M&T Realty Capital Corp. is beginning 2022 with ambitious plans to increase its multifamily financings as part of an effort to double its real estate loan volume over the next two to three years. To achieve those goals, it is leveraging a new leadership structure and a recently announced strategic partnership with the Marcus & Millichap Capital Corp. M&T Realty Capital, M&T Bank’s commercial mortgage banking subsidiary, recorded $5.1 billion in loan volume in 2021, a level that was just below its high watermark of $5.2 billion in 2019, says Michael Berman, CEO of M&T Realty Capital. Multifamily loans made up of the lion’s share of financings, he adds, and the sector provides a significant growth opportunity going forward. “Multifamily is a hot a sector right now — everyone is trying to invest in it,” he says. “It’s just an extraordinarily healthy asset class because of its supply and demand dynamics.” Indeed, the U.S. apartment market enjoyed a banner year in 2021 across all measures. Investment volume reached a record $335.3 billion, nearly 75 percent above the record volume of $193.1 billion posted in 2019, according to commercial real estate brokerage CBRE. Meanwhile, renters absorbed 617,500 apartment units in 2021, …

Search results for

"stock"

NASHVILLE — Xenia Hotels & Resorts (NYSE: XHR), an Orlando-based hospitality REIT, has agreed to acquire the 346-room W Nashville hotel for $328.7 million. The sales price equates to roughly $950,000 per room. The seller and developer of the 14-story hotel, which opened in October 2021 in the city’s Gulch neighborhood and is part of the Marriott family of brands, was not disclosed. The deal is scheduled to close by the end of the first quarter. The W Nashville features six food and beverage options, including two concepts by Chef Andrew Carmellini, as well as rooftop and pool bars. The property also offers 18,000 square feet of indoor meeting and event space and 26,000 square feet of outdoor amenity space, including a 10,000-square-foot pool deck and terraces contiguous with meeting, food and beverage and event spaces. The hotel’s offering of guestrooms includes 60 suites, representing about 17 percent of the total room count. “We are thrilled to have reached an agreement to acquire an outstanding, newly constructed luxury lifestyle hotel located in the desirable Gulch neighborhood in the heart of Nashville,” says Marcel Verbaas, Xenia’s chairman and CEO. “The W Nashville is extremely well-designed and perfectly situated to attract year-round …

By: Jamie Rash, Regional Director, Keystone Development + Investment Talk about a spark. When Spark Therapeutics announced plans at the end of last year to develop a $575 million gene therapy manufacturing plant in Philadelphia, it ignited the city’s evolution into a destination for the largest, most innovative life sciences firms in the world. Over $1 billion in venture capital (VC) investment is pouring into more than 50 Philadelphia life sciences companies that employ some 20,000 people, generating unprecedented demand for lab space. Supply is limited — even with 1 million square feet of lab space in development — and this supply shortage is driving some developers to capitalize on the demand by converting existing building stock. Moving Beyond Meds & Eds Philadelphia is a long-reputed “meds and eds” city, meaning it’s home to anchor institutions of higher learning and world-leading medical facilities that are known for innovation and opportunity. These institutions are major drivers of economic growth throughout the city. Previously, much of the activity in pharmaceuticals and biotechnology occurred in labs in suburban office parks and sprawling corporate campuses. In 2017, the city celebrated two cutting-edge, FDA-approved gene and cell therapies to treat specific types of cancer and …

Healthcare Realty Trust, Healthcare Trust of America Agree to Merge, Forming $11.6B Medical Office Building REIT

by John Nelson

NASHVILLE, TENN. AND SCOTTSDALE, ARIZ. — Healthcare Realty Trust Inc. (NYSE: HR) and Healthcare Trust of America Inc. (NYSE: HTA), two of the larger owners of medical office buildings in the country, have agreed to merge. Upon closing, the combined company will operate under the Healthcare Realty name and use the same stock exchange ticker symbol of “HR,” as well as keep its headquarters in Nashville with offices in Charleston and HTA’s current headquarters of Scottsdale. The combined company is expected to have a pro forma equity market capitalization of approximately $11.6 billion upon the close of the transaction, which is expected to occur in the third quarter pending approval from the shareholders of both companies. The boards of directors of both Healthcare Realty and HTA unanimously approved the merger. With 727 properties totaling 44 million square feet, the new company will be the largest “pure-play” real estate investment trust specializing in medical office buildings (MOB), with nearly double the square footage of the next-largest MOB portfolio. The company will own the largest portfolio of on-campus or adjacent to hospital campus properties comprising 28.2 million square feet. Additionally, 94 percent of the portfolio will be concentrated in the top 100 …

By Randy Lacey, SIOR, senior vice president, CBRE | Oklahoma City; and Chris Zach, CPA, associate, CBRE | Oklahoma City Contrary to popular belief, the ongoing pandemic has been a boon to many aspects of the Oklahoma City economy. Industrial real estate growth has been more prominent than any other commercial sector. Those familiar with the city and surrounding area can vouch for the speed and intensity of housing demand and development, but industrial real estate has set itself apart over the last few years. OKC is Here to Stay Oklahoma City has a lot going for it. The market always has been well-positioned in terms of its central geographic location at the intersection of Interstates 35 and 40 and has seen tremendous growth and success in the last decade, with significant headway in the local industrial real estate market. The industry has proven its resiliency amid the pandemic and should continue to fare well into the future. But low costs of living and doing business have further bolstered the appeal of the community. In fact, Oklahoma City is only one of 14 cities across the country to add more than 100,000 people in the last 10 years, …

CHESTERFIELD, MO. — Keystone Construction Co. has begun work on a 97,000-square-foot indoor volleyball and basketball complex in Chesterfield near St. Louis. Mia Rose Holdings is the developer, MW Weber Architects is the architect and Stock & Associates Consulting Engineers Inc. is the civil engineer. Completion is slated for early 2023. Chesterfield Sports Association (CSA), a nonprofit organization, will own and operate the facility. Nine basketball courts will convert to 18 volleyball courts. Additional features will include a fitness area, spectator seating, lounge areas and multipurpose rooms. CSA plans to host over 40 tournaments each year that will attract out-of-town guests and generate economic activity for local restaurants and hotels.

