KINGSTOWNE, VA. — Avison Young has brokered the sale of a retail portfolio totaling 410,398 square feet in Kingstowne, located in Fairfax County approximately 13 miles southwest of Washington, D.C. Federal Realty Investment Trust (NYSE: FRT) purchased the portfolio for $200 million. The deal will close in two parts, with the first half already completed and the second half scheduled to close in July. Dean Sands and Chip Ryan of Avison Young represented the seller, The Halle Cos. The portfolio is 97 percent leased to 61 tenants, including supermarkets Safeway and Giant. According to local news outlets, the properties also feature tenants such as T.J. Maxx, Ross, HomeGoods, &pizza and Cava. The retail portfolio includes a significant portion of Kingstowne Towne Center, a live-work-play power center in Virginia. The Halle Cos. developed Kingstowne Towne Center in the mid-1980s, converting 1,200 acres into a master-planned community. With large expanses of green space and a centralized town center, Kingstowne is considered one of Northern Virginia’s best places to live and work, according to Avison Young. “Kingstowne Towne Center, with its attractive demographics and significant barriers to entry, is reflective of our Northern Virginia growth strategy, and further demonstrates our corporate commitment to …

Search results for

"stock"

Mirae Asset Global Purchases Academy Sports Headquarters Campus in Metro Houston for $190M

by John Nelson

KATY, TEXAS — Mirae Asset Global Investments, a global investment firm based in Seoul, South Korea, has purchased the headquarters campus of sporting goods retail giant Academy Sports + Outdoors (Nasdaq: ASO) in the west Houston suburb of Katy. Phoenix-based Tratt Properties sold the 1.5 million-square-foot campus, which is triple-net leased to Academy Sports on a long-term lease, for $190 million. The 93-acre campus includes a little over 1.2 million square feet of warehouse space, 250,000 square feet of flexible office space and mezzanine space totaling approximately 800,000 square feet. Located at 1800 N. Mason Road, the site has immediate access to Interstate 10 and Texas Highway 99, which circles Houston. “From a logistics perspective, this property is exceptionally well-located, with access to highways in all directions,” says Ken Hedrick, executive managing director of Newmark. “The scarcity and increasing value of land in the west Houston area further enhance the property’s value.” Hedrick, along with Newmark colleagues Jerry Hopkins, Andrew Ragsdale, Alex Foshay and Kristian Nielsen, represented Tratt Properties in the sale. Dustin Stolly, Jordan Roeschlaub and Nick Scribani, also with Newmark, arranged acquisition financing on behalf of Mirae Asset Global. Tratt Properties is an active logistics real estate investor …

Affordable HousingContent PartnerDevelopmentFeaturesGeorgiaLumentMidwestMultifamilyNortheastSoutheastTexasVideoWestern

Utilizing Tax Credits to Create Affordable Housing in High-Opportunity Communities

The Section 42 Low-Income Housing Credit program has been America’s primary tool in the effort to construct affordable homes for low- and moderate- income households and ease renter cost burdens since 1986. This public-private partnership has created or preserved more than 3.1 million rental units, accounting for over 30 percent of the nation’s affordable housing stock. Congress is considering legislation that would materially expand and strengthen the tax credit program. In addition to several technical changes to tax credit accounting and rules governing the use of private-activity bond financing, the legislation would authorize increases in credit allocation in 2021 and 2022. The impact of these changes would be substantial, catalyzing construction of more than 100,000 additional units per year over a 10-year period, perhaps trimming the number of rent burdened low-income households by half. Building more affordable housing will represent a significant step toward reducing housing instability and economic inequality in America. But are quantitative gains alone enough? Constructing affordable housing in low-poverty, high-opportunity census tracts is challenging. The following discussion explores some ways in which developers, lenders and credit allocating agencies can increase the level of affordable housing construction in low-poverty, high-opportunity areas (LPHOA) and optimize the …

