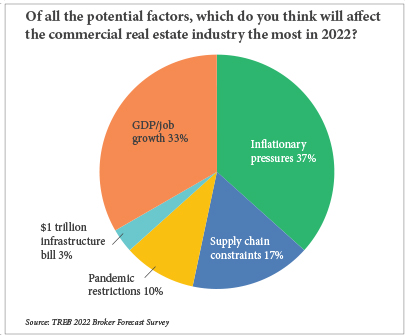

By Taylor Williams In late October, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, gave a virtual speech in which he carried a glass jar with the word “transitory” labeled on it. Inside the jar were wadded-up dollar bills, deposited by Bostic’s staff members each time they used the word “transitory” to describe the surge in prices of consumer goods and services. The exercise was meant to dispel the notion that the current inflationary environment would be fleeting or short-lived. Based on the results of Texas Real Estate Business’ annual reader forecast survey, commercial brokers and developers/managers in the Lone Star State aren’t likely to be contributing to that fund any time soon. When asked to identify the macroeconomic force that was most likely to impact the commercial real estate industry in 2022, both of these groups selected inflationary pressures over supply chain constraints, pandemic restrictions, the $1 trillion infrastructure bill and employment/gross domestic product (GDP) growth. It’s worth noting that the survey officially closed on Monday, Dec. 13, about a week before the nation began to see a major surge in COVID-19 cases, most of which were classified as the Omicron variant. In the subsequent three-week period, …

Search results for

"stock"

DURHAM, N.C. — An affiliate of Raleigh-based Blue Heron Asset Management has sold Foster on the Park, a 164-unit mixed-use property in the Central Park district of downtown Durham, for $78.3 million or $477,000 per unit. Allan Lynch, Jeff Glenn and Andrea Howard of Northmarq represented Blue Heron Asset Management in the sale. San Francisco-based Stockbridge was the buyer. Built in 2020, Foster on the Park offers studio, one- and two-bedroom floorplans. Unit features include plank wood flooring, stainless steel appliances, Nest thermostats and in-unit washers and dryers. Community amenities include a fitness center, resident library, yoga room, lounge and a saltwater pool and lounge. The property also features 2,141 square feet of ground-floor retail space leased to local liquor shop, The Glass Jug. The property was 93 percent occupied at the time of sale. Located at 545 Foster St., Foster on the Park is close to the Historic Durham Athletic Park and Durham Central Park, as well as Google’s new offices at Durham Innovation District. The property is also situated close to retailers and restaurants such as the King’s Sandwich Shop, Durham Distillery, Beer Durham and The Dankery. Additionally, the property is situated 2.3 miles from Duke University.

Howard Hughes Corp. Plans to Invest $325M in Medical Office, Residential Projects in Columbia, Maryland

by John Nelson

COLUMBIA, MD. — The Howard Hughes Corp. (NYSE: HHC) has unveiled plans to invest $325 million to densify Downtown Columbia, the REIT’s 391-acre mixed-use development within the master-planned community of Columbia. Founded by James Rouse in 1967, Columbia is situated within the Baltimore-Washington, D.C. corridor in Maryland and is one of the first master-planned communities in the United States. The first new HHC project within Downtown Columbia’s Lakefront District is a four-story, 86,000-square-foot medical office building representing about $45.8 million in investment. Studio Red Architects is designing the property to achieve LEED Platinum and Fitwel certifications. Orthopaedic Associates of Central Maryland (OACM), a division of The Centers for Advanced Orthopaedics, will move its Columbia office into the new building upon completion in 2024, occupying approximately 20 percent of the asset. The property will be situated near a Whole Foods Market and Lake Kittamaqundi. Several health and wellness tenants signed on at Downtown Columbia to capitalize on the halo effect from the nearby Howard County General Hospital, which is part of Johns Hopkins Medicine. Other tenants at the Lakefront District include The Pearl spa, medtech firm NuVasive, MedStar Health’s headquarters, Healthcare Management Solutions, Welldoc, Sharecare, Consortium Health Plans, Vaya Pharma, Medisolv …

BOSTON — A joint venture between global asset manager Värde Partners and California-based Hawkins Way Capital has purchased the 1,220-room Sheraton Boston Hotel, located at 39 Dalton St. in the city’s Back Bay neighborhood. The hotel sold for $233 million, or roughly $191,000 per room, according to multiple local news outlets including The Boston Globe and WCBV. The partnership purchased the 29-story, 1.1 million-square-foot property from Maryland-based REIT Host Hotels & Resorts Inc. (NASDAQ: HST). The luxury hotel offers amenities such as a pool, business center, fitness center, meeting space, spa and wellness center, convenience store and an onsite restaurant. The Sheraton is Boston’s largest hotel, and the sales price is below that of comparable hotel deals that traded in Boston’s downtown area prior to the pandemic, according to the Globe. Citing data from Pinnacle Advisory Group, the local newspaper puts the downtown Boston hotel market’s average nightly occupancy rate for 2021 at approximately 45 percent. The deal marks the sixth acquisition between Värde Partners and Hawkins Way Capital as part of a larger plan to acquire $1 billion in value-add and distressed hospitality and housing assets in major U.S. cities. The joint venture’s portfolio also includes the DoubleTree by …

NEW YORK CITY — New York City-based investment firm iStar Inc. (NYSE: STAR) has entered into an agreement to sell its portfolio of net-leased office, industrial and entertainment properties for roughly $3 billion. The properties are located in various markets throughout the country and total approximately 18.3 million square feet. The buyer is an affiliate of New York City-based private equity firm Carlyle Group. The deal is expected to close before the end of the first quarter. The stock price of iStar Inc. closed at $24.94 per share on Wednesday, Feb. 2, the first full day of trading after the deal was announced. The stock price is currently up more than 50 percent from its mark of $15.81 a year ago.

