor to Watermark. Hodges Ward Elliott is providing estate advisory services to Watermark, and Clifford Chance US LLP and …

SANTA BARBARA, CALIF. — The student housing industry continued to show strong fundamentals in the first quarter of this year, with preleasing levels off to a robust start and annual rent growth exceeding pre-pandemic levels, according to the latest installment of Yardi’s National Student Housing Report. As of March, preleasing for fall 2022 was reported at 63.8 percent — a number that is 13.5 percent higher than the same time last year and 9.9 percent higher than March 2019 — and the average rent per-bedroom for fall 2022 is $777. These figures are based on the company’s “Yardi 200” markets, which include the top 200 investment-grade universities across all major collegiate conferences, including the Power 5 conferences and Carnegie R1 and R2 universities (research universities in the Carnegie Classification of Institutions of Higher Education). A handful of university markets were almost fully preleased as of March, with Purdue University (99.9 percent preleased), the University of Pittsburgh (99.8 percent preleased) and the University of Wisconsin-Madison (98.3 percent preleased) topping the list. Few universities are struggling with fall 2022 preleasing so far, but those that are tend to have higher acceptance rates, according to the report. The University of Houston had the …

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

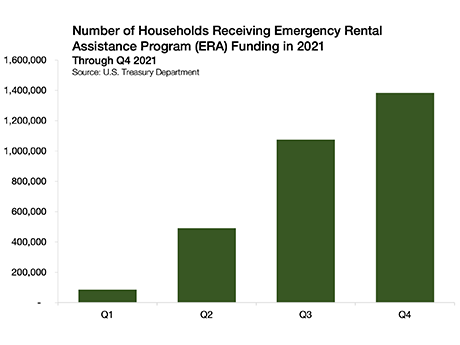

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …

KANSAS CITY, MO. — Flaherty & Collins Properties has received a $46.8 million HUD 223(f) loan for the refinancing of The Yards, a luxury apartment complex in the Stockyards District of Kansas City that opened in May 2020. The Yards consists of 232 apartment units, 3,150 square feet of commercial space and more than 9,500 square feet of amenity spaces. Kevin Muesenfechter and Ali Rode of Gershman Investment Corp. originated the loan. The HUD financing replaces the construction debt provided by Citizens Bank, Equity Bank and First National Bank of Omaha. Flaherty & Collins plans to build a second phase of the development.

SEATTLE — Hudson Pacific Properties Inc. (NYSE: HPP) has completed its purchase of Washington 1000, a fully entitled office development site in Seattle, for $85.6 million. The Los Angeles-based REIT will break ground immediately on a 546,000-square-foot office tower at the site. The total project costs, including the purchase price of the land, is anticipated to range from $340 million to $360 million. Washington 1000 is located at 1000 Olive Way within Seattle’s Amazon-anchored Denny Triangle submarket. The project will sit directly adjacent to the $1.9 billion Washington State Convention Center Addition project, which is adding numerous retail amenities and streetscape improvements to the neighborhood. Project architects LMN and Callison RKTL are designing Washington 1000 to achieve LEED Gold and Fitwel certifications. The design will appeal to post-pandemic office needs with enhanced HVAC filtration units and antimicrobial finishes at key touchpoints. The design will also allow for flexibility with 36,500-square-foot, column-free floorplates, as well as maximum natural light with high ceilings and floor-to-ceiling windows. The project will feature more than 22,000 square feet of amenity-rich outdoor space, including an indoor-outdoor rooftop lounge and two 5,000-square-foot terraces off the second-floor main lobby. The property will also have an end-of-trip facility that …

In 2020, the multifamily marketplace took an unprecedented hit thanks to the global pandemic. Unemployment and layoffs were rife, rent moratoriums were put in place to safeguard against mass evictions, and multifamily investment and new builds took a nosedive. However, as the country has started to emerge from the throes of COVID-19, the marketplace has entered a banner period of growth with forecasts indicating that the number of apartments nationwide will grow by an additional 4.5 million by 2030. This period of unprecedented growth shows no signs of slowing, either. According to Richardson, Texas-based RealPage, a provider of data analytics and property management software, during the first quarter of 2022 there was a total of 18.59 million apartment units in the U.S., a nearly 75,000 unit increase from the fourth quarter of 2021. But that modest growth in supply is being greatly eclipsed by robust demand, says Carl Whitaker, director of research and analysis at RealPage. “In fact, the only thing holding absorption rates back is the fact that occupancy is approaching 98 percent, so there’s just not much available inventory to even be absorbed.” As the rental market continues to rapidly grow, developers and owners are faced with …

NEW YORK CITY — Affiliates of private equity giant Blackstone (NYSE: BX) have agreed to acquire PS Business Parks (NYSE: PSB), a Glendale, Calif.-based commercial owner-operator primarily focused on industrial assets, for $7.6 billion. The deal is scheduled to close in the third quarter. Under the terms of the agreement, New York City-based Blackstone will purchase all outstanding shares of PSB’s common stock for $187.50 per share, which represents a premium of approximately 15 percent over the weighted average share price over the last 60 days. Blackstone plans to take the company private as part of the acquisition. Public Storage (NYSE: PSA), which is also based in Glendale, currently owns about 26 percent of PSB’s common stock, and the self-storage REIT’s executives and shareholders have voted in favor of the sale to Blackstone. The transaction will also include the acquisition of Public Storage’s limited partner equity interests in PSB’s operating partnership at the same per-share price of $187.50. As of March 30, 2022, PSB owned and operated 96 commercial properties across the country, primarily in California, South Florida, Texas and Northern Virginia. Those assets span approximately 27 million square feet and are occupied by nearly 5,000 tenants. Though mainly comprised …