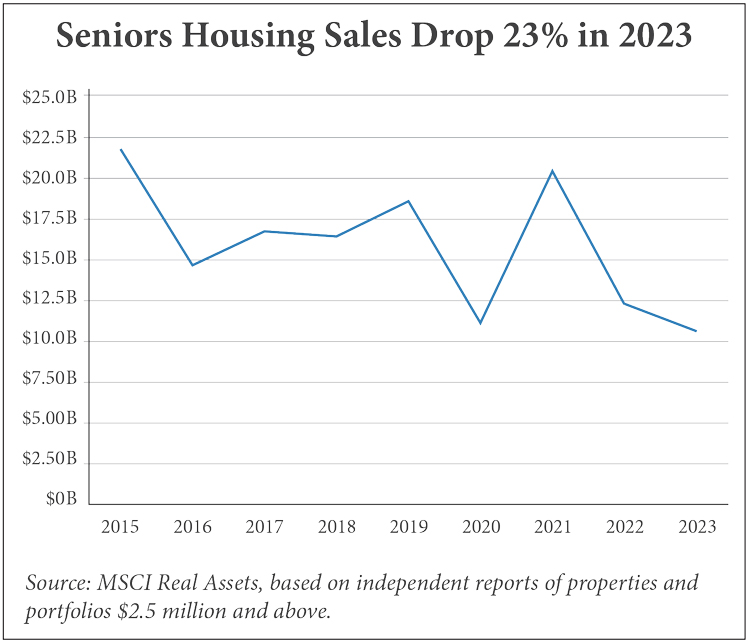

At first blush, 2023 looks like a bad year for seniors housing property sales. Total transaction volume fell 23 percent to $10.6 billion, the sector’s lowest mark in over a decade, according to data from MSCI Real Assets.

“I’m not surprised to see transaction volume down from 2022,” says Kelly Sheehy, senior managing director of Artemis Real Estate Partners. “The combined impact of declining asset values, scarcity of financing for new acquisitions and lender extensions for underperforming assets has kept sellers from listing assets and have prevented levered buyers from acquiring.”

MSCI’s data is based on independent reports of property and portfolio sales of $2.5 million and above. The numbers include both private-pay seniors housing and skilled nursing care, but not active adult properties.

The factors limiting seniors housing transaction volume have affected all real estate asset classes. As far as property acquisitions go, seniors housing was one of the most consistent property sectors in the United States in 2023. Commercial real estate sales across the country were down 51 percent last year, and the two hardest hit sectors were office (sales fell 56 percent) and multifamily (sales fell 61 percent), according to MSCI.

What’s more, seniors housing was the only property sector that saw a boost in transaction volume by total dollars in the fourth quarter as it posted a 9 percent increase over the third quarter.

Meanwhile, some of the largest investors in the space, most notably REIT giant Welltower (NYSE: WELL), have been on buying sprees and have signaled their intent to continue doing so.

Despite the standout performance of the seniors housing sector relative to other real estate asset classes, Jim Costello, chief economist at MSCI, suggests investors should temper their expectations. He notes that seniors housing property and portfolio sales accounted for $3.2 billion in transaction volume in the fourth quarter of 2023 compared $27 billion in the apartment sector.

“It’s a small number growing quickly,” says Costello. “Even that $3.2 billion is still kind of low compared to some previous periods. It’s not like we’re out of the woods.”

“It’s all relative right? Multifamily was the hottest sector out there, but once the interest rates started changing, transaction volume fell off a cliff,” adds John Sweeny, co-head of CBRE Senior Housing. “In seniors housing, because of COVID, transactions were already pretty suppressed.”

Costello goes on to say that whereas the other real estate sectors experienced a dramatic drop-off in sales volume because activity was at “an artificial high” in 2021 and part of 2022 due to low interest rates, the seniors housing transaction activity was tempered by

pandemic-related issues.

“People were hungry for yield anywhere and jumped into real estate with abandon [in 2021 and 2022]. But the seniors housing segment was just kind of flat. It got through 2020, and it saw more demand than during the pandemic period, but it never really grew at a tremendous pace again. To some extent it’s a segment story. Seniors housing didn’t have the excess highs of 2021 and 2022.”