Blackstone Agrees to Acquire Student Housing Giant American Campus Communities for $12.8B

by Katie Sloan

NEW YORK CITY AND AUSTIN, TEXAS — Blackstone Inc. (NYSE: BX) has agreed to acquire American Campus Communities (NYSE: ACC) in a deal valued at $12.8 billion, including the assumption of debt. ACC is the largest publicly traded owner, manager and developer of student housing in the United States. Blackstone plans to take the company private through Blackstone Real Estate Income Trust Inc. and Blackstone Property Partners, which unlike its traditional private-equity funds can hold properties as long-term investments, according to media sources. This move comes as the price of public equity has been more expensive than private institutional capital over the past few years, according to Bill Bayless, co-founder and CEO of ACC, in a letter to employees. During that time, many of the private players in the sector were able to acquire and develop more aggressively than the cost of public equities permitted. The purchase price represents a premium of 22 percent against ACC’s 90-day, volume-weighted average share price as of April 18, and a 30 percent premium over the company’s closing stock price on Feb. 16, the day prior to ACC disclosing an indication of willingness from Blackstone to acquire the Austin-based firm. This transaction marks Blackstone’s largest investment …

By Taylor Williams Industrial brokers and developers throughout New Jersey and Eastern Pennsylvania are flush with tenant demand, but the frenetic pace and frequency at which revenues and costs change in this market has introduced a whole new set of operating challenges. In terms of the supply side of the market, developers of industrial product, like those of every other property type, have been squeezed by supply chain disruption. Prices and lead times for ordering key materials change radically and often without warning. Developers who try to circumvent these obstacles by ordering way earlier than normal in the process now run an increased risk of having to take delivery of supplies without having all permits and sources of construction financing in place. Such a misfire in timing can create lags in delivery, potentially alienating tenants needing turnkey space and generating additional short-term costs via storage of the materials before construction begins. In addition, misaligning these timelines can spook potential investors that want the certainty of knowing that a project is moving forward. “We’re buying supplies a year in advance and trying to sync up deliveries of those materials with when we expect to have full project approval,” says Peter Polt, …

DANVILLE, VA. — Clayco has broken ground on Tyson Foods’ new poultry processing facility in Danville. Construction started last month and is slated for completion by the spring of 2023. Built on a 64-acre site, the project will be used primarily for the production of fully cooked, Tyson-branded chicken products. Tyson Foods has committed to purchasing 60 million pounds of Virginia-grown chicken over the next three years. The chicken processing plant’s features will include a mezzanine level, ASRS cold storage structure, raw materials storage, production and packaging space, a two-story space for offices, and cold storage spaces that will range in temperatures throughout the building. A wastewater treatment plant will also be included. Lamar Johnson Collaborative is the designer for the project, with Clayco in charge of designing and building. Other project partners include Concrete Strategies, Tucker Jones and Stock Engineering.

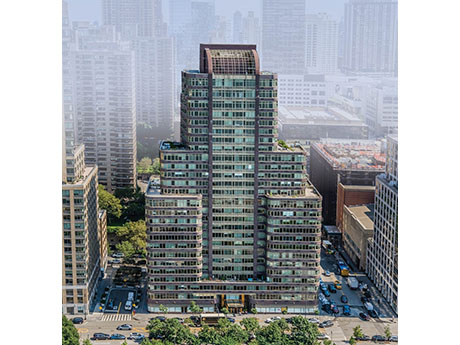

A&E Real Estate Acquires Apartment Tower in Manhattan from Equity Residential for $266M