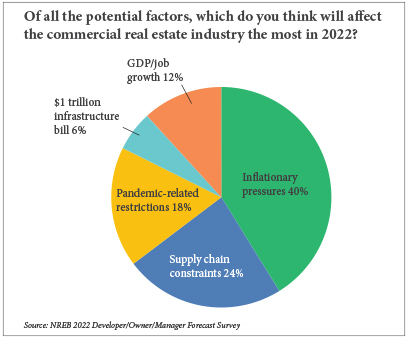

By Taylor Williams In late October of last year, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, gave a virtual speech in which he carried a glass jar with the word “transitory” labeled on it. Inside the jar were wadded-up dollar bills, deposited by Bostic’s staff members each time they used the word “transitory” to describe the surge in prices of consumer goods and services. The exercise was meant to dispel the notion that the current inflationary environment would be fleeting or short-lived. Based on the results of Northeast Real Estate Business’ annual reader forecast survey, commercial brokers and developers/owners in the region aren’t likely to be contributing to that fund any time soon. Inflation Could Linger When asked to identify the macroeconomic force that was most likely to impact the commercial real estate industry in 2022, roughly a third of broker respondents selected inflationary pressures over supply chain constraints, pandemic restrictions, the $1 trillion infrastructure bill and employment/gross domestic product (GDP) growth. Concerns over pandemic-related restrictions on businesses, which adversely impact demand for space, was a close second among broker respondents. Some brokers elaborated on these views in the free-response section of the survey. “Continued inflation will …

BOSTON — Indianapolis-based pharmaceutical giant Eli Lilly & Co. has unveiled plans for a $700 million institute for genetic medicine in Boston’s Seaport District. The opening is slated for 2024. The company has signed a 334,000-square-foot lease at 15 Necco St., a 12-story healthcare and life sciences building that Alexandria Real Estate Equities (NYSE: ARE) is developing. At the facility, Lilly will develop genetic medicines with a range of applications, including diabetes, immunology and central nervous system research. Curtis Cole, John Carroll III, Evan Gallagher, Tim Allen and Caitlin Mahoney of Colliers represented Eli Lilly in the deal. The site will also include a shared space modeled after Lilly Gateway Labs in San Francisco to support biotech startups in the Boston area. This area will afford users access to dedicated and configurable lab and office space and opportunities for collaboration with Lilly scientists. These companies are expected to generate as many as 150 additional new jobs once the space is fully occupied. The investment follows Lilly’s 2020 Prevail Therapeutics initiative, which centered on the launch of a gene therapy facility in New York City. Lilly projects that within five years, employment at the Boston facility will grow from 120 to …

Ares Management Acquires Capital Automotive for $3.8B, Including 250 Net-Leased Car Dealerships

by John Nelson

NEW YORK CITY AND MCLEAN, VA. — Ares Management Corp. (NYSE: ARES) has acquired Capital Automotive LLC, a McLean-based firm that specializes in the sale-leaseback of car dealerships under new triple-net leases. Ares purchased the company through its alternative credit strategy division and real estate group for $3.8 billion. The seller was a private real estate fund managed by Brookfield Asset Management (NYSE: BAM). Capital Automotive owns more than 250 real estate assets in the United States and Canada that are structured under long-term, triple-net leases to various car dealers. The names and locations of the properties were not disclosed. Ares purchased Capital to expand and diversify its net-lease investment strategy. Including the recent investment in Capital Automotive, Ares’ funds have invested in over 1,200 real estate assets totaling approximately $7.2 billion of gross asset value in North America and Europe over the past 15 months. These net lease investments include retail, industrial and office properties leased to tenants with varying credit profiles. Ares’ real estate group had approximately $41.2 billion of assets under management as of year-end 2021. Ares Management’s stock price closed on Thursday, Feb. 17 at $79.01 per share, up from $52.02 a year ago, a nearly …

ATLANTA AND NEW YORK CITY — Blackstone Real Estate Income Trust Inc. (BREIT) has entered into a definitive agreement to acquire Preferred Apartment Communities Inc. (PAC) for approximately $5.8 billion. Under the terms of the agreement, BREIT will acquire all outstanding shares of PAC’s common stock for $25 per share in an all-cash transaction. PAC’s portfolio includes 44 multifamily communities totaling approximately 12,000 units concentrated largely in Atlanta, Orlando, Tampa, Jacksonville, Charlotte and Nashville, as well as 54 grocery-anchored retail assets comprising roughly 6 million square feet in Atlanta, Orlando, Nashville and Raleigh. BREIT will also acquire PAC’s two Sun Belt office properties and 10 mezzanine/preferred equity investments collateralized by new or under-construction multifamily assets. “Investing using BREIT’s perpetual capital will enable us to be long-term owners of these vibrant communities,” says Jacob Werner, co-head of Americas acquisitions for BREIT. “The company’s grocery-anchored retail portfolio performance has also been strong and resilient, and we believe these types of necessity-oriented assets located in areas with growing populations are well positioned for continued growth.” Joel Murphy, PAC’s chairman and CEO, says the transaction is an excellent outcome for shareholders and the culmination of efforts over the past few years to simplify and …