Bid-ask gap narrows

That fourth-quarter increase in transaction volume comes along with an increase in the capitalization rate, signaling that prices are going down and the industry is tilting toward a buyer’s market. The seniors housing cap rate ended the year at 7.2 percent, after spending quite a while in the 6 percent range (though these numbers combine private-pay housing and skilled nursing), according to MSCI. Only hotels are selling at a higher cap rate (8.3 percent).

“Cap rate increases have certainly been impacted by interest rate increases as observed in 2023, as well as reductions in loan-to-value ratios and reduced supply of financing in the market,” says Raoul Nowitz, senior managing director at SOLIC Capital Advisors.

“This will help bridge the bid-ask spread as significant investment fund capital remains on the sidelines waiting to be deployed in the right situations at suitable pricing,” adds Nowitz.

Sheehy notes that the increased sales volume in the fourth quarter allowed for “true apples-to-apples cap rate comparisons,” creating a more accurate view of current pricing.

Curtis King, executive vice president at HJ Sims, suggests rising cap rates might help set the table for a stronger transaction year in 2024.

“At the beginning of 2023, sellers were reluctant to adjust their asking prices in line with what buyers were able to pay given their increased cost of capital. However, as sellers acknowledged the new valuations, they adjusted their asking prices downward, reducing the bid-ask spread. If this trend persists, transaction volume is likely to increase in the coming year.”

However, David Kliewer, co-head of Continuum Advisors, suggests that sellers who can wait may do so. Interest rates are no longer on the rise and, if they begin to come down again, pricing may increase for sellers.

“Many owners remain on the sidelines awaiting better operating performance of their communities, along with the anticipation of improved capital markets and lending environment in the future. Where sellers’ pricing expectations in 2021 and 2022 were at levels that prompted many trades, we found in 2023 for those who have the ability to hold, many are doing so in hopes of a better exit value.”

Another factor that’s helping is predictability. Yes, interest rates are higher now than they’ve been in years, but the Federal Reserve has signaled the increases in the federal funds rate are over for now. That means those seeking financing can get a better handle on what their cost of capital will be, and bank lenders may soon re-enter the seniors housing sector.

“Uncertainty just makes people stand pat,” says Sweeny. “Cap rates and interest rates will stabilize. We should see a more normal environment the second half of this year, and then volume will continue to increase as markets continue to stabilize.”

(To combat inflation, the Federal Reserve aggressively raised the federal funds rate 11 times from near zero percent in March 2022 to a target range of 5.25 to 5.5 percent as of mid-January, leading to higher borrowing costs across the board in the seniors housing industry.)

REITs make a comeback

MSCI’s data shows that private investors — encompassing private equity firms, unlisted REITs, high-net-worth individuals and others — continue to be the biggest players in seniors housing transactions. Private investors accounted for 78.2 percent of acquisitions and 60 percent of sales in 2023, making them net buyers on the year.

“The market has continued to be dominated by private equity buyers with deep capital bases, regional operators seeking market consolidation opportunities, and public and private real estate REITs,” says Nowitz. “Special-situation buyers have also been seeking distressed and value-add opportunities. Sellers are those more likely to be capital constrained and those seeking exits on investments with long-term holds and built-in gains to date.”

Most other classes of investors — foreign, institutional and owner-operators — were net sellers in 2023. But REITs, after being sellers in 2021 and 2022, came back as buyers in 2023 and have indicated 2024 could be a big year for acquisitions.

Welltower, in particular, made a lot of noise in the past 12 months. In its fourth-quarter earnings call, the REIT said it made $5.9 billion in investments during 2023, including $2.8 billion in acquisitions in the fourth quarter alone. Among the highlights:

• As part of dissolving its international joint venture with Revera Inc., Welltower acquired the remaining interest in 110 properties.

• In October, Welltower purchased 12 communities in Quebec totaling 4,173 units for $639.2 million (based on the exchange rate at that time). Because these properties are in Canada, they are not reflected in MSCI’s data.

• Welltower acquired 10 communities from Kayne Anderson Real Estate for $469 million.

• This February, Welltower already made a $969 million acquisition, purchasing 25 active adult communities from Affinity Living, which will stay on as the operator and partner.