by John Nelson

NEW YORK CITY — A&E Real Estate, a private multifamily investment and management firm based in New York City, has purchased 140 Riverside Boulevard, a luxury 354-unit apartment tower on the Upper West Side of Manhattan. Equity Residential (NYSE: EQR), a multifamily REIT based in Chicago, sold the 28-story community for $266 million. Darcy Stacom and Ryan Silber of CBRE represented Equity Residential in the sale. Built in 2002, the apartment tower features controlled access, a doorman, fitness center, interior courtyard, multiple tenant lounges, onsite management, package services, storage space and concierge services. The property is situated opposite Riverside Park South, a New York City park that fronts the Hudson River. Additionally, the community includes commercial space currently leased to New York Cat Hospital, a veterinarian’s clinic, and Dwight School, a private school catering to pre-K and kindergarten students. “140 Riverside Boulevard is a stand-out in the New York market, situated both waterfront and park-front with direct access to the Hudson River Park system,” says Stacom. “The property has been meticulously maintained and is truly excellent real estate — as this transaction validates.” Founded in 2011, A&E Real Estate began with the acquisition of a 49-unit apartment community in Brooklyn. …

DALLAS AND COPPELL, TEXAS — Dave & Buster’s Entertainment Inc. (NASDAQ: PLAY) has agreed to acquire family entertainment concept Main Event for $835 million in an all-cash transaction. The seller is a joint venture between Ardent Leisure Group Limited and Red Bird Capital Partners, and the deal is expected to close later this year. Chris Morris, current CEO of Main Event, will serve as CEO of the combined entity upon closing. The move ends the search for a new Dave & Buster’s CEO, which has been ongoing for approximately seven months following the retirement of Brian Jenkins. The purchase price represents a valuation of approximately nine times Main Event’s 12-month adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) as of Dec. 31. Deutsche Bank Securities Inc., JPMorgan Chase Bank, N.A. and BMO Capital Markets Corp. are the joint lead arrangers and joint book-runners on the transaction. “From a strategic fit perspective, Main Event’s business model, footprint and asset quality aligns well with Dave & Buster’s,” says Kevin Sheehan, board chair and interim CEO of the Coppell-based buyer. “Main Event targets a different demographic — families with younger children — while Dave & Buster’s primarily targets young adults,” he continues. …

CORPUS CHRISTI, TEXAS — Whataburger, a Corpus Christi-based fast food burger chain, is opening its first metro Atlanta restaurants this year. The two locations will be situated at 705 Town Park Lane NW in Kennesaw and 9766 GA-92 in Woodstock. At its Kennesaw location, Whataburger plans to hire 180 employees, and to employ more than 1,400 employees in the metro Atlanta area restaurants by the end of 2023. In 2023, other Whataburger locations will open around metro Atlanta including at 503 Lakeland Plaza in Cumming; SEQ Buford Drive and Exchange Drive in Buford; 3321 Lexington Road in Athens; 3201 Atlanta Highway in Athens; 100 Pottery Road in Commerce; and 15 Wallace Blvd. in Dawsonville. Whataburger currently has one Georgia restaurant in Thomasville. The burger chain has over 880 locations across 14 states.

SANTA BARBARA, CALIF. — The national average for in-place industrial rents across the top 30 U.S. markets reached $6.45 per square foot in February, a 4.4 percent year-over-year increase according to research from CommercialEdge, a product of Yardi Systems. The Santa Barbara-based firm found that the average effective rental rates signed over the same interval was $7.35 per square foot, 90 cents higher than the national average for in-place leases, a nearly 14 percent swing. Southern California markets led the nation in rent expansion, largely due to intense activity in the Ports of Los Angeles and Long Beach. Orange County recorded the most significant 12-month change with a 7 percent hike, reaching $11.65 per square foot. Los Angeles (6.7 percent) and the Inland Empire (6.5 percent) rounded out the top three markets nationally. On the other end of the spectrum, markets that have higher availability of developable land recorded weaker rent growth in the last 12 months. Newly delivered stock in these markets is helping developers meet demand, while also elevating vacancy levels. Across the top 30 U.S. markets, rent growth was slowest in Charlotte (1.1 percent), Houston (1.7 percent) and Indianapolis (2.3. percent). The spread between the average lease …