The multifamily investment sales sector had well-documented success in 2021 with a record volume of over $220 billion in transaction activity. Factors driving competition for transactions within the sector included: increasing home prices, widespread interest in renting and the easing of COVID-19 restrictions bringing renters back into the nation’s cities, all of which drove the average, nationwide multifamily occupancy rate above 97 percent. With firmly rooted fundamentals, investor interest across the spectrum of multifamily has been intense. Traditionally popular core investment products (stabilized and value-add assets located in primary and secondary markets) were the clear winners with investors. Some multifamily REIT stocks increased by 75 to 100 percent in 2021, explains Arthur Milston, senior managing director with NAI Global and co-head of the company’s Capital Markets Group. Milston sat down with REBusinessOnline to explain where NAI Global sees growth and opportunities in 2022. REBusiness: Who are the primary investor groups acquiring multifamily? What types/locations are they attracted to? Milston: Historically, multifamily has always had very fragmented ownership compared to other asset classes. Currently, the dominant players are the large aggregators of product, whether it be REITs or institutional investors that are buying, typically in conjunction with an operating partner. Pension …

LANSING, MICH. — Ultium Cells, a joint venture between General Motors Co. (NYSE: GM) and LG Energy Solution, has unveiled plans for a $2.6 billion investment to build its third battery cell manufacturing plant in the United States. The facility, which will be located in Lansing, the state capital, is part of a larger $7 billion investment in four Michigan manufacturing sites to increase battery cell and electric truck manufacturing capacity. Detroit-based GM says this is the single largest investment announcement in its history. The Michigan Strategic Fund Board approved $824.1 million in incentives for the projects, according to local media reports. Ultium Cells will build the new plant in Lansing on land leased from GM. The facility is expected to create 1,700 new jobs when fully operational. Site preparation on the roughly 2.8 million-square-foot property is scheduled to begin this summer, and the plant is expected to open in late 2024. The facility will supply battery cells to Orion Assembly in Michigan and other GM electric vehicle (EV) assembly plants. “This significant investment demonstrates our commitment to strengthen our Michigan and U.S. manufacturing presence and grow good-paying jobs,” says Mary Barra, GM chair and CEO. “We will have the …

NEW YORK CITY AND PHILADELPHIA — Blackstone Real Estate Income Trust Inc. (BREIT) has agreed to acquire Resource REIT, a publicly registered, non-traded REIT based in Philadelphia, for $3.7 billion in an all-cash transaction. Under the terms of the deal, BREIT will acquire all of the outstanding shares of common stock of Resource REIT for $14.75 per share, including the assumption of existing debt. The transaction is expected to close in the second quarter. Resource REIT’s portfolio currently consists of 42 garden-style apartment communities totaling more than 12,600 units across 13 states, including Arizona, Colorado, Florida, Georgia and Texas. “This transaction represents a continuation of our high-conviction investing in top-quality multifamily communities in growth markets across the country,” says Asim Hamid, senior managing director at Blackstone. “We intend to capitalize on our expertise, scale and management practices to ensure these properties are well maintained and provide an exceptional experience for residents.” Lazard Frères & Co. LLC is acting as exclusive financial advisor to Resource REIT, and DLA Piper LLP is acting as the firm’s legal counsel. BofA Securities, BMO Capital Markets Corp., Eastdil Secured Advisors LLC and RBC Capital Markets LLC are acting as financial advisors to BREIT. Simpson Thacher …

By Katie Sloan The pandemic has brought many challenges to the student housing industry, particularly as it relates to the much anticipated — and often dreaded — summer turn season. In 2020, the biggest hurdle was keeping shared spaces sanitized while maintaining the safety of residents and onsite staff. Owners and operators had the added challenge of navigating labor shortages, which left many companies scrambling to find everything from cleaning crews to onsite staff, and supply chain issues that resulted in everything from paint to furniture and appliances being stuck offshore or in ports, with little predictability as to delivery. Student Housing Business polled a number of owners, operators and vendors on their thoughts and best practices for circumventing supply chain issues in the new year. Owners & Operators Plan Ahead Owners and operators are getting on the ball and starting to plan. “I’m no expert on the supply chain, but our experience this year really has focused on furniture delivery, whereas in the first year of COVID-19 it was supplies for cleaning and sanitizing,” says Christine Richards, president of management at Core Spaces. “Items that were supposed to be delivered in June were showing up in December, which created …

HOUSTON — CyrusOne Inc. (NASDAQ: CONE) has entered into a definitive agreement to sell four of its data centers in Houston for approximately $670 million. Under the terms of the agreement, DataBank Holdings Ltd. will acquire Houston West I, II and III, as well as Houston Galleria. The four facilities total more than 300,000 square feet. Additionally, CyrusOne will lease back the Houston West III shell to support a lease signed with a customer in the fourth quarter of 2021. The transaction is expected to close by the end of this quarter. Proceeds from the sale will be utilized to fund future development projects. “We are excited to execute on our capital recycling initiative to fund our continued growth,” says David Ferdman, interim president and CEO of Dallas-based CyrusOne. “This divestiture further optimizes our portfolio as we redeploy capital into accretive developments across core markets with diverse hyperscale and enterprise demand in the U.S. and Europe.” The transaction marks DataBank’s entry into the Houston market. “With our deep roots in Texas, [Houston] was a logical metro for us to expand into and allows us to bring our digital infrastructure and interconnection solutions to the fourth-largest metro in the U.S.,” says …