In all cases, Welltower cited pricing as a key element. More specifically, its acquisitions were all well below replacement cost. For the Cogir acquisition, for example, Welltower said the assets were acquired at a 40 percent discount to replacement cost.

“We had a great year, a record-setting year in terms of capital deployment and we meaningfully strengthened our balance sheet and liquidity profile,” said Welltower CEO Shankh Mitra during the company’s fourth-quarter earnings call. “Just as important, perhaps, is the groundwork we laid to sustain this level of performance and continue to deliver outsized growth not only in 2024, but also well into the future.”

Although Ventas (NYSE: VTR) didn’t have as many splashy acquisitions as Welltower in 2023, the industry’s second largest owner has also been open about its plans to buy in 2024. Its largest acquisition in 2023 was taking ownership of 64 seniors housing properties under a $486 million mezzanine loan to Santerre Health Investors.

“We intend to build on our compelling organic growth opportunity by layering on value-creating external investments focused on seniors housing,” said Debra Cafaro, chairman and CEO, on the company’s fourth-quarter earnings call. “There is a confluence of market factors giving us confidence that 2024 and 2025 should be rich with investment opportunities. We’re already seeing our pipeline expand as high-quality seniors housing communities in good markets with embedded growth come to market, and we have a line of sight to complete over $300 million of investments in the first half of this year.”

The reason REITs were able to drive acquisitions in 2023 comes down to an important element: dry powder. When lenders are scarce and interest rates are high, buyers with liquid cash are primed to take advantage of a situation where there are fewer competing offers.

“During tough transaction times cash is king, and those seniors housing buyers who have positioned themselves with plenty of cash are reaping the rewards,” says Adam Heavenrich, managing director of Heavenrich & Co.

“Public REITs such as Welltower and Ventas generally are targeting stable, cash-flowing properties in strong markets where they have operating partners. Any potential seller of these property types has likely been sidelined from the transaction market since COVID, waiting for the markets to stabilize,” explains Heavenrich. “One of the drivers of this seniors housing market is the credit tightening that has occurred in the debt markets. Lenders have tightened underwriting standards and debt-service coverage ratios and have lowered their loan-to-value ratios. Buyers like Welltower and Ventas were able to take advantage of their unique capital positions to make all-cash offers.”

“Welltower is a cash buyer and its cost of capital is much cheaper than others,” adds Michael Uccellini, president and CEO of The United Group of Companies. “They don’t need debt to complete their acquisitions. Therefore, they could compete where others couldn’t. 2025 will be a stronger year for sellers as capital will be cheaper, there will be more dry powder in the marketplace, and there will be a more active debt market. Sponsors need to hold on in 2024, as it will be bumpy ride.”

Smoother selling in 2024?

Industry experts generally agree that an increase in seniors housing transaction activity is likely in 2024.

“I anticipate that activity in 2024 will surpass that of 2023, although not reaching anywhere near the record levels seen in 2022,” says King.

“It appears that more property owners are adjusting to new valuations and thus may be more likely to sell in coming year. Other owners will opt to retain their properties, however, aiming to take advantage of low future supply levels to enhance margins by increasing occupancy and raising rates.”

An incoming wave of debt maturities could be one factor encouraging sales, King notes.

“The sale of distressed properties is likely to rise in 2024. Numerous borrowers face maturing loans this year, necessitating a substantial paydown given current lending parameters. Many of these borrowers lack the capital for these paydowns, while others are hesitant to invest further in challenging situations. Consequently, selling these communities may be the only viable option for such borrowers.”

Despite the general increase in occupancy industrywide, many properties are still struggling and will need to be sold, says Kliewer.

“We believe transaction volume will be higher, driven largely by more cash-flowing deals coming to market as operating trends improve. Continued high levels of distressed sales for assets that are older and experiencing operational losses will make it necessary for owners to divest of those assets.”

Whatever is to come, Sweeny notes that the metrics for seniors housing are healthy, and should remain that way for a long time.

“Supply is down meaningfully from pre-pandemic levels and demand is up. In the next decade there will be a tremendous amount of additional product needed. This all makes the investment environment attractive right now.”

— By Jeff Shaw. This article originally appeared in the February-March edition of Seniors Housing Business.